Rising non-performing loan in the country's banking sector, especially in state-owned scheduled commercial banks, for the past few years put serious threat to Bangladesh's financial sector. However, the scenarios are not properly reflected or published in annual reports of the banks.

Currently, a total of 59 scheduled banks (six SOCBs, three SDBs, 41 PCBs, nine FCBs) are operating under full control and supervision of the central bank, which is authorised to do so as per the Bangladesh Bank Order, 1972 and Bank Company Act, 1991. There are five non-scheduled banks operating in Bangladesh for special and definitive objectives under various acts.

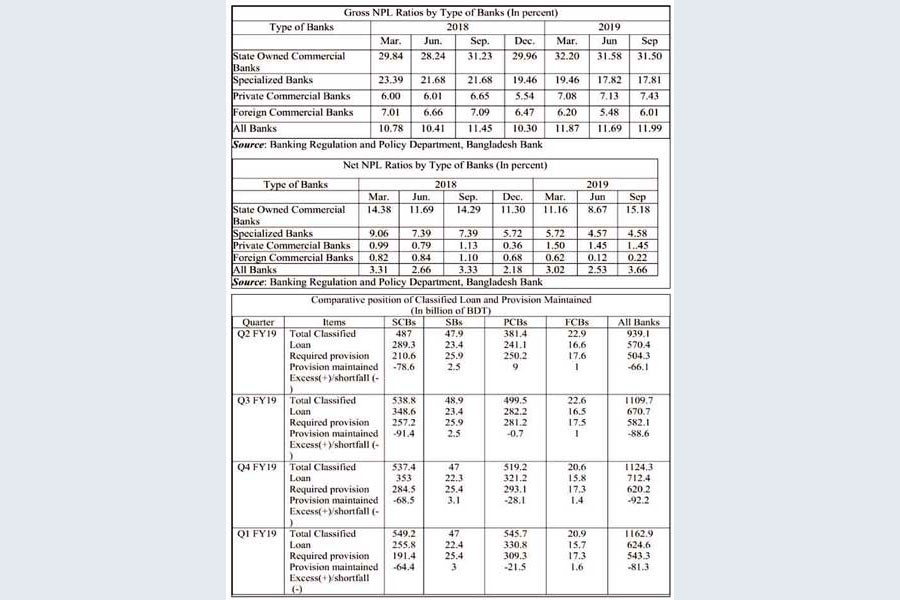

Total reported classified loan in the country's banking sector amounted to Tk 1,162.9 billion at quarter one of 2019-20 financial year (As of September. 2019), up by 3.43 per cent compared to the previous quarter's (June, 2019) amount of Tk 1,124.3 billion.

The actual scenarios are much worse than the ones reflected or disclosed in the annual reports. If we consider the court's stay order, restructured loan, yearend rescheduled loan, payment of partial installment of term loans, creation or sanctioning of one loan to pay off going-to-be-classified loan, servicing the interest of continuous loan only rather than adjustment of principal and subsequent renewal of continuous loan by bank at yearend, the actual amount of non-performing loan would be much higher under objective criteria of loan classification. If we become a little bit rigid, many loans would be classified under qualitative judgement due to circumstances of fund diversion, poor control over collateral, incurring loss with poor cash flow etc.

Statutory audit of these banks also don't reflect the true financial health and asset quality of the bank. Because, interest/profit (for non-conventional bank) on classified loan is to be recorded as interest suspense rather than interest income as per BRPD (Banking Regulation and Policy Department) Guidelines and interest cannot be booked on bad and loss loan, which are majorly overlooked in the statutory audit as audit is not done on classification of each loan properly in line with BRPD Guidelines.

Hence profit, as shown in the income statement, is exaggerated and proper loan provisioning is ignored. Ultimately profitability, asset quality and capital position (as per Basel-III Guideline) of banks are improperly presented in annual reports.

Factors that all contributed together towards skyrocketing classified loans at this worse stage include inclusion of more directors from the same family through amending Banking Company Act, relaxation of classification and rescheduling policy and incentive to bad large borrower under large loan restructuring policy.

Things that can be done to get rid of this situation are phasing out inclusion of directors from the same family and limiting to maximum two (for this amendment of Banking Company required), stopping appointment of director based on political affiliation in state-owned commercial bank, transparency in forming board, minimum academic background to be a Bank Director, stopping appointment of most biased/dependent director in the name of independent director, imposition of restriction to form political party-backed trade body in SOCBs, scrapping the CIP (commercially important person) or VIP (very important person) status of loan defaulter, regular update and posting of loan defaulter status at website of respective bank, introduction of digital display of defaulters with photograph at entry of each branch including Head office, ensuring quick disposal of case at Artho Rin Adalat (Money Loan Court) including highest time limit (if necessary number of the same status court and judges can be increased based on number of pending cases), increasing the number of special bench at High Court division of the Supreme Court with maximum time limit to dispose off the case, imposition of travel ban abroad of loan defaulters and withholding their passport, restriction on participation of loan defaulter in state programmes etc. - all these are to create regulatory embargo and social restriction on loan defaulters for which only honest political commitment is enough.

Furthermore, following issues need to be addressed at the level of bank management: independent and impartial credit evaluation by CRM (customer relationship management) for fresh and existing loan proposal, strict compliance of loan classification, rigid compliance of rescheduling and restructuring policy, strict compliance of single borrower and large loan exposure, adequate collateral (properly valued) against loan, sanctioning more loan to new group and new prospective venture rather than currently overexposed group, identifying sectoral prospects and loan gap, continuous study and research (specifically various economic sector in the country, its prospects and threat for changes in national and international business dynamics) to diversify loan, eye on implication of government policy and changes in international business environment etc.

Md. Asiful Huq is Chief Rating Officer at CRISL.

[Opinion expressed in this article is the author's own and does not necessarily reflect the position of the entity where he works.]