Trade tensions that have clouded Wall Street’s outlook for more than eight months will come to a head this weekend at a global political summit, with investors bracing for a range of outcomes that stand to influence stocks for the rest of the year.

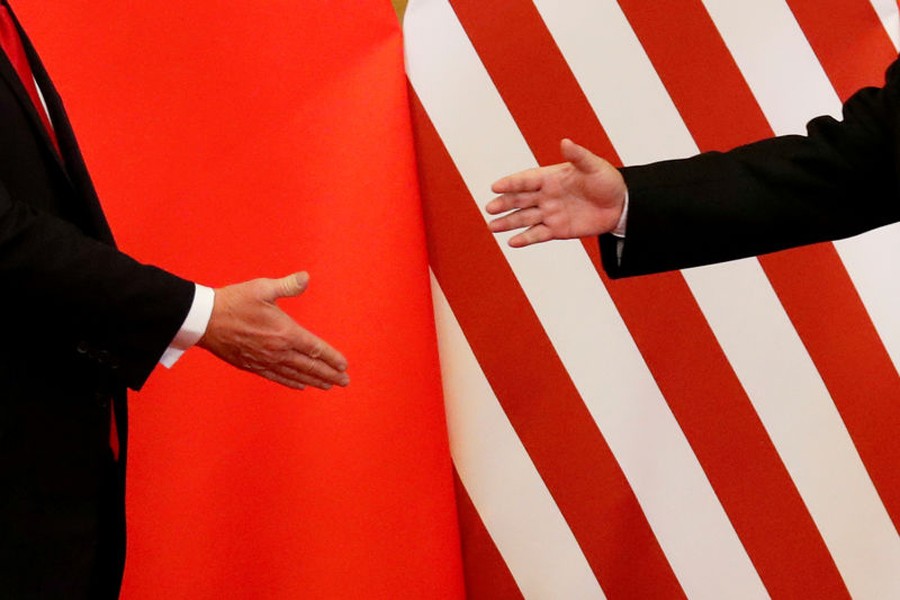

At the G20 summit on Saturday, US President Donald Trump and his Chinese counterpart Xi Jinping are expected to talk, in what some see as the most important meeting in years between the leaders of the world’s two largest economies.

Trump has imposed tariffs on $250 billion worth of Chinese imports and threatened even more, and investors are concerned that an escalation of tit-for-tat measures will crimp economic and corporate profit growth.

While hopes are dim for an outright deal, many investors are optimistic the two sides will show some progress toward potentially ending the tariff war. By contrast, investors said, any escalation in tensions could send the market, which recently confirmed a correction, back toward its recent lows.

“It feels like people are hopeful that this meeting yields if not a concrete plan on how to move forward in trade, at least some positive commentary from both sides that we are going to work towards a resolution,” said Mona Mahajan, US investment strategist with Allianz Global Investors.

“We are optimistic that we hopefully won’t get a worst-case scenario, which is President Trump comes away and says absolutely no on any prospect of working with China going forward,” she said.

Investor consensus over the past two weeks has been forming that “there is some type of short-term deal coming out of this that opens the window for a bigger deal,” said Walter Todd, chief investment officer at Greenwood Capital, although he cautioned there was “still a lot of uncertainty.”

US options activity already shows that traders are bracing for more volatility tied to the meeting of the heads of the world’s 20 largest economies, which gets underway on Friday in Buenos Aires, Argentina.

The benchmark S&P 500 .SPX stock index has bounced back this week after having dropped more than 10 per cent from its all-time high by the end of last week, perhaps leaving more room for declines should the meeting disappoint investors. The index is now up just 2.4 per cent in 2018.

“I don’t think that our market would have a real significant upward move based off of G20, but if something goes off kilter a little bit, you could definitely see significant downside pressure,” said Jonathan Corpina, senior managing partner for Meridian Equity Partners, who works on the New York Stock Exchange trading floor.

Wall Street’s attention has been trained on interest rate policy along with the US-China talks. But the focus may have shifted more to trade, following comments on Wednesday by Federal Reserve Chair Jerome Powell that lifted stocks and that many investors read as signaling that the Fed’s rate-hiking cycle may be nearing an end.

In the wake of Powell’s speech, Nicholas Colas, co-founder of DataTrek Research, said “what happens in Buenos Aires will determine if stocks post a positive 2018.”

The spectre of a global trade war has hovered over the market since Trump announced tariffs on imported steel and aluminium in March. Trump also recently said the US was studying auto tariffs, which could ripple through Europe and Japan, while a pact with Canada and Mexico left some investors heartened about potential progress with China.

“I think it’s the number one issue for investors,” Rick Meckler, partner at Cherry Lane Investments in New Vernon, New Jersey, said of trade.

“It’s ever since we started with the tariffs that the market has begun to wobble,” Meckler said. “And if our future is an all-out trade war with China, I don’t think the stock market could sustain these levels of prices.”

Should trade tensions escalate, Mahajan said it could shave expected earnings growth for S&P 500 companies in 2019 to 7 per cent from about 9 per cent.

To be sure, some investors were wary of putting too much weight on the meeting.

“The market would be at greater risk if something happens and the market rallies, and you have this perception that ‘ok everything has been solved,’” said Willie Delwiche, investment strategist at Baird in Milwaukee.

Still, with US corporate leaders increasingly voicing concerns over rising costs associated with tariffs, any development that eases those pressures would be welcome on Wall Street.

“Trade policy is having a negative effect on growth here in the U.S. and elsewhere,” said Jamie Cox, managing partner at Harris Financial Group in Richmond, Virginia. “This particular meeting between President Trump and President Xi is a pivotal moment where something needs to get done.”

Ameriprise Chief Market Strategist David Joy was doubtful of “any real resolution” but said “a so-called ceasefire that would allow discussions to continue without further escalation would be welcome.”

“Conversely, a lack of progress that leaves in place the possibility of more and higher tariffs would likely be market negative,” Joy said in written commentary this week.

UBS equity strategist Keith Parker said in a research note this week that “the absence of a negative G20 outcome,” that is if the sides agree to just keep talking, could see the S&P 500 trade up 4 per cent into year end. By contrast, Parker said, the index could fall 7 per cent if the trade dispute escalates, “with Trump-Xi talks going poorly a step to that downside case.”