Banking sectors all over the world are facing a common dilemma-- recovery of significant corporate debts incurred by individuals as well as institutions to stay afloat during the ongoing Covid pandemic. They were forced to do so during 2020 and will have to continue doing so well into 2021. Even as vaccines have rolled out, the world is facing the prospect of prolonged retrenchment as indebted firms pull back investments and repair their balance sheets, hampering economic recovery.

In addition, the scarcity of private investment, particularly in developing countries is also forcing fiscal authorities in these countries to take on greater debt burdens to stimulate the expected recovery. Consequently, non-performing loans and the accompanying debt overhang are affecting not only socio-economic growth but also creation of opportunities.

In this context, it was interesting to note the recent comments made in the first week of February by European Central Bank (ECB) Chief Christine Legarde who was a former French Finance Minister. She has rejected calls to cancel debts run up by Eurozone Members to buttress their economies during the ongoing Covid-19 crisis.

It may be mentioned here that the ECB has taken unprecedented steps to cushion the economic blow from the pandemic in the 19-nation Euro area. They have launched a massive bond-buying scheme that has so far totalled Euro 1.85 trillion equal to about US Dollar 2.2 trillion. Many among these States (supported by about 100 economists) who have received such financial support have been hinting that the debt that has piled up under this system needs to be cancelled. In response to such suggestions Legarde has commented that such a step would be "unthinkable" and has also pointed out that it would be a violation of the European treaty which strictly prohibits monetary financing of states from this context.

In Bangladesh and many other countries in South and South-east Asia, the Corona pandemic has also created several problems within the banking sector. In our country, consistent with a humanistic approach, low interest loans were created within our banking and financial institutional structures. The government undertook this measure to keep businesses afloat. In addition, a large percentage of those who could not repay their loans- within the agreed time frame-, their repayment period were extended.

In some cases there were intentional defaults, but in majority of the cases, that was not so. Such intentional defaults were mostly applicable in the case of individuals or institutions who had obtained their loans with the help of extraneous influence -- political or bureaucratic -- without having their business background checked. Investigations afterwards have revealed that most of these intentional defaulters took loan in the name of one sector and then used it in another. However, in the case of others who have used loans for honest efforts, our banking sector has tried to reschedule or restructure their loans as has been done in India and Thailand.

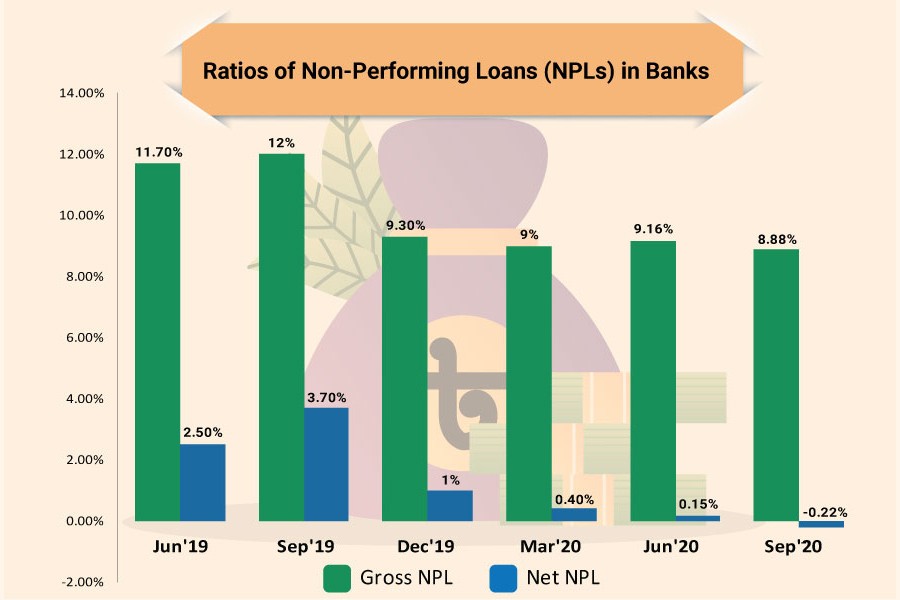

Incidentally, it has recently been reported in the media that the equation of default loans in Bangladesh went down in 2020 because of general forbearance pertaining to loan repayment. Under this policy, defaulters can reschedule classified loans by making a down payment of only 2 per cent instead of existing minimum of 10 per cent.

Bangladesh Bank data released recently has indicated that such loans -NPL-- stood at Taka 887.34 billion last year- down 5.93 per cent year-on-year. However, the central bank is yet to reveal the full data on the rescheduling and write-off loans for the final quarter of 2020. It is understood that the central bank prepared its statement by calculating the credits disbursed by the domestic and offshore banking units of banks operating in Bangladesh.

Economists have, however, been critical of this assertion. They have accused that such a trend was not only meaningless but that it was due to the central bank's instruction to lenders not to classify any loans throughout 2020 under the general forbearance of moratorium. It may be recalled here that the moratorium on bank loan payments was introduced in March, 2020 after the arrival of the pandemic which had cast a deep and long shadow on our socio-economic front.

