With the rapid developments in theory of monetary policy, the practice of monetary policy framework has greatly been evolved since the early 1990s. Meanwhile many central banks around the world especially in the industrialised/developed countries have transformed their long-existed monetary policy framework mostly from the Quantity Theory based monetary aggregate targeting regime to interest rate or inflation targeting regime depending on their own status of economic and financial developments.

Likewise other central banks around the world, Bangladesh Bank (BB) has its own institutional arrangement under which monetary policy decisions are made and executed. BB's current monetary policy framework is essentially a monetary aggregate targeting based on the ideology that broad money (M2) is largely determined by reserve money (RM) through money multiplier.

Under this framework, broad money (M2) is considered as intermediate target and reserve money consisting of currency outside banks plus cash in tills and cash balances of the deposit money banks (DMBs) with Bangladesh Bank as operating target.

To reach its reserve money target, Bangladesh Bank controls liquidity in the market on a day-to-day basis using various indirect monetary policy tools such as auctions based repo and reverse repo operations, buying and selling of Bangladesh Bank bills including government's debt instruments comprising of various treasury bills and bonds. If required, BB sporadically uses its available direct monetary policy instruments such as change in cash reserve ratio (CRR) and or the statutory liquidity ratio (SLR) depending on the macroeconomic situation and liquidity position of banks.

Bangladesh Bank also intervenes in foreign exchange market to reduce undue volatility in the exchange rate of Taka against other currencies and for maintaining export competitiveness. In addition, central bank of the country uses refinancing lines and mandatory credit quotas to steer credit allocation in priority sectors of the economy, as well as a variety of regulatory measures to promote financial inclusion, inclusive growth and environmental stability.

Bangladesh has experienced a significant transformation from its agrarian based to an outward-oriented industry and service sectors based economy during the last three decades or more. With the implementation of structural adjustment policies and gradual opening of external sector, Bangladesh economy has consistently exhibited a strong real Gross Domestic Product (GDP) growth performance in the recent years. It is now proceeding towards a middle-income country status where controlling monetary aggregates by using reserve money may appear to be tricky and thus transmit of monetary policy decisions in the real sectors of the economy may be inadequate.

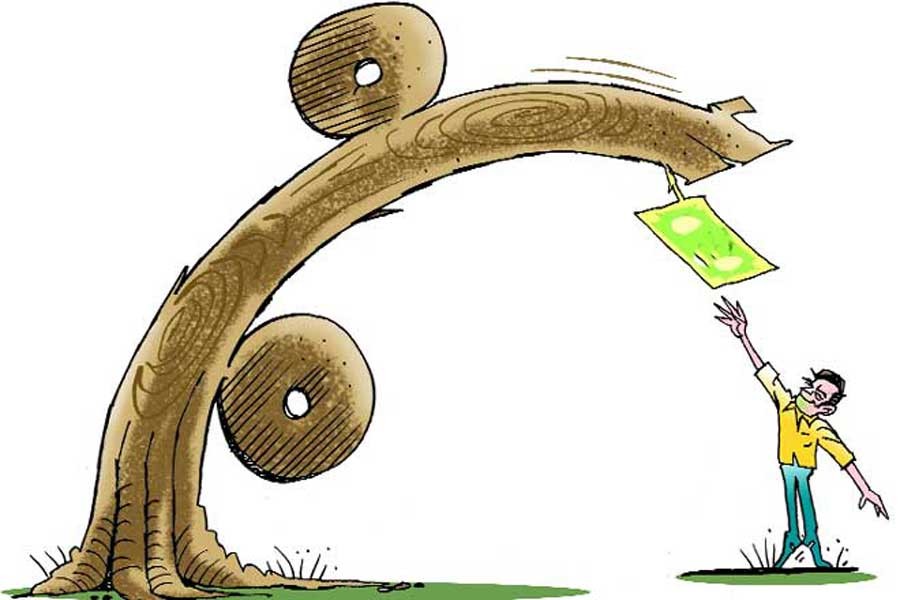

Therefore, BB is proceeding with preparatory work for adopting a policy interest rates focused monetary policy regime in which policy interest rates exert direct impact on prices in the financial and real sectors, rather than indirectly through a monetary aggregate (broad money) as in the policy regime now in use. The intended regime is expected to quicken and heighten efficiency in transmission of intentions of monetary policy.

The process of shifting current monetary policy regime may be initiated by introducing flexible monetary targeting (FMT) for gradually transformation to an interest rate targeting framework. The International Monetary Fund (IMF) SARTTAC is currently extending technical assistance in BB's ongoing preparatory work for transformation towards inflation targeting framework.

The piece is taken from Bangladesh Bank Annual Report (July 2019-June 2020). www.bb.org.bd