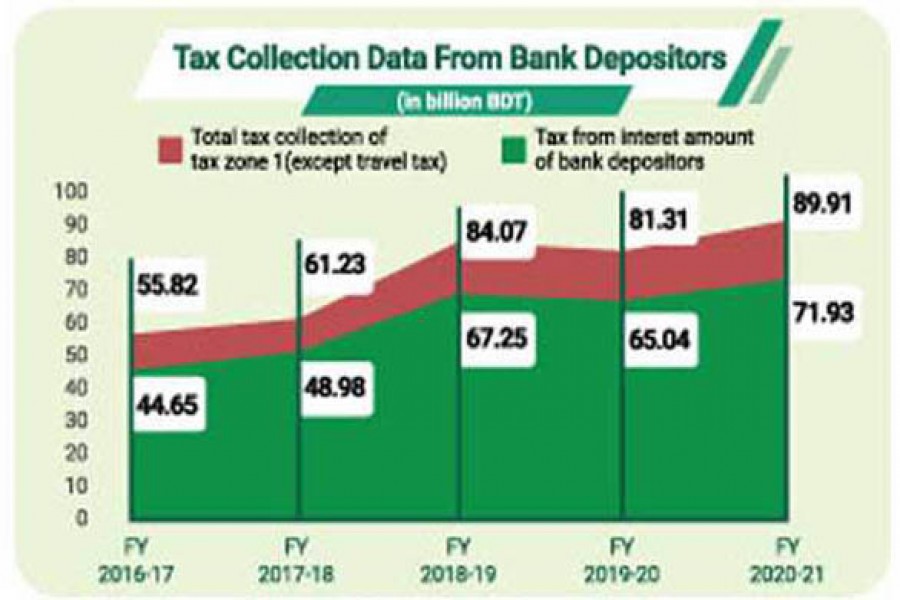

Advance tax collection from depositors has jumped by 61.09 per cent in the past five years, thanks to the expansion of banking services to bring more people under recorded transactions.

Around 1.0-million depositors are paying taxes on their interest amount irrespective of having taxable income, although only 3.62 per cent of the population is formally registered under the tax net.

The National Board of Revenue (NBR) collects 10-per cent advance tax from interest amount of depositors with taxpayer's identification number (TIN) and 15 per cent for not having TIN.

However, the deducted tax at source is adjustable with their actual payable taxes or refundable in case of untaxable income at the time of submitting tax returns at year-end.

But the fact is the depositors with no taxable income hardly get refund of the paid taxes at source on their bank deposits.

Umme Salma Begum, a widow lives in Dhaka city's Kalabagan neighbourhood, receives pension of her late husband to defray her living expenses.

She usually deposits the money in banks and withdraws the amount whenever needed.

"Despite having no taxable income, the government is forcing me to pay tax on the interest amount of my bank deposits. It's tax injustice as I'm supposed to enjoy the tax-free limit up to Tk 350,000."

It is not possible to visit tax offices at this age to lobby for tax refund, adds the widow.

The tax refund system is neither automated nor efficient enough to facilitate taxpayers get their refund without hassle.

According to the Income Tax Ordinance-1984, all TIN holders, with three exceptions, have to submit tax returns annually.

People having taxable income are able to adjust the deducted tax with the actual payable tax, but those without taxable income are supposed to get the refund from tax offices.

Preferring anonymity, a field-level official says the taxman usually discourages refunding tax as they have to meet annual tax collection target set by finance ministry.

"People having income below the tax-free limit hardly bothers submitting tax returns or visiting tax offices," he said.

According to the NBR data, only 2.4 out of 5.8-million TIN holders submit returns to tax offices.

The tax official says automation of the tax refund system can resolve this tax injustice to the people having below taxable income.

Senior citizens, housewives, widows and other low-income people who do not have taxable income should get refund of their paid tax at source, he admitted.

Md Jamal Uddin, a fresh graduate from Dhaka University, has recently started his job at a private firm located in upscale Gulshan district.

He finds the manual return submission process during this Covid-19 pandemic a major hurdle for taxpayers.

"Many of us are not willing to visit tax offices for submitting tax returns anticipating harassment by taxmen," Mr Jamal said.

Last year, the NBR did not hold tax fairs to avoid public gathering with an eye to containing the spread of the deadly pathogen.

According to the official, tax deducted at source from low-income depositors' interest amount remained deposited in the public exchequer for want of an efficient refund system and unavailability of an online return submission system.

BRAC Bank managing director and chief executive officer Selim RF Hussain suggested that the government fix a threshold for at-source tax collection to give relief to low-income depositors.

He expressed doubt in the refund process for those without taxable income, saying that he never heard anyone receive refund of the paid tax from the NBR.

Mr Hussain, however, supports the at-source tax collection from bank deposits to build tax compliance and encourage people to submit tax returns.

Theoretically, it is an advance income tax and the deducted tax is adjustable with the actual payable tax upon submission of tax returns, he says.

"This tax rule is not unjust. Rather, it's a right way to push people for tax compliance," adds the banker.

AKM Badiul Alam, income tax commissioner of the designated tax zone (01) for collecting source tax from bank depositors, said their efforts to realise proper taxes that banks deduct from depositors helped achieve the hefty growth.

The total volume of bank deposits in banks declined to Tk 12 trillion in December 2020 from Tk 13 trillion in September 2020, he cited.

Despite decline in interest rate and depositors' shift to the share market and savings certificate, the taxman could maintain upward growth of tax collection through efficient monitoring, Mr Alam mentioned.

According to the NBR data, around 80 per cent of the total tax collection of zone-01 comes from bank depositors' interest amount.