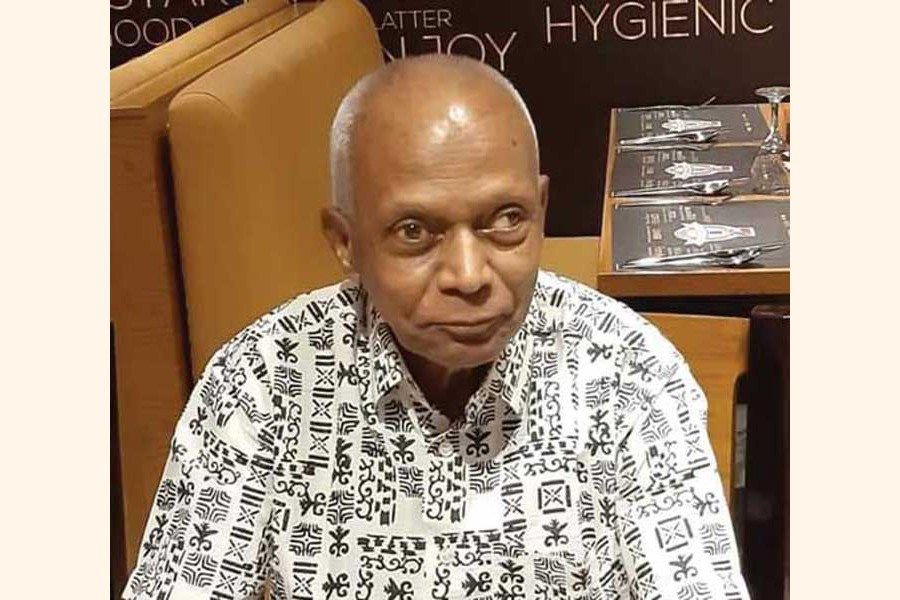

A distinguished central banker, Allah Malik Kazemi, left us a few days ago for ever. The ravaging corona onslaught didn't spare him either. Not only the community of central bankers but all other bankers, the media personnel and academics paid glowing tribute to this saint-like central banker. He started his career as a central banker and remained so till his last breath. He was a Change Management Adviser to the Governor of Bangladesh Bank. I benefitted from his advice for almost seven years as a Governor. But in reality he was my 'friend, philosopher and guide' even after my departure from the central bank. We used to exchange mails and texts on many of the policy issues until a few days before his demise. I got a lengthy email from him in mid-May where he shared his views on how the central bank and government should respond to the economic fallouts of the ongoing pandemic. He was aware of the constraint faced by the government in mobilising domestic resources due to sudden slowdown of the economy and hence suggested me to articulate through my public interventions how best the government could have access to emergency and other external financing facilities from its international finance and development partners. He was also in favor of attracting more relatively better-off NRBs to buy paperless securities online including government treasury bonds from the Motijheel office of Bangladesh Bank. He emphasised the need for fast-tracking digital transaction of wage earner's bonds and invest and premium bonds from the same office. On the domestic front, he was supportive of cautious expansion of the balance sheet of Bangladesh Bank so that inflation also remains subdued. He thought BB could opt for more refinance to the banks to help MSMEs, farmers, MFIs and manufacturing units as the inflation is still restrained. Indeed, I tried my best to make my policy advocacy in this line. We also exchanged views on introduction of a robust credit guarantee scheme to reassure the banks that the government and central bank were ready to share most part of the risk for the loans to be given to MSMEs including women entrepreneurs who have not enough credit histories and cash flow footprints. I hope BB will go forward in setting up this scheme as fast as possible to fast-track the implementation of the stimulus packages. In another mail, he advised me to focus on 'misspending' of the health budget in addition to asking for more resources for it. He was always in favor of market-determined financial sector development. And his bias towards socially responsible financing is also well known to the banking community. Indeed, BB could become a pioneer in promoting sustainable finance mainly because of his forward-looking policy ideas showered on me during the entire stint of my governorship. In fact, we could establish 'out-of-the-box' departments like Sustainable Finance, Financial Inclusion, Agriculture, SMEs etc. in the central bank mainly because of his prudent advice. I must record here his unqualified support to me for the digital transformation of the central bank including modernization of payment system championing mobile and agent banking. His intellectual support in designing desired regulatory guidelines for these financial services was also unparalleled. I remain hugely grateful to Kazemi Bhai, as I used to call him for his strong support for the innovations that we were able to bring in central banking.

I used to know Kazemi Bhai right since 1976 when he stepped into the central bank through my friend Ziaull Hasan Siddiqui who too became one of his closest friends. I remember, I first met him in Uttara Bank Local office in Motijheel when I went to meet Zia. Both were interns in this branch of the commercial bank. I was then working in BIDS which was housed at Adamjee court, just a few steps away from their place of work. I also used to go to BB to see Zia and invariably spent some time with Kazemi Bhai. That relationship got further cemented when I had the privilege of working with him at the central bank. I went to BB with an open mind as I thought this was a golden opportunity to reshape this apex regulatory body for serving 'many and not a few'. And Kazemi Bhai was at the same wave-length with me on this issue of 'good finance'. He was then a Senior Consultant, thanks to Dr. Salehuddin Ahmed for providing that space to him. Later, we designated him as a Change Management Adviser. Within a few days of my joining, we decided to go to Jamuna Resort in Tangail for three days for a Special Retreat to take stock of what the central bank was doing and as well how to carve a new strategic plan for the organization in a participatory manner. All the senior officials above GMs participated in this Retreat which became an annual event. It was not easy to break the ice in the first few hours of the Retreat. But gradually they opened up and started identifying major challenges and opportunities for the central bank amidst Global Financial Crisis. Kazemi Bhai helped articulate the ways forward while writing the Strategic Plan based on the in-depth discussions that we had during the Retreat. The first Five Year Strategic plan identified the goals like Financial Inclusion, Digital Management and Payment System, state-of-the-art human resource development, focused attention to research and development and , of course, socially responsible finance.

