The success of Bangladeshi denim and denim products were widely covered in the media during the 8th Bangladesh Denim Expo held in May 2018 in Dhaka. Reports of high growth and high market shares of Bangladeshi denim apparels in the major export destinations of North American and Europe have raised hopes. Eurostat reported that the market value of Bangladeshi denim in the EU was worth 1.30 billion euros, a marginal 0.54 per cent increase from 1.29 billion euros in 2016. In the same year, Bangladesh exported denim products worth US$507.92 million to the US market, scoring a 9.55 per cent growth compared to $463.61 million in 2016, as reported by the Office of Textiles and Apparel (Otexa) in the USA.

Interestingly, during the past five years (2013 - 2017), Bangladesh imported a considerable amount of denim fabrics, close to $ 1.0 billion. The top sources of import of denim fabrics for Bangladesh are China, Pakistan, Hong Kong, India, Thailand and Turkey. Apart from the imported denim fabrics, Bangladeshi denim producers have been continuously increasing their own production capacity from the scratch, processing imported raw cotton for warp, and processing waste cotton into weft, and now meet a little more than half of the total requirement for export oriented denim apparels, jeans, jackets, and shirts. But Bangladesh produces mostly 100 per cent cotton denim fabrics, and not the blended denim which is of rising demand globally.

Denim, these days, is a lot more than the traditional 100 per cent coarse cotton fabric woven usually with indigio-dyed warp, the length-wise stretch of yarn, interlaced with natural-dyed cross-wise yarn or weft, going under two or three warp yarns each time it goes over the warp once. Blending with stretch-tolerant yarns of man-made fibers has changed the characteristics of denim fabrics, its usage, performance of the garments made out of denim, and the overall denim business substantially in the recent times.

Accordingly, the Harmonized Tariff Classification or Harmonised System (HS) now has two product codes at the six-digit level that can track the global trade of denim fabrics. Denim made of 100 per cent cotton or predominantly cotton blended with man-made fibers, including stretch materials, where cotton makes up more than 85 per cent of the fabric by weight is coded under HS520942, and the second code HS521142 is used for denim fabric containing less than 85 per cent cotton by weight blended with synthetic/artificial fibers.

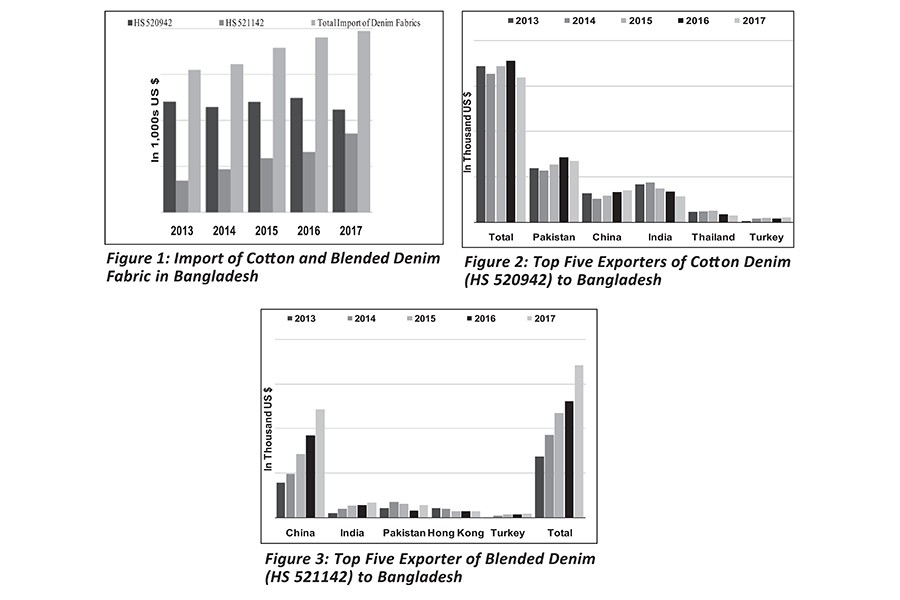

Mirror data, as reported by the partners, during the 5-year span of 2013-2017 for Bangladesh derived from UN Comtrade database (Figure 1) tells us that imports of cotton denim (HS 520942) experienced a slight decrease gradually, making sense of the increase domestic supply capacity.

The waste cotton from our knitwear products is used as the raw material for spinning the naturally dyed weft yarns, and also for the dyed yarn used as warp yarn, for denim requires yarns of lower count made from cotton of relatively shorter staple length. In other words, availability of waste cotton from our knot and woven products acted as a competitive advantage behind the beginning of our denim industry, which is thriving at the moment, but may experience unforeseen turns due to Trump's trade war affecting the global value chain of cotton and cotton products.

Denim enterprises in Bangladesh will do well if they give due consideration to manufacturing blended denim as well. The import trend (Figure-1) demonstrates a clearly increasing trend of higher imports of blended denim (HS 521142) in the recent years.

For cotton denim, the largest exporter to Bangladesh is Pakistan, followed by China and India. As of 2013 and 2014, India exported more to Bangladesh, compared to China, but in the more recent years of 2015 -2017, China surpassed India in exporting cotton denim to Bangladesh.

Trump's trade war will adversely affect the cotton import of both China and India, and their supply capacity of denim fabrics will be substantially reduced, and/or become costlier.

Prices of raw cotton from the USA, the single largest supplier of cotton, are already falling, and both Bangladesh and Pakistan will be in the position to import cheaper cotton. But both Bangladesh and Pakistan are not be in the position to fully utilize the price advantages offered by cheaper cotton prices from the USA, because neither have adequate processing capacity. The denim factories in Bangladesh are already operating at their full capacity. In Pakistan, capacity utilization in denim factories is poorer due to power shortages and weaker domestic currency, compared to Bangladesh. However, Pakistan is targeting a big jump in export in the current fiscal year after giving tax breaks to exporters and expecting a reverse a three year slump.

Additionally, unlike Bangladesh, Pakistan can always capitalise on their home-grown cotton. Hence, it will be reasonable to expect that it will be relatively easier for Pakistani manufacturers to scale up their production of denim fabrics, and likely to increase their share of exports of cotton denim to Bangladesh, whereas the other two closes competitors, China and India will be able to export less to Bangladesh. The relative performance of the top five exporters of cotton based denim fabrics (HS 520942) to Bangladesh during 2013 - 2017 is shown in Figure 2.

The scenario for blended denim fabrics (HS 521142) is slightly different. For the same period of 2013 -2017, the top exporter to Bangladesh is China. China holds about 70 per cent of the import market share in Bangladesh for blended denim during these consecutive years. It's time for Bangladeshi manufacturers of stretch jeans to think about the rising costs and unavailability of blended denim from China in the coming months, after the onset of Trump's trade war.

Pakistan does not have significant supply capacity for blended denim. Turkey has considerable supply capacity, and will not be adversely affected by the trade war. Hence, It is likely that Turkey will considerably increase their export of blended denim to Bangladesh in the coming months.

In addition to absorbing the short and medium term supply shock of blended denim fabrics, Bangladeshi denim sector needs to consider the increasing global market preference for blended denim. Slim fit and stretch jeans are the preferred casual wear of men and women in the West where our exports go. The fashion trend is shifting towards more body contour, more flexibility and ease of wear, more breathability and lightness of the fabric. This means blended denim. Those currently planning for investment in production of denim fabrics will be better off to include blended denim in their product line.

Shaquib Quoreshi is an Enterpriser at Business Intelligence Limited.