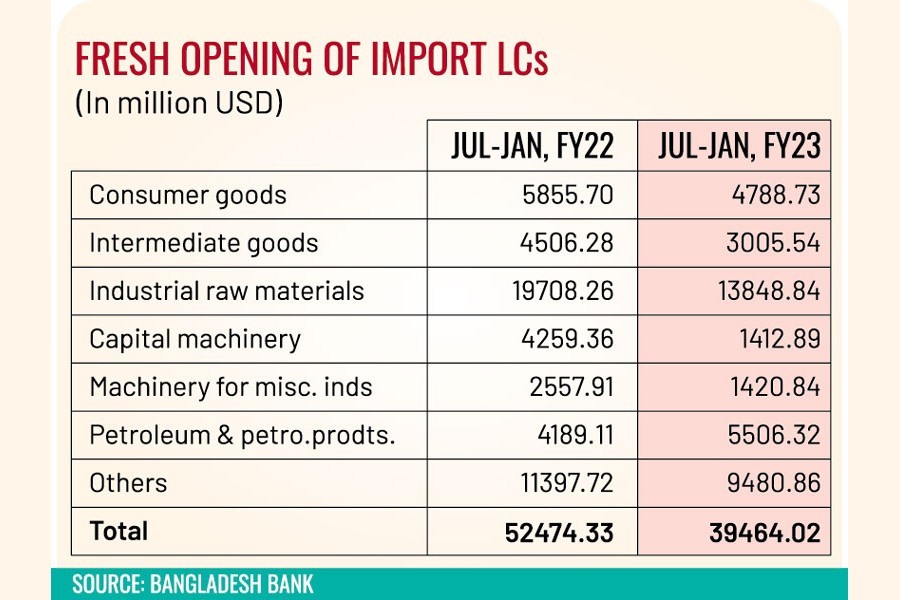

Fresh letter of credit (LC) opening in seven months to January this fiscal fell nearly 25 per cent, year on year, to US$ 39.46 billion amid belt-tightening for forex crunch.

Bankers, economists and importers say that the drastic fall in import LCs is due to the tightening of import by the central bank through a number of interventions, including the raising of LC margins, under government-directed austerity measures.

However, the import of consumer goods comprising major cereals fell 18.66 per cent during the period under review to $4.8 billion, according to Bangladesh Bank (BB) statistics.

Import of intermediate goods--mainly coal, cement clinkers and so--dropped by 33.3 per cent to $3.0 billion during the July-January period of the fiscal year 2022-23.

Industrial raw materials - textile fabrics, edible oils (crude), raw cotton etc--for the growing industrial sector were also imported on a lower scale, marking a nearly 30-percent fall to $13.8 billion. The manufacturing sector has a stake of around 23 per cent to the economy.

Capital-machinery import, an indicator of investment, dropped nearly 67 per cent to $1.4 billion, and machinery for miscellaneous industries fell by 44.5 per cent to nearly $1.4 billion during the period.

Only one major area -- LC opening for petroleum products --- however, recorded an increase by 31.4 per cent to $5.5 billion.

The 'others category' comprising commercial and industrial sectors, including Rooppur Nuclear Power Plant, also had lower imports costing $9.5 billion, down by 17 per cent, during the period over its corresponding period a year earlier.

Bankers said the trend could continue as the central bank has taken a number of measures to contain imports to keep the country's foreign-exchange reserves in a comfort zone at this hour of a global crisis.

Syed Mahbubur Rahman, managing director and CEO at the privately-owned commercial bank MTB, told the FE that this is a "collective effort of central bank and commercial banks for the time being as we lack adequate foreign exchange to meet the payments".

But he stressed the need for enhancing imports again to feed the economy and domestic market, which for long remained overheated with commodity prices spiraling by the day.

"Our economy is expanding so we need to raise the imports for the sake of the economy in the near future," the banker suggests.

Md Abul Bashar Chowdhury, chairman at BSM Group of Companies, a leading cereal importer, noted that "demand for many consumer goods dropped in the country in recent times due to price surges".

He does not know about the others' position on the essential imports for the holy month of Ramadan. "I have imported for Ramadan," the businessman told the FE correspondent.

Dr M. Masrur Reaz, chairman of Policy Exchange of Bangladesh, sees it as a good sign for the economy in the short term. He said the current-account deficit continued to narrow following the import tightening.

The economist, however, feels that industrial output would be affected in the situation. "We have to accept it in the present context of the economy."