Lending facilities of banks are still major sources of funds for Bangladeshi industries, businesses and new ventures. Though there are alternative sources of funds, bank finance plays the predominant role. So, risk is closely associated with lending. In order to mitigate credit risk, identification and quantification of risk is highly crucial. Recently, Bangladesh Bank (BB) has developed a new tool Internal Credit Risk Rating System (ICRRS) replacing the earlier CRG-Credit Risk Grading.

APPLICABILITY OF ICRRS: ICRRS is applicable for all exposures (irrespective of amount) except consumer loans, small enterprises having total loans exposures less than Tk 5.0 million and small enterprises in manufacturing having total loans exposures less than Tk 10 million, short-term agri-loans, micro-credit and lending to bank non-banking financial institutions (NBFIs) and insurance. So, a large amount of credit facility cannot be extended without doing ICRRS.

KEY FEATURES

* ICRRS can generate sector-wise score, which is a great initiative. Earlier, CRG was generalised and it could not differentiate sector-specific parameters. RMG industry's business parameter cannot be the same to those of trading business.

* It has given more emphasis on leverage and cash flow. A highly leveraged concern or a firm having poor/negative cash flow is very likely to generate low score in new rating-ICRRS.

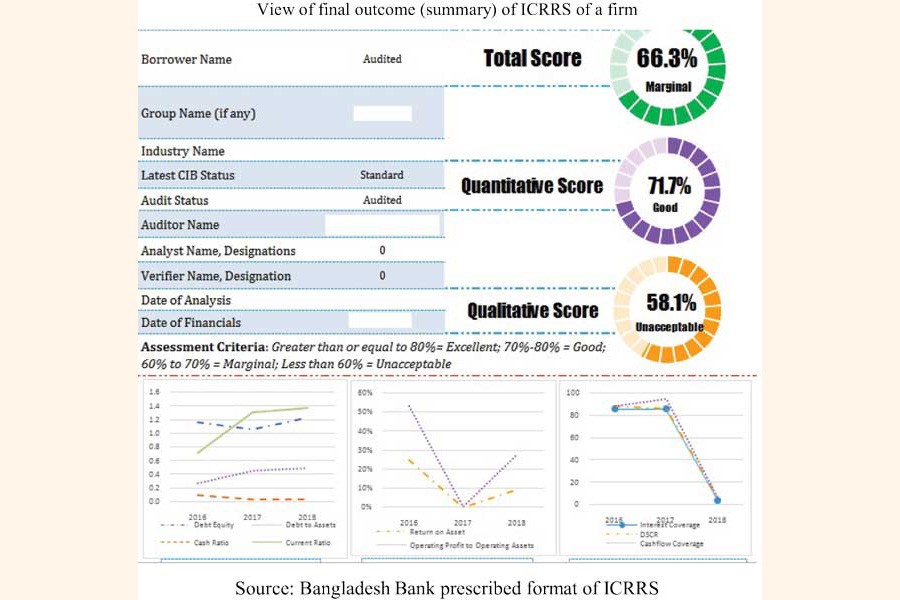

* ICRRS have two analysis parts: quantitative and qualitative. 60 per cent weight is assigned to quantitative part while rest 40 per cent weight is assigned to qualitative part. The earlier tool i.e., CRG had 50-50 weight for these two parts. More emphasis has been given on quantitative part of ICRRS. Leverage, liquidity, profitability, coverage, operational efficiency and earning quality are parameters of quantitative part.

* Performance behaviour, business and industry risk, management risk, security risk, relationship risk and compliance risk are the components of qualitative part, many of which are similar to earlier CRG. However, BB has clearly indicated how these fields are to be filled up in its guideline. Good thing is how many times a customer was rescheduled and how many times was marked adversely in classification are also reflected in the score line with good amount of weight. So, a bad borrower with irregular payment habit will obtain poor score in ICRRS.

* If a concern intends to take loan by providing corporate guarantee of a sister concern, it will not be acceptable if it has not obtained good credit rating. Regularity in payment to suppliers, acceptability of audit firms, change of audit firms etc., are also reflected here.

These features have made ICRRS a comprehensive tool of credit risk management in Bangladesh. Another good thing is ICRRS' flexibility. If a company scores poor, still it can get loan, if the concerned borrower's bank can properly justify the lending. In case of score 80 and above it will be marked 'Excellent', for 70 to 79, it will be 'Good', for 60 to 69, it will be 'Marginal' and for below 60, 'Unacceptable'. If a company scores 'Unacceptable' in ICRRS, borrower bank still can renew their credit facilities for 2 (two) more times. So a firm has still chance to improve in its financial and other parameters and can utilise existing credit lines till that time.

