Agent banking booms while helping banks in netting deposits, distributing inbound remittances and disbursing credits, thereby bringing unbanked people under formal banking network.

Although agent banking is spreading at a faster pace, especially in the rural areas, in recent times, it remains mainly concentrated in Dhaka and Chattogram divisions, sources say.

Even in the time of spreading COVID-19 virus, when every other business and banking activities saw a downturn, the agent banking made a significant progress, creating endless possibilities for both banks and their customers.

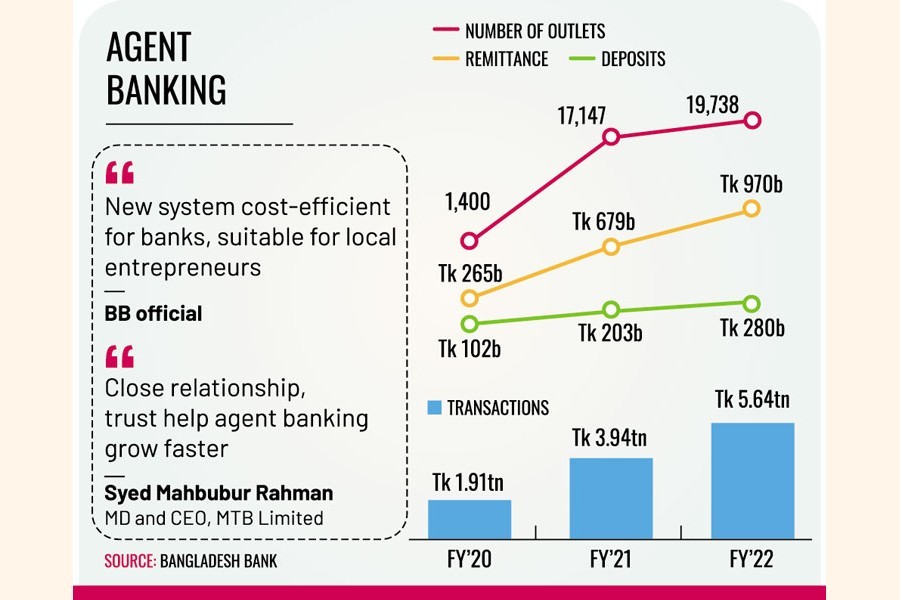

According to statistics available with Bangladesh Bank (BB), a total of 14,299 agents were deployed with 19,737 outlets in FY'22, which was 10.74 per cent and 15.10 per cent higher than 12,912 agents and 17,147 outlets respectively in FY'21.

The total number of accounts up to June 2022 was 16,074,378 with total balance of Tk 280.85 billion. The distribution of foreign remittances through agent banking in FY'22 was Tk 970.48 billion. The total number of balance and remittances handled by the agent bankers in FY'21 were worth Tk 204 billion and Tk 679 billion respectively.

Agent banking is defined as the banking service provided outside of regular bank branches by engaging agents under a valid agency agreement. It was first introduced here by Bangladesh Bank (BB) in 2013. The aim is to provide financial services to the underserved and poor segments of the population, especially those from the geographically dispersed locations.

Seeking anonymity, a BB official said it is a system through which banks can extend their services to the remote areas without setting up a branch or employing their own officials to the backwoods.

"This new system is cost-efficient for the banks as well as suitable for a local entrepreneur to act for a bank in their locality. As a result, agent banking is gaining much popularity in the remote areas," the central- bank official said.

Despite significant growth over the years, the agent banking remains confined to Dhaka and Chattogram divisions, leaving underprivileged people in other parts out of the facility, he said.

Dhaka division has a maximum of 3,738 agents, accounting for 25 per cent of the total, while Chattogram division came second with 22 per cent of the agents. On the other hand, the share of Mymensingh, Sylhet, Barisal, Rangpur, Khulna and Rajshahi divisions were 6.0 per cent, 6.0 per cent, 7.0 per cent, 10 per cent, 12 per cent and 12 per cent respectively.

Managing director and chief executive officer (CEO) of Mutual Trust Bank (MTB) Limited Syed Mahbubur Rahman terms the concept of agent-banking service good one to cover unbanked people in the remote areas.

The agents appointed by the banks are local people. So, they know well everyone in their territory and those who take its service also know the agents quite well, he told the FE.

"This relationship and trust help it grows in a faster way. Commission is the agents' main earning. So, they (agents) work round the clock to make it a successful venture," said the top executive of the MTB that collects deposits amounting to around Tk 5.0 billion through its 198 agents.