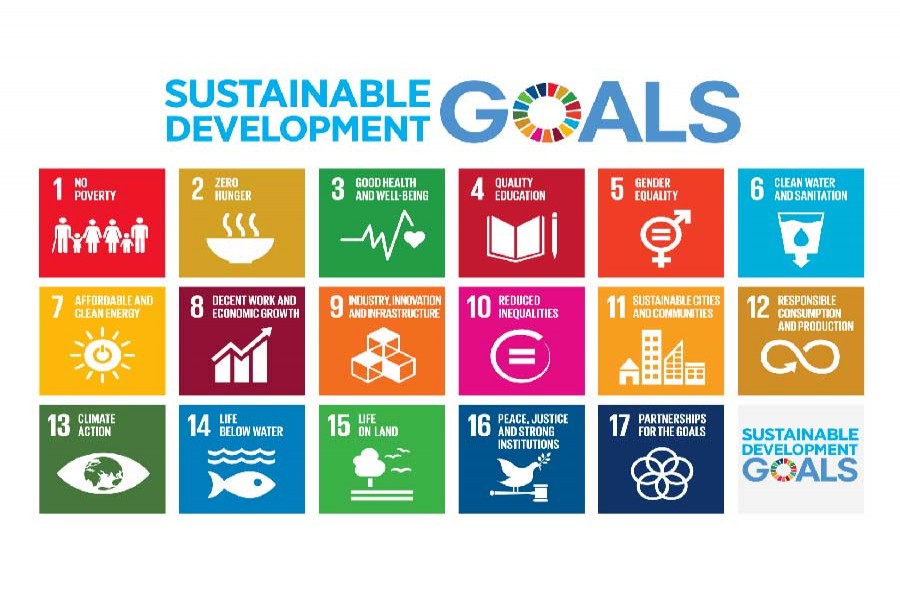

It is pertinent to shed light on the challenges regarding the proper implementation of Sustainable Development Goals (SDGs) in Bangladesh.

One of the main challenges in achieving SDGs is making improvement in implementation of projects and programmes. Delays in project implementation have deleterious impact on cost as well as on the intended benefits.

Improving tax-effort by 9.0 percentage points over the next 13 years will not be easy. The National Board of Revenue (NBR) must undertake new initiatives based on reforms, automation, capacity development and audit to improve revenue mobilisation.

Access to climate funds critically depends on our capacity to negotiate with the development partners. In this context, Bangladesh has identified areas of strengthening. These should be ensured on a priority basis.

The 7FYP states that the international experience with the implementation of infrastructure through public-private partnerships (PPPs) suggests that this policy has worked best when the legal framework is well-thought-out and when the management of the initiative involves competent professional staff. The legal framework needs to lay down clear rules of engagement, the incentive framework and dispute resolution mechanism that compares favourably with international good practice. Government needs to work on these two important areas.

Implementation of PPP remains a big challenge. The potential areas for PPP are power generation, infrastructure and urbanisation. Despite positive developments, PPP has yet to emerge as a major financing avenue in Bangladesh. Three factors can be largely ascribed to slow progress in PPP. These include: (i) absence of a well-thought-out legal framework; (ii) lack of internationally competent professional and project management staff; and (iii) lack of PPP related capacity in Ministries.

MOVING FORWARD: The Economic and Social Commission for Asia and the Pacific (UNESCAP) estimated in 2016 that by 2030 it will cost 10 per cent of gross domestic product (GDP) in India and 20 per cent of GDP in Bangladesh to initiate the social investment package. South Asian countries require greater resources to meet the infrastructure gap.

Larger domestic and external resources can be stimulated through the following strategies: (i) Domestic Resource Mobilisation: Improving the tax base and reinforcing tax administration and compliance can boost domestic resources. Also, identifying the loopholes and closing them to prevent tax leakages is essential. (ii) Harnessing private investments and public-private partnerships for sustainable development: PPPs have shown considerable success in addressing specific urban infrastructure needs since they can contribute to enhancing public investments. Countries have also stimulated private sector to contribute to the corporate social responsibility to increase public resources. (iii) Regional and international cooperation for sustainable financing: Potential for regional cooperation is immense in South Asia. This can be used to meet the resource financing needs of the relatively less developed capital markets from the more developed capital markets. SAARC Development Fund, South Asian Development Bank and the New Development Bank can all contribute to raising capital.

