Imports slumped in terms of value of letters of credit or LCs in the first half of this fiscal year as Bangladesh gets tightfisted to ease pressures on its foreign-exchange reserves.

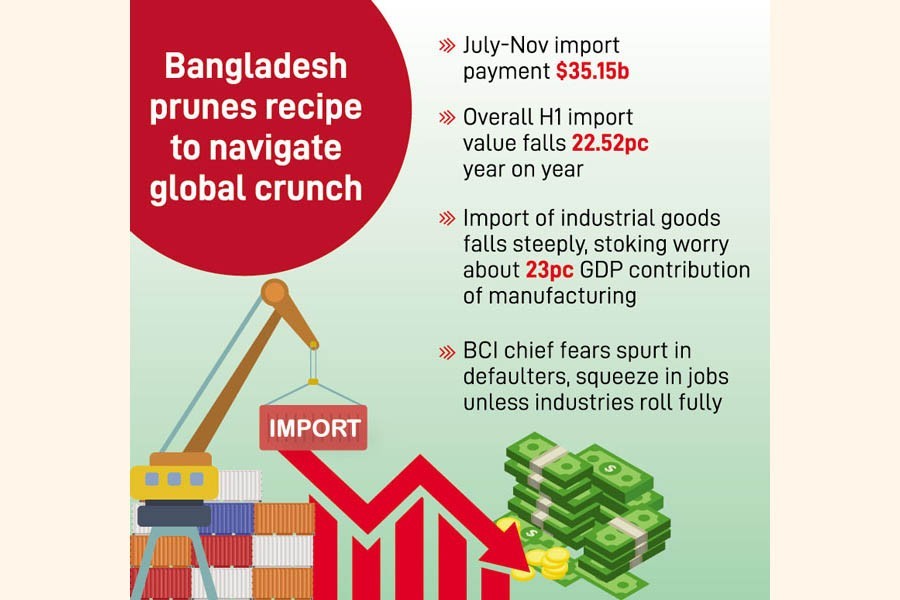

According to Bangladesh Bank (BB) statistics, the overall import growth in value terms fell 22.52 per cent during July-December 2022 period over the same period a year before.

The statistics show that the import of capital machinery fell sharply by 65.32 per cent during the period under review while industrial raw materials decreased by 27.27 per cent and consumer goods squeezed 14.41 per cent.

However, the import value in terms of LC settlements grew by 7.71 per cent year on year during the H1 of the FY2022-23. Settlements consider more time than the opening of LCs as a lag effect.

Although the settlement value for consumer goods fell 9.27 per cent during July-December and capital machinery 7.13 per cent during the same period over that of corresponding period of last year.

The settlement value of industrial raw materials, however, rose by 12.58 per cent during H1 of the fiscal year over its preceding period

The BB in its report has mentioned that the decrease in LC opening is the result of several initiatives taken by the central bank to ease the pressure on dollar-taka exchange rates, as part of austerity measures taken by the government.

Industry people involved in the manufacturing sector told the FE that the picture, especially import of capital goods, is not a good sign for the economy as it contributes to the GDP nearly 23 per cent.

They argue that there are other factors apart from Bangladesh Bank initiatives, like higher inflationary pressures on the economy and global outlooks.

Anwar Ul Alam Chowdhury Pervez, president of Bangladesh Chamber of Industry (BCI), told the FE that the government now concentrates on how to provide uninterrupted power supply to continue production failing which the manufacturing contribution to the economy will shrink.

"We need power at affordable prices and this should be uninterrupted."

Otherwise, he cautions, the number of loan defaulters in the banking industry will rise. "It will hit the employment and other social indicators as well."

Some consumer-goods importers said the demand for consumer goods decreased in recent periods in the country and they blamed the ongoing higher inflationary pressure on the economy.

Md Abul Bashar Chowdhury, chairman at BSM Group of Companies, told the FE: "The demand for many consumer goods has dropped in recent period in Bangladesh."

He feels that the government and the central bank should look at the upcoming Ramadan when the demand for consumer goods increases shoots up.

"If we don't have an adequate quantity of consumer goods, the price level will spike during the month of Ramadan," he said.

Mr. Chowdhury, who is one of the leading consumer-goods importers, however, thinks that the global price trend is more or less favorable as the prices of some goods decreased on the international market.

Industry people said the LC opening tightened much on construction items, including rods, cement, ceramics, and so on.

Mr. Aameir Alihussain, managing director at the country's biggest rod producer - BSRM -- told the FE that they have been using their inventory following "rationing" in the imports.

"Our inventory is now drying up," he mentioned.

Mr. Aameri said there is a huge demand for construction materials during the peak season. "There will be a crisis of rods unless the opening of LCs for import of scraps is eased."