In this context one needs to refer also to a recent comment made by Ahsan H. Mansur, Executive Director of Policy Research Institute of Bangladesh (PRI). He has correctly advised that banks should adopt a cautious stance while disbursing new loans given the ongoing business slowdown so that they can protect themselves from the pressure of delinquent loans.

Nevertheless, one aspect has emerged as a least common denominator for most borrowers, especially micro-entrepreneurs and also a large proportion of small and medium-sized enterprises (SMEs) who are associated with e-commerce. They are facing unprecedented operational disruption, low revenue, raw materials shortage, weak demand for products and services, capital deficiency and poor cash inflow. This is affecting repayment.

In this context attention has also been drawn to the fact that the Indian Ministry of Finance on 20.2.2020 extended legal and regulatory protection to the business sector by issuing an Office Order to consider this pandemic as 'force majeure'. China has also undertaken similar measures. The USA has similarly issued regulatory directives to financial institutions so that there can be a constructive engagement with borrowers. We, in Bangladesh, appear to have undertaken some steps, but as yet, the regulatory principles associated with borrowing, is not completely pro-active.

Europe for quite some time has struggled with slow and inefficient insolvency regimes which aggravate debt overhangs by liquidating insolvent but viable businesses. In contrast, the US's Chapter 11 bankruptcy system has allowed viable businesses to swiftly restructure.

It would be worthwhile to recall here how South Korea resolved problems during the 1997 Asian financial crisis. The South Korean public sector proactively provided the necessary incentives and coordination between creditors and debtors during that crisis. They did so through a careful and clear joint action plan.

Anxiety has surfaced particularly in Europe because despite extraordinary fiscal action to shield the economy from the pandemic, European firms' debt to-GDP ratio has jumped 9.1 per cent by Q3 2020 and their leverage ratio has jumped almost 20 per cent. It is being anticipated that the situation might deteriorate further over Q4 2020 and Q1 2021. It is also assumed that as activity recovers with the vaccine roll-out, the debt overhang will significantly constrain investment and the number of non-performing loans could rise and generate more insolvency and macroeconomic damage.

This emerging dynamic has led to some economic strategists to suggest that certain sections of the private sector might be able to bear the cost that will be associated with minimising the economic impact. Public equity injections could be initiated for them. In turn, they could be encouraged to undertake necessary private solutions that could reduce costs and create better incentives for economically efficient outcomes.

However, one feels that the whole process in developing countries would require careful scrutiny as to how Europe is trying to deal with this crisis through their 2019 Directive 2019/1023 on restructuring and insolvency (DRI). A coordinated strategy could then be worked out. In this context, different Chambers of Commerce and representatives from Banks (Reserve or Central Bank) could also create a pool of restructuring professionals for states to draw on, given the lack of qualified professionals in some systems. This challenging reorganisation effort will, as a first step, need to identify the degree of viability and which businesses are unsustainable. This will mostly apply for SMEs who pose a particular challenge, given fixed restructuring costs, size, capital structures, and diversity. The diversity of SMEs impacted by Covid-19 has made this more complex.

One also needs to understand that the debt structure was not just created by the pandemic. There is also the question of pre-Covid-19 debt that will also need to be included in the restructuring effort to guarantee sustainability. There will consequently have to be the factor that could encourage greater use of equity as a key objective of the capital markets. From that point of view restructuring will present an opportunity to deepen equity markets by encouraging debt-for-equity solutions.

There is general consensus that our economic recovery depends on resolving the corporate debt overhang created by the pandemic. Tackling insolvency procedures might have gradually improved over the past decade, but decisive and swift public action is needed to take advantage of prospective reforms.

We, both the public and private sector, must step in to provide the resources, guidance and coordination necessary to push through the necessary monumental restructuring. Otherwise, we could face risks associated with a piecemeal approach. This could then result in a drawn-out restructuring process that might push many viable firms into liquidation and slow-down the economic recovery. An approach centred on private restructurings would also minimise the use of public funds at a time when governments face multiple competing fiscal pressures.

Any discussion on this important issue will also have to take into account that in certain sectors of our economy the export paradigm has suffered because foreign orders have reduced due to the impact of the pandemic in these countries. In addition, transportation of manufactured items has also become difficult because of quarantine restrictions. Yes, digitalisation has opened up many windows within the local consumer markets. However, the situation has become difficult when it comes to trading with consumers abroad.

The last aspect is that of earning revenue through tax. When a business institution starts losing money and is unable to pay back bank loans, it not only affects the banking sector but also that sector's ability to pay income tax. Consequently, it might be a useful idea to coordinate with the National Board of Revenue (NBR) and seek their suggestions as to how this matrix might be helped to move forward.

Muhammad Zamir, a former Ambassador, is an analyst specialised in foreign affairs, right to information and good governance, can be reached at