The world today is beefing up on cross-fertilisation of technology-uptake and job diversification. And when it comes to labour-intensive industries like the apparel sector, this discussion gets a leapfrog.

The apparel industry is undergoing a revolution which is termed 'Apparel 4.0' meaning the digitasation of apparel production processes ranging from concept to post-retail. This revolution is believed to be enabling companies to monitor and automate the entire production process with complete supply chain transparency.

Apparel 4.0 branches in to application of cutting-edge terminologies spelled as smart clothing, robotics (e.g. sewbots), simulation, industrial IOT, augmented reality, Machine-to-Machine (M2M) communication in knitting machines, smart factory, 3D printing, smart fabrics, AI-infused Industrial ERP (enterprise resource planning) etc.

Bangladesh's regional peers like India, China and Vietnam are equipping their factories with Apparel 4.0 technologies. In India, Raymond has embraced sewbot technology while smart clothing, augmented reality, and 3D printing are much in use in Chinese factories. Vietnam has made significant progress in RFID (Radio Frequency Identification Device), additive manufacturing and ERP.

However, all the crispy terms spelled above come at the cost of job losses, meaning machines replacing humans. McKinsey Global Institute, in a study, predicts that by 2030, as many as 800 million jobs could be lost worldwide due to automation. In the context of Bangladesh, the textiles and garments sector will be the worst sufferer of Industry 4.0 (IR4.0) as there is a possibility of around 60 per cent (5.0 million) of jobs being lost in the next 15 years, according to a2i (access to information) programme of the government of Bangladesh.

a2i, in its study on future skills, has identified five major sectors of Bangladesh to be mostly encountered by Industry 4.0-led automation. They are 'Readymade Garment and Textile', 'Leather & Footwear', 'Agro-food Processing', 'Furniture' and 'Tourism & Hospitality'. Among the five, the share of jobs with a high probability of automation is the highest in furniture and readymade garment sector (60 per cent) respectively. Inarguably, our textile and garment sector is strongly characterised by low skills and labour-intensive production. Given the fact, the bulk of salaried jobs in this sector (such as sewing machine operators) mostly require repetitive and manual tasks. So, the large part of our garment wage workers are at high risk of automation since we largely make basic garments.

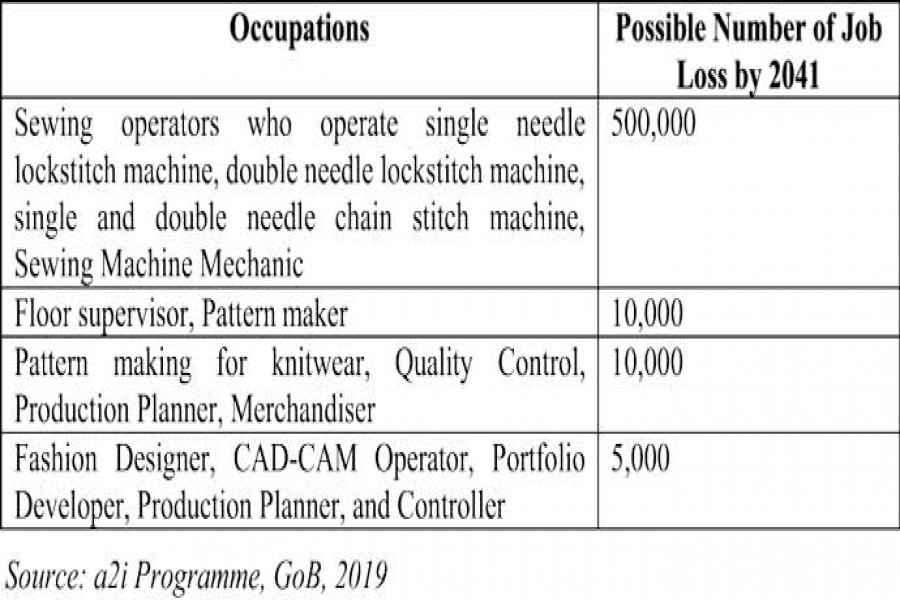

Furthermore, a2i study shed light on possible job losses for certain occupations due to the advent of Industry 4.0 in the area of textile and garment sector (see chart).

Against this backdrop, this industry will have to embrace new lines of occupation. For instance, fabric handling for sewing will be supervised by 'Pick and Place Robot Operator' while fabric inspection/colour solutions/retail management will be handled by an 'Artificial Neural Network Expert'. Adding to these, designations like 'Numerical Controller', 'Automated Fusing and Pressing Machine Operator', 'Computer-aided Process Planning Professional', 'Enterprise Resource Planning Expert' will be much-heard in this sector.

In Bangladesh perspective, there are very few applications of automation in important manufacturing industries related to RMG. However, a debate has already started in various public forums specifically on the consequence of automation led by Apparel 4.0 in countries having labour-intensive manufacturing. Think-tanks and policymakers are quantifying ins and outs of the possible impact of Apparel 4.0.

The ray of hope is that there are a few companies in Bangladesh that are at the cusp of implementing automation in their operation in a bid to cushion the advent of Apparel 4.0. However, instances are very few. Reportedly, Mohammadi Group has installed automated knitting machines that require human intervention only in case of programme designs or to clean machines while Envoy Textiles Ltd (ETL) has employed robotic autoconers. Similarly, DBL Group has made their dyes and chemical dispensing system automated. In addition, Beximco Group is using AI-infused ThreadSol software offering integrated planning process which will reduce material wastage by using effective concepts of fabric utilisation.

However, such developments are evident only in giant factories. But our RMG sector has a large representation from SMEs (small and medium-sized enterprises) and unfortunately, they will face the worst hit of automation. So, the government-led training and upskilling initiatives, especially for small factories, are an absolute requirement.

Moreover, holistic upskilling is imperative in this sector and, it should be ranging from shop floor through to management and board level to harness an all-out paradigm shift in operational competence.

Considering the importance of technological upgrades for future success of apparel industries, our competing countries have introduced special policy support like Technology Upgradation Fund Scheme (TUFS) for the garment and textile industry, which has already been introduced in India. To bring similar best practices in our country, the leaders in this sector should negotiate with the government for similar facilities.

Moreover, to create a technology-proof workforce in our textiles and garments sector, we have to reduce our dependence on basic products. Because, the scope of applying IR4.0-led technology is limited in basic product manufacturing whereas high-end value-added opens the opportunity to implement latest technology and compel the management to train its workers on the latest industrial applications.

It is, therefore, imperative to attend to the need for capacity building of our garments industry and make it compatible for disruptive technologies so that it may meet the demand of high-end and branded fashion segments.

Sabbir Rahman Khan is a Research Associate at Bangladesh Foreign Trade Institute (BFTI). The views expressed in this article are personal.