The central bank has decided to extend its policy support further to bring back stability in the country's ailing capital market, officials said.

As part of the initiative, a bank's investment in the shares of non-listed companies can be deducted from the calculation of its share market exposure.

The decision along with some others was taken at a high-level meeting of policy-makers, held at the central bank headquarters in Dhaka on Thursday with Fazle Kabir, the Bangladesh Bank (BB) Governor, in the chair.

"We've considered the issue positively that will also help the banks to increase their investment capacity in the share market," S M Moniruzzaman, the BB Deputy Governor, told the FE after meeting.

Among others, Md. Ashadul Islam, Senior Secretary of the Financial Institutions Division, M. Khairul Hossain, Chairman of the Bangladesh Securities and Exchange Commission (BSEC), and the BB Advisors - Allah Malik Kazemi and S K Sur Chowdury - attended the meeting.

The meeting also advised the monitoring committee on the capital market refinancing scheme to take effective measures to immediately start disbursement of the fund, amounting to around Tk 9.0 billion.

The three-member committee, headed by Saifur Rahman, Executive Director of the BSEC, is scheduled to meet on Sunday to finalise disbursement procedures of the revolving fund.

Senior officials from both the BB and the Investment Corporation of Bangladesh (ICB) are also members of the committee.

The central bank will release the fund soon after receiving recommendations from the committee, the BB deputy governor added.

On May 02, the government extended the tenure of the capital market refinancing scheme until December 31, 2022, with some amendments, to help revamp the country's stock market.

Now the fund will be treated as a revolving one that will be eligible for other capital market intermediatories along with small investors, according to a notification, issued by the Ministry of Finance (MoF) on the day.

On March 05, 2012, the government formed the fund worth Tk 9.0 billion to protect the interest of small investors in the share market. It was scheduled to be expired on December 31, 2019.

The scheme was announced as part of the government-set compensation package for the investors, who had investment below Tk 1.0 million during the 2010-11 stock market debacles.

At the meeting on Thursday, the scheduled banks were also advised to complete subscription process of the ICB's subordinate bonds as early as possible.

The state-run investment agency is set to collect fund worth Tk 20 billion through issuing its subordinate bonds that will be fully redeemable, unsecured and unlisted.

"The additional fund will help the ICB to strengthen its transaction capacity," Mr. Moniruzzaman explained.

He also said the BSEC will arrange a meeting to resolve misunderstanding on capital market investment calculation of the banks on both 'consolidated' and 'solo' basis.

Under the exiting provisions, the market value of total investment of a banking company in the capital market on consolidated basis will not exceed 50 per cent of the sum of its consolidated paid-up capital, balance in share-premium account, statutory reserves and retained earnings as stated in the latest audited financial statements.

On the other hand, the banks are now allowed to invest maximum 25 per cent of their total capital in the share market on solo basis in line with the Banking Companies (Amended) Act 2013.

According to the Banking Companies Act 1991 (Amended 2013), total capital comprises four components: paid-up capital, balance in share premium account, statutory reserves, and retained earnings - as stated in the latest audited financial statements.

While calculating total investment in share market, different components, including all types of shares, debentures, corporate bonds, mutual fund units and other capital market securities, will be taken into account.

"We expect that all these measures will help bring positive impact on the country's capital market in near future," a central banker told the FE.

He also said the BB is always supportive towards development of the share market.

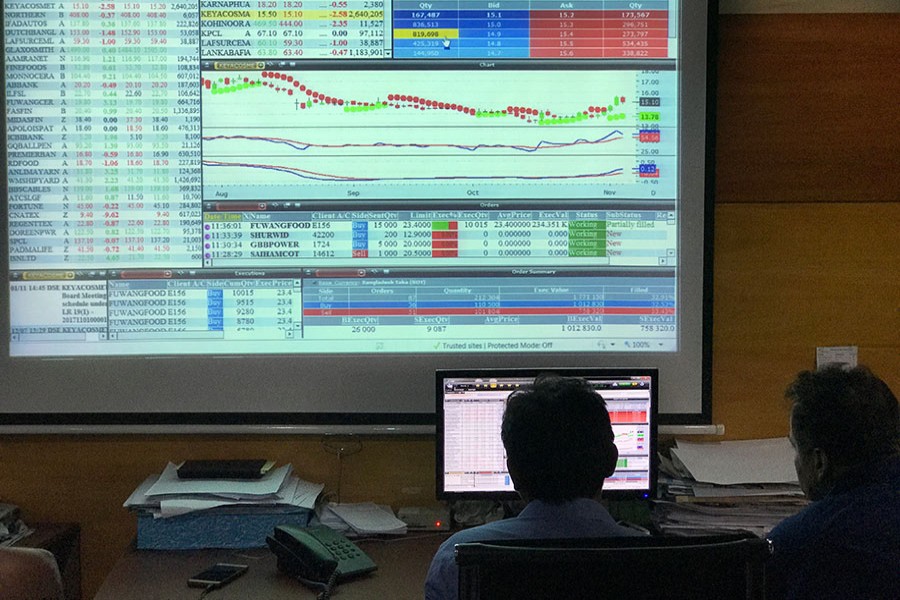

The policymakers' latest moves have come against the backdrop of falling trend in the country's share market in the recent months.

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), eroded more than 675 points or 12 per cent since January 24 amid periodic ups and down.

The market capitalisation of the prime bourse also shed Tk 314 billion since then, which prompted a number of small investors to take to the streets and stage token hunger strike.

Market analysts cited some reasons, including dearth of quality stocks, lack of investors' confidence, and shortage of liquidity etc, for the latest erosion in stock prices.