Only five countries have managed to graduate out of the 'Least Developed Country' (LDC) status and became 'Other Developing Countries' since the formation of LDC group in 1971. However, in terms of economic structure, these countries are quite different from Bangladesh. Among these graduated former LDCs, Cape Verde, and Samoa fall into the category of small island developing states (SIDS). While Botswana and Equatorial Guinea are countries with abundant natural resources, Equatorial Guinea is the only country to graduate under income only criterion, while the rest of the countries matched two criteria of gross national income (GNI) per capita and Human Assets Index (HAI). All countries had weaker than desirable scores in Economic Vulnerability Index. Compared to these countries, Bangladesh is a country with huge population. It is not dependent on natural resources and met graduation thresholds for all three criteria. Therefore, in essence, experiences of former LDCs are not going to be extremely helpful in predicting outcomes of post-graduation era. Nonetheless, they can offer several insights about how a country can maintain progress smoothly in after graduating from LDC status.

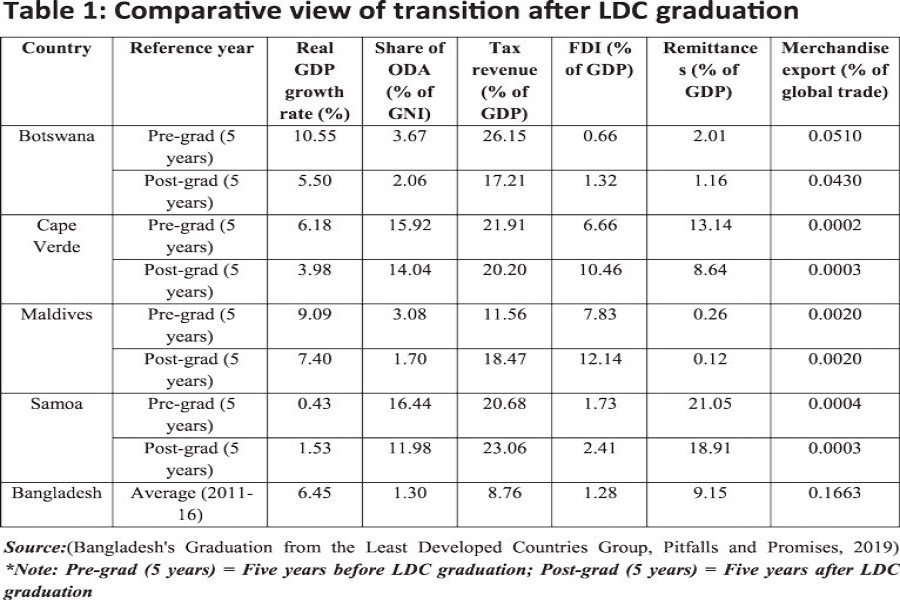

Table 1 provides a comparative picture of the former LDCs through the transition period (Equatorial Guinea is excluded because it graduated only in mid-2017). If we look at the few primary indicators for these countries five year prior to graduation and five year after graduation, it gives us a good idea about how LDC graduation have shaped their economic performances. A common theme for Botswana, Cape Verde and Maldives during the transition period has been a slowdown of economic growth. In the immediate post-graduation era, Botswana saw its growth cut down by half while Cape Verde by more than a third. Maldives also experienced slow growth- particularly due to the slow performance of the main export items (fish fillets and frozen fish) to key export destination (EU, Japan). Loss of Duty-Free Quota-Free (DFQF) status in the European market created adverse pressure on the Maldivian economy.

Despite a fall in the gross domestic product (GDP) growth rate, Botswana's mining industry boomed in post-graduation era and the government maintained a high current account surplus and high tax revenue earning owing to successful diamond mining industry. The country is closely integrated with the global trade and cyclical factors are determinants of growth. But overall, the economic performance of the country has been good since graduation.

One issue that has remained historically challenging for Bangladesh is the collection of tax-revenue in terms of GDP. Evidence suggests, during preparation period of graduation, former LDCs had a high starting tax-GDP ratio. And in the post-graduation transition period, they maintained close to 20 per cent tax revenue-GDP ratio. Overall, the tax revenue collection efforts of Bangladesh will need to go up over the years.

An interesting issue that can be learned from former LDCs are share of official development assistance (ODA) with respect to national income and share of foreign direct investment (FDI) against GDP during the transition period. It has been observed that the proportion of ODA falls against income when any country develops. Countries grow more aid independent in post-graduation era. All graduated LDCs have experienced stronger inflow of FDI in the post-graduation era. This has helped them to recover from early loss of preferential access.

Apart from Cape Verde, all the other four countries had a three-year grace period for preferential access, International Support Measures (ISMs) and other LDC-specific preferences. Cape Verde undertook good planning prior to graduation. The country successfully negotiated with European Union (EU) for additional two-year grace period for 'Everything But Arms' (EBA) above the original three-year grace period, and some other transition period deals with prominent trade partners like China (Bhattacharya & Khan, 2019). Malaysia and Botswana have also planned about potential negative impact of graduation. It can be noted, only EU and Turkey have an explicit policy for extending LDC-specific trade preferences for a transition period, the same is not necessarily true for other countries offering unilateral trade preferences (UNCTAD, 2016). For example, there are no smooth transition provisions in case of Japan's or Canada's Generalised System of Preferences (GSP) scheme. Therefore, one option for Bangladesh is to start planning for the future ahead and negotiate for transition period preferential access, with options for post-graduation trade deals or free-trade agreements with countries of interest.

From the perspective of Bangladesh, remittance earning has always been a matter of key interest. A strong remittance inflow helps to develop good reserve of foreign currencies, which provides significant leverage to central banks in maintaining favourable exchange rates. Small island nations and land-locked LDCs also substantially rely on remittance inflow due to lack of mature exporting sectors. Former LDCs also face problems like unemployment, underemployment, automation and inadequate working opportunities. Consequently, they resorted to exportation of manpower. As a result, their remittance inflow almost doubled as share of GDP in years following graduation. Bangladesh also needs to emphasise on maximising the migration opportunities to ensure a higher remittance inflow.

It is essential to remember that all countries are different and likely to have their distinct versions of post-graduation challenges. But a common theme for any graduating country will be loss of trade preferences. Experience of former LDCs show why it is important to concentrate on building capacity of domestic industries and develop infrastructures to overcome headwinds of higher integration into the more competitive, global economy.

Importantly, Bangladesh is much better advanced on the development path. Bangladesh has a highly-diversified economy with huge domestic demands for different products. The export performance and remittance inflows are substantial. It has a buoyant private sector with strong entrepreneurial skills. The social fabric is dynamic. The formation of human capital has taken roots. Therefore, with further policy reforms and investments in human capital, technology and institutions, Bangladesh can transit smoothly from LDC to the road of upper middle income country.

Dr. Shamsul Alam is Member (Senior Secretary), General Economics Division, Bangladesh Planning Commission.