This was the beginning of the journey of change management in BB in which he was deeply enmeshed. He then started motivating the strategic management team to monitor the progress made in each department and advised me to prepare the human resources to have more young recruits who would take the burden of transformation. He wanted to see more humane human resources. With his support, we overhauled the entire training landscape by making BIBM a center of excellence and modernising BB Training Academy. We also recruited a Chief Economist from the World Bank who was followed by similar professionals from IMF and a foreign University. They became part of my Senior Management Team and we held debate on innovative monetary policies and most other tools of central banking in this team meeting where Kazemi Bhai was our mentor. Thanks to his guidance, we started sending BB officials to different training institutes of various central banks of global repute. In addition, we started a few Masters Courses at AIT Bangkok and Dhaka University for equipping the young BB officials to make quality monetary, foreign exchange and other developmental central banking policies. He always supported me in bending rules to allow brilliant officials to go abroad for higher studies including PhDs.

I learned later from my colleagues that he started his central banking career in the Personnel Department (HRD) where he left a lasting mark on how to develop clear policies on recruitment, promotion, placement, training, retirement, accommodation and pension. No doubt, human resource development initiatives which we took during my tenure got his strong support. His interest in research originates from the same source. He thought unless we equipped our officials with the latest methods of research as well as statistical tools they would not contribute much towards preparing Monetary Policy Statements, Balance of Payment, Annual Reports, Quarterly Reports and many other policy documents.

However, the brightest spot of his career has been the mastery over the foreign exchange regulations and management. He moved to the Exchange Control Department when there was a real shortage of foreign exchange. The foreign exchange regime was tightly controlled and he not only helped the central bank in make it more flexible but also made Bangladesh Taka move towards convertibility gradually. I remember how he made a huge contribution towards guiding the committee led by former Executive Director Ahsanullah in reforming the Foreign Exchange Regulation Act in 2015. The process actually started in 2012 and he was the main driving force in reforming this act which we inherited from the British period. He helped the committee in defining basic terms like Export, Import, and Current Account Balance etc. with appropriate legal connotations. We also were able to reform clauses 17A and 17B to make it simpler and digitally implementable to cut the unnecessary paper work.The foreign investors working in Bangladesh got a big relief from this digitisation. In fact, digitisation of central banking and liberalisation of foreign exchange regime has been a continuous process where Kazemi Bhai's golden touch was always decisive. His support to the Scrutiny Committee led by the governor for foreign private loans and introduction of offshore banking was also crucial. As the foreign exchange reserve started swelling, we started allowing further relaxation on the rules of carrying foreign exchanges for the travelers. The amount up to twelve thousand USD from virtually nothing. He was also instrumental in preparing the foreign exchange reserve management guideline. The monthly foreign exchange investment meeting could never close without his final nod. In addition, he drafted the Money Laundering Prevention Act which later became the foundation of the latest all-embracing Anti- Money Laundering Act.

The Monetary Policy Statements used to be invariably finalised by Kazemi Bhai with support from the younger officials. His understanding of fundamentals of macroeconomic framework including monetary and fiscal policies, and the five-year plans was unique. His consistent use of basic tools like Repo, Reverse Repo, CRR, SLR, and various liquidity ratios was simply superb. His prows on debt management and handling of instruments like Ways and Means, Over Drafts, devolvement of different bonds and bills was without parallel.

Let me now add a few more lines on his contribution to global campaign for Financial Inclusion and Sustainable Finance. Bangladesh Bank became a founder trustee of Alliance for Financial Inclusion (AFI). I put Kazemi Bhai in the small working group to design the governance and operational guidelines for AFI. He did such a superb job that AFI recognised his service with an award. They always appreciated his wisdom. He was equally forthcoming in guiding me through the UNEP led Inquiry on Sustainable Finance as one of the eleven member international advisory team. In fact, our focus on sustainable finance including promoting solar energy and green transformation of the textile and leather sectors have been highly rated by the international community. We also played a decisive role in RIO +20 global summit where draft SDGs were thoroughly discussed. The talking points prepared by Kazemi Bhai for this summit me were simply invaluable.

Indeed he was a polymath and a moving encyclopedia on financial matters. He became an institution in his own right. A versatile central banker who was most unassuming and humane. To me he was much more than an adviser. He was my well-wisher and a true friend both at my 'best and worst' times. He worked with more than half a dozen Governors. And five of us met virtually immediately after his death to pay our respect to this outstanding change-maker in Bangladesh Bank. During this first ever confluence of so many governors and three other senior central bankers who worked with him we all agreed that he was an exceptional central banker. A thoroughly honest, upright, modern and multi-disciplinary man, Mr Kazemi's professionalism and prudence were uncommon. Zia called him a stoic which we all supported. Former Chief Economist Dr. Faisal Ahmed found in him arts, science and ethics intertwined to make him such a successful policy-maker. His depth of stoicism went beyond a philosophy of personal ethics and practical wisdom. He will remain to his fellow colleagues including the governors as a symbol of rationalism, fathomless depth of diverse knowledge including arts and literatures and compassion for others. I was amased by the depth of love and respect for him among his colleagues including the junior ones when I joined at a webinar organised by them to mourn his death. I only hope we live up to the values he used to uphold. We are now passing through the most critical time globally. This is the time when we are in need of the wise policy-advice of Kazemi Bhai the most. But unfortunately the nation has been left with a void by his sudden departure. May his soul live in peace.

Dr Atiur Rahman is Bangabandhu Chair Professor and a former Governor of Bangladesh Bank. [email protected]