The rapid pace of agent banking is changing the rural economic landscape as millions of unbanked people are coming into the fold of the formal financial services, bankers said on Friday.

The total transactions through the agent banks had expanded by 151 per cent to Tk 284.15 billion just within a year, the central bank statistics show.

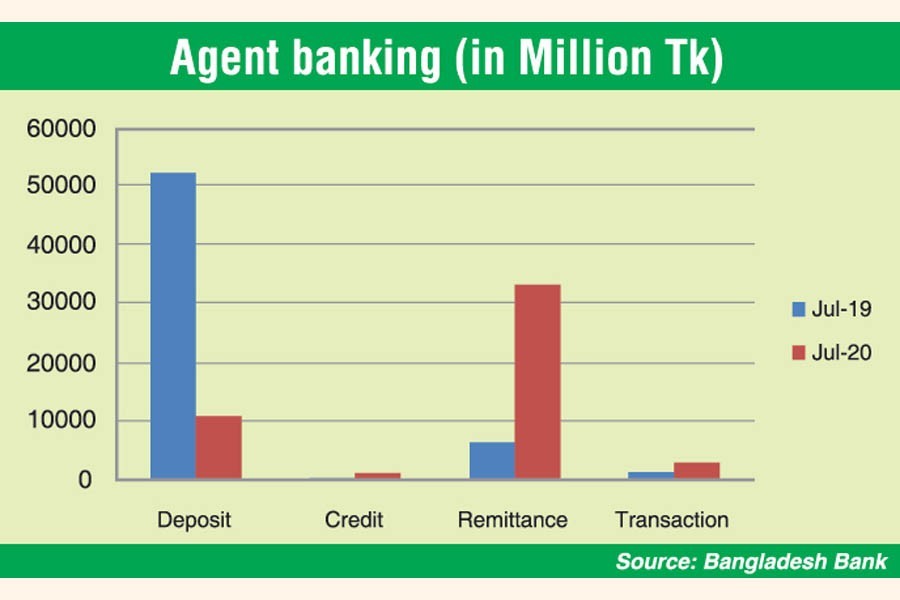

Between July 2019 and July 2020, the transaction had grown up by Tk 171.09 billion to Tk 284.15 billion.

During the last one year, the number of transactions, deposit balance, credit flow, inflow of remittances, utility bill payments, number of accounts, agents and outlets have seen a tremendous growth.

Economists and bankers said the agent banking had not only brought the unbanked people under the disciplined financial transaction system, it has also kept a pivotal role in the rural economic expansion.

The agent banking is a limited financial service for persons under a valid agency agreement rather than a teller or cashier.

An agent, who is a third-party, conducts banking transactions, such as cash deposit, cash withdrawal, account opening, account inquiries, small-amount loan disbursement, loan recovery, fund transfer and paying bills under the government safety net programme on behalf of a bank.

According to the BB, the country's agents and their outlets for commercial banking services have become almost double within a year and a half reaching banking services to the doorsteps of the people living in rural and remote areas.

In December 2018, the number of agents across the country was 5,101, which swelled to 9,180 in July this year.

The number of outlets had also expanded to 12,861 in July 2020 from 6,932 in December 2018, the central bank statistics showed.

Out of the number of banking agents and outlets, 85 per cent have been set up in the rural areas where commercial banks are scarcely available.

Meanwhile, the number of bank accounts through the agents had increased by 115 per cent during the last year.

BB data showed that the number of accounts through in the agent banking system soared to 7,685,990 in July 2020 from 3,575,659 in July 2019.

A senior BB official told the FE the agent banks had also facilitated the remittance inflow to the country, as the people in remote areas have now the access to these operators for getting remittances sent home from abroad.

According to the BB, the inward remittance through the banking system swelled by 422 per cent to Tk 33.28 billion in July 2020 from Tk 6.37 billion in July 2019.

Managing director of Prime Bank Limited Rahel Ahmed told the FE the agent banking had a big prospect in Bangladesh as lots of people are still unbanked.

"We have recently got the licence from the central bank. We will start our operation soon targeting the agriculture and micro merchants in rural Bangladesh," Mr Ahmed said.

Chief financial officer of the Mercantile Bank Tapash Paul said the agent banking has brought new opportunities for the country as many unbanked people had been brought under the financial inclusion.

"The agent banks are not only collecting deposits, but also disbursing loans, especially in the agriculture sector. These are facilitating the economic activities in villages," he told the FE

Center for Policy Dialogue (CPD) research director Dr KG Moazzem said the agent banking is helping Bangladesh boost inclusive banking and achieving the target of SDGs relating to the financial inclusion.

This system has increased the money flow and financial transaction in the rural economy and the given informal economic activities into a formal shape, he told the FE.

The CPD research director suggested the commercial banks extend their credit facilities in the rural areas rather than collecting the deposits only.

"Lower credit flow against huge deposit collection through the agent banking will hamper financial equilibrium as those money would be channelled to urban areas only. This is not an equal distribution. So, lending to rural areas will have to be boosted," he added.

According to the BB data, the agent banks had disbursed only Tk 949 million as loans against deposits of Tk 107.78 billion until July 2020.

Mr Ahmed said although the deposit collections have got a big boost through agent banking, lending remains in the slow lane.

Dr Moazzem suggested the government utilise the agent banks for disbursing the COVID-19 stimulus package for the small businessmen and farmers.