AREA OF FUTURE IMPROVEMENT: Though ICRRS has removed much of previous shortcomings, still there are a few areas that require attention for future improvement.

A. A few businesses are not included in ICRRS

Most of the businesses of Bangladesh are included in ICRRS. However, a few widely practised businesses and industries are not included in the listing. Though there are sectors for other industry or services but generalised benchmark should not be set for some specific business.

Right sector selection in ICRRS is very important. Because, yardstick for different ratios and parameters of ICRRS varies sector to sector. With same scores & numbers, one industry can get 'Marginal' rating; while another may get 'Unacceptable' rating.

There is no specific category for contractors. The government is taking many development initiatives like large bridges, roads, highways construction, repair and enhancement works. In addition, there are many projects in education and health engineering sectors. Usually, they participate in tenders mostly through e-GP. There is category for 'Housing and Construction' which can be used for real estate business. But, contractors are of different types and the same rating of 'Housing and Construction' should not be used to categorise contractors. Transport & automobiles, airlines ticket seller, tours & travel operators, furniture manufacturers and many more industries should be identified with specific parameters.

B. No separate scores for non-funded facilities in ICRRS

In ICRRS, all debt-related ratios count debt amount but do not differentiate between non-funded and funded credit. There are many forms of non-funded credit facilities like different types of Letter of Credit facilities including Back-to-Back L/Cs, Acceptance of Bills, Shipping Guarantees, Bank Guarantees like Bid Bond, Performance Guarantee, APG, Performance Security etc. Measure for non funded credit facilities cannot be similar to direct funded facility in terms of the nature of risk and other features; though a non-funded credit may turn into funded facility.

C. Assignment of Bill Receivables of contractors is not counted as security in ICRRS

Many banks provide Performance Guarantee/ APG facility for contractors against assignment of bill receivables of work/supply orders favouring the bank. A contractor's revenue source is bills receivables and assignment of these bills favouring bank is considered primary security in many banks. In case of breach of contract/encashment claim of guarantee, bank can utilise the bill amount they receive from works of contractors. However, in ICRRS, there is no scope to count this security. In ICRRS, only fully pledged security/ hypothecation in different forms and landed property are considered/counted [refer to Qualitative Assessment part of ICRRS].

D. Separate benchmarks are required for NGOS & MFIs

As working pattern of NGOs and Micro Finance Institutions (MFIs) are different from conventional businesses, separate benchmarks are required for doing credit rating of these concerns. Moreover, ICRRS should be mandatory for these concerns.

E. Exclusion for 100% security coverage

Many experts feel that if a lending is proposed against 100 per cent security coverage, these concerns may be added to exclusion list of ICRRS i.e., a bank/FI can skip ICRRS for these concerns.

F. ICRRS should be mandatory for Corporate Guarantors

There is provision for rating substitution for Corporate Guarantors i.e. ICRRS can be substituted for Corporate Guarantors in case of large conglomerates. But, other than rating substitution, it is not mandatory. For any Corporate Guarantee, the guarantor company/firm's ICRRS should be mandatory under any case.

G. More fields should be added in Primary Security tab

Usually, if a firm borrows loans, it provides collateral security in the form of landed property. It means in addition to stocks, margin and other primary security, the landed property stands as additional/collateral security to the loans. But if the loan is House Building Loan/ Construction Finance, then the landed property itself is the primary security. These features need to be added in primary security tab.

ICRRS-PRESCRIBED FIELDS LACKS UNIFORMITY: ICRRS-prescribed fields for putting input for Balance Sheet, Profit & Loss Account and Cash Flow Statement Analysis are ideal and globally accepted forms now-a-days. However, many audit firms do not prepare financials in line of ICRRS. This makes the job of banker i.e. Credit Analyst difficult to prepare ICRRS. For example, ICRRS has mandatory field for noting current portion of long-term field. However, many financials do not specifically show this figure. This increases risk of miscalculation/wrong ICRRS rating. Many financials do not separately show Bank Overdraft, Working capital Loans and Short Term loans. This may also lead to wrong calculation of rating.

To conclude, ICRRS is an excellent outcome of long research of an expert team. In the current scenario of non-performing loans (NPLs) in Bangladesh, it can be utilised to prevent low quality lending in future. If ICRRS is implemented effectively, firms having poor financials with high debt and low parameters have to improve their scores and it will help develop a healthy lending environment.

Mohammad Shafiqul Islam is Assistant Vice President, NRBC Bank.