Payments to US oil-major Chevron against gas purchase by Bangladesh couldn't be cleared for six months amid dollar crunch with the prospect of supply disruption from its largest producer, said sources.

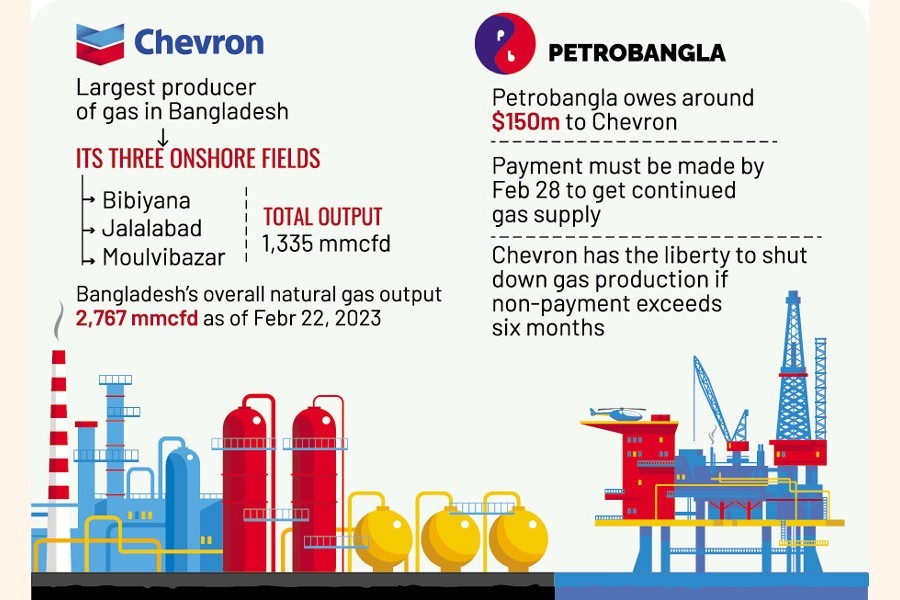

State-run Petrobangla has not been able to pay Chevron for the natural gas produced from Bangladesh gas-fields for nearly six months, since September 2022, and currently owes around $150 million in arrears to the international oil company, a senior official of the corporation told the FE Thursday.

According to gas purchase and sales agreement (GPSA) between Chevron and Petrobangla, the company has the liberty to shut down gas production if the non-payment exceeds a six-month period, said the official.

It means to get continued gas supply from Chevron-operated gas-fields, Bangladesh will have to make payment by February 28 as per the GPSA, said the official.

Petrobangla, however, made a payment worth US$10 million, around one-fourth of its monthly bill, last week to appease the Chevron management for continuation of gas production from its fields, he added.

Bangladesh did never before default on paying Chevron gas bills, said sources.

He said Bangladesh used to make payment within one month of getting natural gas supplied into its national gas grid.

Chevron is currently the largest producer of natural gas in Bangladesh with its total output of around 1,335 million cubic feet per day (mmcfd), or around 60.50 per cent of total output from local gas-fields, according to Petrobangla reckonings as on February 22, 2023.

The US hydrocarbon explorer has three operating onshore fields - Bibiyana, Jalalabad and Moulvibazar, located in blocks 12, 13 and 14 respectively.

Bangladesh's overall natural gas output is currently hovering around 2,767mmcfd including 561mmcfd of re-gasified LNG, according to Petrobangla data as on February 22.

With the payments stalled, Chevron is not being able to carry out development works like optimization of Bibiyana field, installing a compression station near Jalalabad field, and drilling a couple of new wells to ramp up natural gas output.

The company usually carries out its development works with the funds it gets from gas sales.

Expecting increased engagement in oil-and gas-exploration activities by Chevron, Bangladesh recently approved expansion of the Bibiyana gas-field with an additional 60 square kilometers as "flank" area.

Pointing at the significance of gas production from Chevron-operated fields, sources reminded that an abrupt fall in gas supply from Bangladesh's largest producing Bibiyana gas-field had triggered a countrywide natural gas crisis that affected industries, power plants and household consumers during early April in 2022.

Chevron Bangladesh had to shut a damaged onshore gas well in Bibiyana, located in Bangladesh's gas-rich northeastern region, along with five other onshore gas wells in the Bibiyana gas-field on April 3.

Natural gas output from Chevron-operated Bibiyana field had dropped by about one-third to about 800mmcfd because of the shutdown, from about 1,275mmcfd earlier, according to official data.

The well was damaged when sand started flowing out with natural gas due to production anomalies.

Although the five gas wells in the Bibiyana field came online within four days on April 7, Petrobangla had to impose a 10-day gas rationing over April 12-April 21 for local industries, asking industrial consumers to not consume natural gas for four hours daily to tide over severe energy shortage. The damaged onshore gas well in Bibiyana resumed operation after three weeks on April 28.

The payments crisis has not impacted liquefied natural gas (LNG) import yet as Petrobangla plans to ramp up spot procurement in 2023.

The oil, gas and mineral resources corporation-nicknamed Petrobangla-resells regasified LNG to end-users through its subsidiary gas-marketing and-distribution companies. But prices of many of these are regulated, resulting in large subsidies that balloon in a high-price environment.

Bangladesh of late hiked domestic gas prices by up to 178.88 per cent for industries and power plants with effect from February 2023. Before the raise, the subsidy requirement was around Tk 60 billion, but after the February-1 hike, the subsidy requirement has declined, according to a senior Petrobangla official.

Some officials were concerned that Bangladesh was prioritizing payments for spot LNG procurement, which could make counterparties across a range of other fuel imports unhappy.

Bangladesh's two 500mmcfd-capacity operational floating storage and regasification units (FSRUs) -- owned by US' Excelerate Energy and local Summit Group-are also getting regular payments against the regasification of LNG, said one official.

"Petrobangla is trying to clear all the dues to Chevron as soon as possible," Petrobangla chairman Zanendra Nath Sarker told the FE Thursday.

"We discussed with the central bank a couple of occasions recently the matter of facilitating payments to Chevron," he added.

When contacted over gas-bill arrears, communications manager of Chevron Bangladesh Shaikh Jahidur Rahman said, "Chevron Bangladesh continues to work in partnership with the government of Bangladesh and Petrobangla to deliver the safe, reliable supply of affordable natural gas which is essential to help meet the country's growing energy demand."

He adds: "Chevron has been investing in Bangladesh for more than twenty-five years. We are excited by the country's potential economic growth and the benefits this can bring to its people. As a longstanding company policy we do not comment on commercial issues."

Azizjst@yahoo.com