Dhaka bourse performed mixed in last week amid investors' cautious behavior while injecting fresh funds.

The market witnessed erosion mainly because of investors' selling pressure in major sectors including the banking issues.

In last week, the Dhaka Stock Exchange (DSE) featured five sessions and three out of five closed in red.

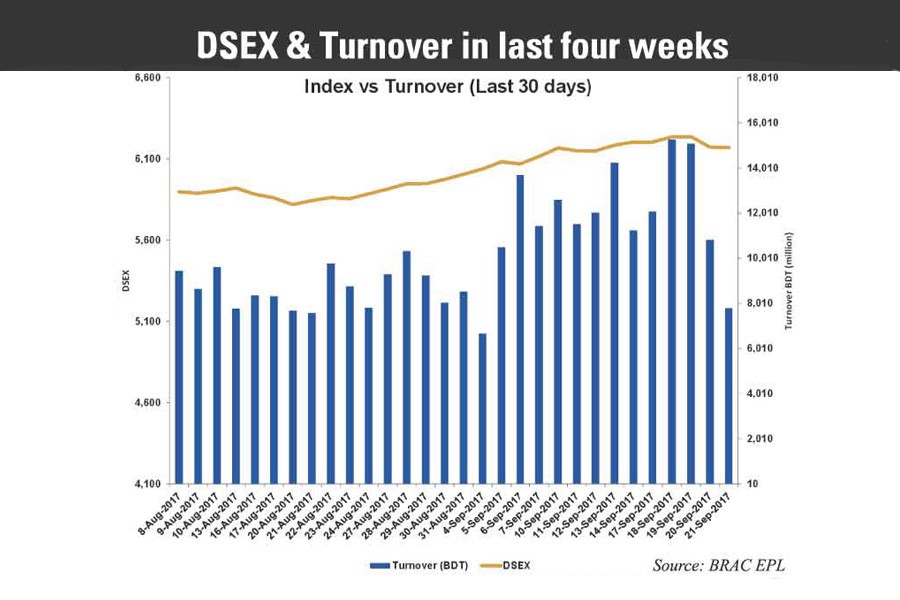

At the end of the week, the DSE broad index DSEX closed at 6170 points with a loss of 33.4 compared to previous week.

The shariah-based index DSES closed at 1361.89 points with a loss of 23.39, while the blue chip index DS30 lost 27.65 points and closed at 2197.54.

In five sessions, the DSE featured a total turnover of above Tk 61.05 billion which was 0.96 per cent less than the turnover of the previous session.

The average daily turnover was above Tk 12.21 billion against average daily turnover of above Tk 12.32 billion observed in previous week.

Meanwhile, average trade volume increased by 12.4 per cent and total number of trades saw 1.6 per cent decrease.

Among the large cap sectors, only bank closed positive this week with 2.87 per cent gain.

The charts of top gainers and turnover leaders were continued to be dominated by the banking sector stocks which snared 47.8 per cent of the week's total turnover.

Top ten traded stocks captured 31.3 per cent of the week's total turnover.

According to International Leasing Securities, the market faced mild correction in last week as the investors preferred to book quick-gain on their investment over the recent price surge.

"Many investors were busy to rebalance their portfolios ahead of year-end corporate declarations," said the International Leasing Securities.

It said several issues from bank and life insurance sector enjoyed buoyancy while selling of shares mostly from textile, engineering, telecom and pharmaceuticals & chemicals sectors contributed to the fall in indices.

"Investors' participation remained encouraging as the turnover stayed over Tk 12 billion while some investors were observing the market movement."

Investor's activities were mostly concentrated in bank which grabbed 46.3 per cent of market turnover followed by textile 11.3 per cent and financial institutions 8.3 per cent.

"Though the week started with its previous gaining momentum with heavy buoyancy on mostly banking sector, last two sessions experienced price correction as investors went for profit booking," said another market review of EBL Securities.

Among the gaining sectors, the bank and life insurance advanced 2.9 per cent and 1.5 per cent respectively.

Among the losing sectors, ceramics declined 4.8 per cent, paper & printing 3.6 per cent and IT 3.3 per cent.

Among the top 10 gainers, Rupali Bank advanced 16.50 per cent, Uttara Bank 15.51 per cent, National Bank 12.32 per cent and Standard Bank 9.59 per cent.

Among the week's turnover leaders, Social Islami Bank featured average turnover of Tk 594.4 million followed by National Bank Tk 546.3 million, First Security Islami Bank Tk 360.2 million and IFIC Bank Tk 353.1 million.

Among the scrip-wise top losers, Monno Ceramics declined 15.3 per cent, Dulamia Cotton Mills 14.4 per cent, Samata Leather 14.3 per cent and Legacy Footwear 12.4 per cent.

During this week, the port city bourse, CSE closed in red zone. CASPI and CSCX shed 71.5 points and 115 points respectively.