Banks in Bangladesh see returns on their assets go sagging largely for trade contraction and lending-interest cap among other dampers, putting them in an uncomfortable situation, leading bankers say.

They say core health indicators of the banks, especially net interest margin (NIM), continue to deteriorate.

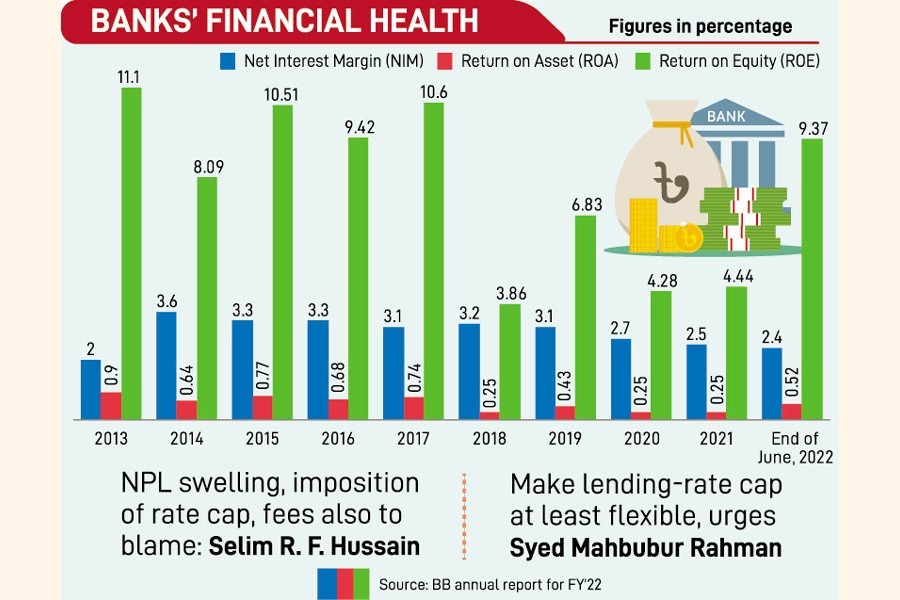

Two other major indicators, namely return on assets (ROA), and return on equity (ROE), also sustained constant fall in nine years to 2021.

Although the ROA and ROE saw a slide turnaround during January-June period of 2022, the downtrends, according to banking sources, still prevail.

They attributed such rebound for a very short period of time until June, 2022 to factors like rise in overall import and surge in dollar price against the local currency before the government's belt-tightening measures came into play to buttress the rapidly falling foreign-exchange reserves.

Although various indicators are used to determine earnings and profitability, the most representative and widely used ones are return on assets or ROA, return on equity or ROE and net interest margin or NIM.

According to recently published annual report of Bangladesh Bank for the fiscal year 2021-2022, the net interest margin or NIM of the country's banking system was 3.6 per cent in 2014. Since then, the downturn continued, reaching 2.5 per cent in 2021. It further declined to 2.4 per cent until June 2022.

The situation almost same for ROA which was recorded 0.90 per cent in 2013 and kept plunging to reach 0.25 per cent in 2021. But it made a slight turnaround to 0.52 per cent at the end of June 2022.

On the other hand, the ROE was recorded at 11.10 per cent in 2013 which declined to 4.44 per cent in 2021. This indicator had made a remarkable jump to 9.37 per cent until June 2022, according to the BB data.

The significant fall in the most representative and widely used profitability-calculating factors has indicated that overall financial health of the banks is not so good.

Managing Director and Chief Executive Officer (CEO) of Brac Bank Selim R. F. Hussain said people often talk that banks are making profit of Tk 3.0 billion and Tk 4.0 billion without knowing the volume of investment the banks made.

"We have to see the rate of return. The recent data of ROA, ROE and NIM clearly show that the profitability of banks is falling drastically. Profit and profitability is not the same thing," he said.

Mr. Hussain, also chairman of the Association of Bankers, Bangladesh (ABB), said growing volume of non-performing loans (NPL), imposition of lending-rate cap and other fees worsened the situation further.

A large portion of the asset book became unproductive because of the bad loans and it keeps rising. As a result, the financial health of the banks keeps waning, he said.

"Things will not improve unless the artificial lending cap on all forms of credits is lifted immediately," the leading banker concluded about the much-talked-about measure, one of regulatory steps meant for containing inflation.

According to the BB statistics, the volume of non-performing loan or NPL soared to Tk 1.34 trillion at the end of September 2022 from Tk 1.25 trillion recorded three months ago. Of the amount, Tk 1.18 trillion turned bad loans which the central bank apprehended as not recoverable.

The NPLs jumped by Tk 311 billion from Tk 1.03 trillion registered in December 2021.

Managing Director and CEO of Mutual Trust Bank Limited Syed Mahbubur Rahman said the costs of fund have gone up because of the growing NPLs but they cannot match it because of the interest-rate ceiling at 9.0 per cent.

"The banks are now in extreme pressure because of growing profitability loss. Things might further deteriorate in coming days," he said.

Asked why the ROA and ROE witnessed turnaround in the last half of the immediate-past fiscal year after years of fall, he said the country witnessed significant rise in foreign trade during that period of time. At the same time, a rapid surge in dollar prices during the same period of time helped banks to gain some profit.

"That's why it (ROA and ROE) was going up. But the government imposed some restrictions as part of its austerity measures from August last. So, I think, things would be reversing again," he said.

Mr. Rahman was suggesting the policymakers to make the lending-rate cap at least flexible considering current state of the country's banking system.

"We don't say complete uncapping of the lending-rate cap. But the government can make it flexible so that the banks can get some breathing space in spread, which is core income of banks," he added.