ROLE OF PUBLIC SECTOR: Public sector would account for around 34 per cent of the financing requirement. The major role of the government will be to expand the resources and strengthen capacity to mobilise that resource.

Enhancing the SDG orientation of the Budget: The budget is expected to be more oriented on SDGs, as it is the main instrument for the government for implementing SDG action plans.

Bond Financing: The government may buy foreign exchange reserves in the local currency and convert it into bonds and treasury bonds

Deregulation of Energy Prices: A full deregulation involves - (i) determination of fuel prices according to the market demand and supply condition; and (ii) opening up the market to more than one agency. In the first stage Bangladesh may adopt option 1 whereby fuel prices would be determined by the market forces. Such a move would not only reduce fiscal burden - releases public funds for other priority activities including SDGs.

Debt-Financing: A debt level of 30-35 per cent perhaps suggests that SDG resource gap financing may be accomplished through increased debt financing.

Enhanced Tax Effort: Average tax effort indices show that our tax effort is lowest among comparators implying that Bangladesh lags far behind its tax revenue potential. Thus, tax effort may be increased further by 2.0 or 3.0 per cent of GDP through invoking appropriate reforms.

Intensify actions to attract FDI: The government has invited Japan, China and India to set up Special Economic Zones (SEZs), and these countries have also shown their interests in doing so. If properly materialised, these SEZs will have the potential of receiving substantial FDIs from these countries and also from Singapore, USA, UK, Malaysia and Thailand among others.

ROLE OF THE PRIVATE SECTOR: Private sector has historically been playing an important role in economic development in Bangladesh. Almost all past medium-term development plans have relied on private financing to implement the plans. In the 7FYP, private sector is expected to finance 77.3 per cent of the total outlays. It is thus envisaged that the largest portion of SDG implementation resource gap would come from the private sector.

It is projected that the private sector would contribute about 37.03 per cent of the total additional cost in FY2017 which will increase to 46.27 per cent in FY2030. The private sector is estimated to contribute 42 per cent of total financing.

The contribution of external sources is expected to decrease from 18.35 per cent of total additional cost in FY2017 to 13.25 per cent in FY2030 which indicates that external dependency of Bangladesh will decrease over time.

ROLE OF DEVELOPMENT PARTNERS: Although the role of the development partners (DPs) in the development process has been shrinking over time, they are still considered a major player as far as socio-economic development is concerned. Foreign aid is expected to contribute to 5.0 per cent of total SDG financing:

- Continue and upgrade support to Policy and Implementation;

- Promises in terms of financing SDGs and transfer of technologies to LDCs and developing countries given in Goal 17 by the Developed Counties, must be kept;

- Strengthen the role of DPs for localisation of SDGs realigning their country strategies with enhanced fund provisions;

- Scale up investment in health and education sector(Supply side intervention);

- Reinforce the action for building resilience against climate change and disaster;

- Enhance support to capacity building and sustainability;

- Promote actions that have lasting impact on the societal progress-particularly human development.

ROLE OF NGOS: The non-governmental organisations (NGOs) can play a significant role in implementing SDGs at the grassroots levels by operating in the remote areas and helping people to combat the adverse effects of climate change. It has been estimated that around 5.0 per cent of the total additional resource requirement may be contributed by the NGOs. In addition to micro-finance services, NGOs can be largely engaged in following sectors relating to human development: (1) Health, Nutrition and Population; (2) Education; (3) Water, Sanitation and Hygiene; (4) Skill Development; (5) Disaster, Environment and Climate Change; (6) Rural Development; (7) Urban Development; (8) Agriculture and Food Security; (9) Migration; (10) Gender Justice and Women Empowerment; and (11) Poverty eradication

The article is adapted from a paper Prof. Shamsul Alam, Member (Senior Secretary), General Economics Division, Bangladesh Planning Commission, presented at the Bangladesh Development

Forum, 2018.