The term "economic development" typically refers to the improvement in various indicators such as literacy rate, life expectancy, poverty rate, etc. In respect of all the indicators, Bangladesh economy is developing. Present literacy rate of the country is 61.5 per cent, life expectancy is 72 years which is higher than the average world standard, poverty rate is also on a gradual decreasing trend. Within the last five years, poverty rate has reduced from 31.5 per cent to 22.5 per cent.

But, one issue that is not in harmony with the development of the country is growing inequality in society. The indicators that we consider to measure economic development are based on the average of various numbers. If we analyse the numbers separately, it may be observed that the gap between higher-income level and lower-income level is widening. In the year 2005-06, the position of lower-income level of five per cent people was 0.77 per cent. Based on this information, it can be estimated that the portion of 10 per cent lower-income level people (LILP) was more than 1.54 per cent (assuming that income of second five per cent is higher than 1st five per cent). But according to the Bangladesh Bureau of Statistics (BBS), income of lower-income level 10 per cent people is only one per cent. In comparison to the years 2005-2006 and 2016-2017, it appears that the average income of lower-income level people of the country is decreasing.

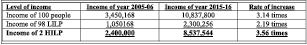

If we analyse the increasing rate of wages, rate of inflation in general and inflation of food items, this grim reality is found to be increasingly persistent. Per capita income in the year 2005-2006 was Tk.34,502. Let us consider that this per capita income of Tk.34,502 represented 98 lower-income level people whose per month income was Tk.893 and two higher-income level people (HILP) whose monthly income was Tk.100,000. As per this example per capita income may be calculated as under:

After ten years, in the year 2015-2016, per capita income reached Tk 108,378 which is 3.14 times higher than per capita income for the year 2005-06. According to the Annual Economic Review of 2017, the income of Tk. 3507 for the year 2005-06 rose to Tk. 7680 in 2015-16. Based on this, income of Tk. 893 of the year 2005-06 has reached Tk. 1956. The income in the year 2015-16 has increased 2.19 times compared with the income for the year 2005-06. Income of lower-income level people has increased 2.19 times but average per capita income has increased 3.14 times. Now, question may be raised how this gap has been filled up. The answer to the question may be as under:

The above calculation indicates that income of high-income level persons increased 3.56 times. The income of lower-income level people is increasing at a lower pace compared with that of the higher-income level people. It is also pertinent to mention that the lower-income level people are not only being deprived in their earning end but also being deprived at their expenditure end. Normally, a major part, almost 50 per cent of the earnings of lower-income level people is spent on a single basic need -- food. In 2005-06, a lower-income level person spent Tk. 5358 on food items. Based on the index of food items, the value of food items of Tk. 5358 of the year 2005-06 has reached Tk. 12579 in 2015-16. Increase in the portion of income spent on food items means capacity to purchase other important items such as education, medicine, clothing and others has decreased. The decrease of purchasing capacity, despite the increase of income, means decrease in the real income of the person. Now, question may be raised how the income of higher-income level people has increased by 3.56 times. The income of higher-income level people increases in two ways-- one is due to inflation and secondly, due to income on savings through investment. Normally, a major part of income of higher-income level people remains unspent for essential items and this unspent amount is invested for further income. A calculation of increasing income of higher-income level people is presented below:

For the purpose of calculation, it has been assumed that a higher-income level person spent 50 per cent of income on food, education, shelter, clothing, medicine and other comfortable and luxurious goods, and the remaining 50 per cent was invested for generating income. In the above example, annual income was Tk. 2,400,000 out of which 50 per cent was spent for consumption and the remaining half i.e., Tk. 1,200,000 was invested which has generated income @ almost 10 per cent and in ten years the principal amount with income added to it has increased 2.73 times.

The analysis clearly indicates that during the last 10 years, overall growth rate was satisfactory resulting in satisfactory average per capita income, which is more than six per cent but the gap between lower-income and higher-income level people is widening.

There are various reasons behind the increase of inequality, despite satisfactory growth. Inadequate wages, low price of agricultural products, abnormal loan default culture, excessive dependency on indirect tax, lack of good governance, etc., are some of the reasons.

Taking the opportunity of prevailing unemployment in the country, most industrialists do not pay sufficient wages to the workers. Although there is labour law in the country to protect the interest of the workers, there prevails a serious deficiency in overseeing the practices on the ground. For example, as per prevailing labour law, workers are entitled to get benefit of profit of the industry in the form of `Workers Profit Participation Fund' but most of the industries do not pay the benefit of profit to the workers. As for the agricultural products, middlemen and business syndicates are major hindrances in fetching fair prices.

Another reason, as mentioned above, is the excessive dependence on indirect tax to meet government expenditure. Every year major part of budget, i.e., more than 70 per cent comes from indirect tax and deficit financing. From economic perspective, indirect tax is regressive. Indirect taxes make the distribution of income more unequal and it is inflationary in nature.

Loan default at abnormal rate is highly instrumental in increasing inequality. Normally, the benefits of default loan are enjoyed by the investors i.e., high income level people and it contributes to widen the gap between the rich and the poor. There is no doubt that the economy of the country is growing, but to reach the benefit of growth to the people of all walks of life, necessary steps need to be taken to reduce the gap between the rich and the poor.

Md Shahadat Hossain, FCA is Member Council and former Vice-President, Institute of Chartered Accountants of Bangladesh.