Bangladesh is making hefty penalty payments in dollar as demurrage for payment delays against LNG import and less-than-agreed re-gasification of the liquid gas in two offshore units under private sector, sources said.

Long-term suppliers of the liquefied natural gas (LNG) are bagging around US$160-200 million while floating, storage, re-gasification units (FSRU) owners getting US$7.80 million as extras every month, they said, at a time when the country exercises austerity for forex crunch.

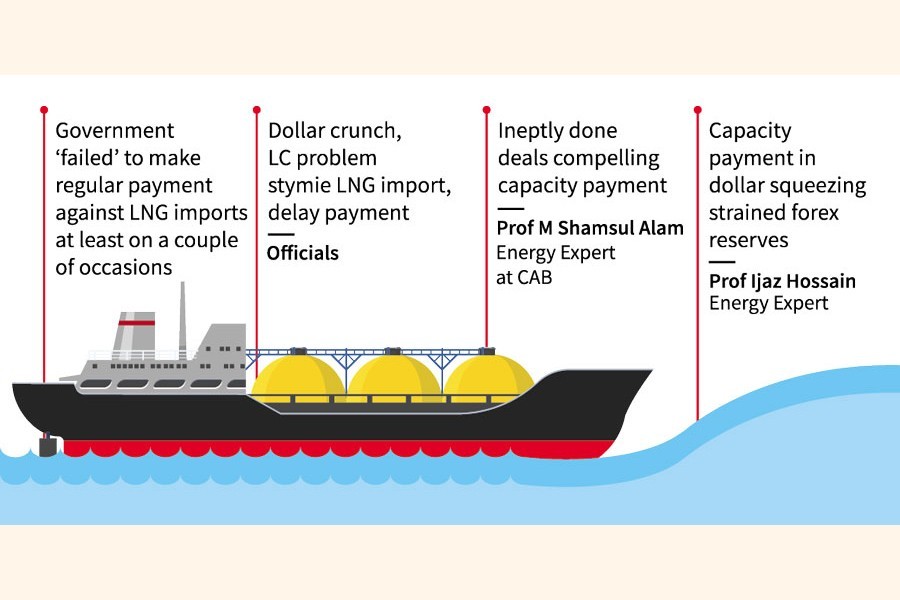

The government 'failed' recently to make regular payment against LNG imports at least on a couple of occasions, resulting in payments of demurrage in US dollar, the sources said.

State-run Petrobangla had to pay demurrage to both the long-term LNG suppliers--Qatargas and Oman Trading International (OTI)--at London Inter Bank Offered rate plus 4.0 per cent above the overall import costs, a senior energy ministry official told the FE Tuesday.

He said the petroleum corporation has to pay around US$ 160 million to US$ 200 million to the LNG suppliers monthly as it usually imports four to five LNG cargoes each month.

When contacted, a senior Petrobangla official acknowledged having to pay demurrages to the long-term LNG suppliers as it failed to make payment against the fuel imports on time.

The official, however, wouldn't give the figure of the amount paid as demurrages.

Scarcity of the greenback in local banks and their reluctance to open letter of credit (LC) against imports lead to import-bill default, said the official.

Separately, the government is paying 'capacity payment' in dollar worth around US$7.80 million every month to two private floating, storage, re-gasification units (FSRU) owners as LNG is being regasified at a lower level than their capacities, insiders said.

Ineptly done deals are compelling Petrobangla to make capacity payment, alleged energy expert at the Consumers Association of Bangladesh (CAB) Prof M Shamsul Alam.

The petroleum corporation is now facing a double-edged sword as it cannot use the re-gasification capacity of the two FSRUs--one locally owned and the other foreign-owned--for cutback on LNG import while it is forced to pay for their unused capacity.

It is currently re-gasifying around 421 million cubic feet per day (mmcfd) of liquefied natural gas from the two LNG-import terminals, leaving 57 per cent of the capacities of the FSRUs unused, according to Petrobangla statistics as on January 9.

On top of that, owners of both the FSRUs - US Excelerate Energy's Excelence and local Summit Group's Summit LNG--are also enjoying waivers of import duties and value-added tax (VAT) regarding implementation of the FSRUs.

The FSRU companies are also enjoying exemption from payment of VAT, advance tax and supplementary duty on products and services, according a senior official of the National Board of Revenue (NBR).

Sources said Petrobangla has deals with the LNG-terminal owners to pay around US$450,000 per day in total to re-gasify up to 1,000mmcfd LNG from the two units located at Moheshkhali island in the Bay of Bengal.

According to agreements, the corporation is required to pay the US Excelence around US$237,000 per day and Summit LNG around US$217,000 per day.

The payment is obligatory no matter whether LNG is re-gasified in the agreed quantity or less.

Both the deals are on a take-or-pay basis, meaning Petrobangla will have to pay the stipulated amount after the commissioning of the FSRUs, no matter if it re-gasifies LNG or not.

Both the FSRUs are designed to re-gasify around 500mmcfd, which is the agreed quantity.

Energy experts term paying 'high' capacity payments to the FSRU owners "total government failure to negotiate (deals) properly".

"This is devastating. We don't know where we are heading," Prof Shamsul Alam said on a note of concern over the extra payments against LNG imports at a time of forex crunch.

The CAB leader accused Petrobangla of what he said cheating the consumers while raising natural gas tariffs, latest by 23 per cent in June last year.

Petrobangla had projected to re-gasify around 684.84mmcfd liquefied natural gas in 2022 to raise tariffs but its LNG re-gasification was much below the projection, he said.

He also wanted to know the amount of revenue requirement which could be saved due to lower-than-expected import of the liquid gas.

Mr Alam also alleged that the FSRU owners have drained out US dollars through over-invoicing.

"It's unfortunate that the government has awarded both the FSRUs to private sector without competitive tenders and is now making huge payments, including capacity payment, in US dollar," said another energy expert, Prof Ijaz Hossain.

Making capacity payment in dollar is squeezing country's already- strained foreign-currency reserves, said the professor of Bangladesh University of Engineering and Technology (BUET).

The government should have appointed an international consultant before inking deals with the FSRU operators, he opined.

Bangladesh's overall natural gas supply now hovers around 2,652mmcfd, including re-gasified LNG of around 421mmcfd, against total demand for over 4,000mmcfd, according to Petrobangla data as on January 10, 2023.

Cost of LNG import is currently around US$11 per million British thermal unit (MMBtu) considering Brent-crude price at around US$85 per barrel.