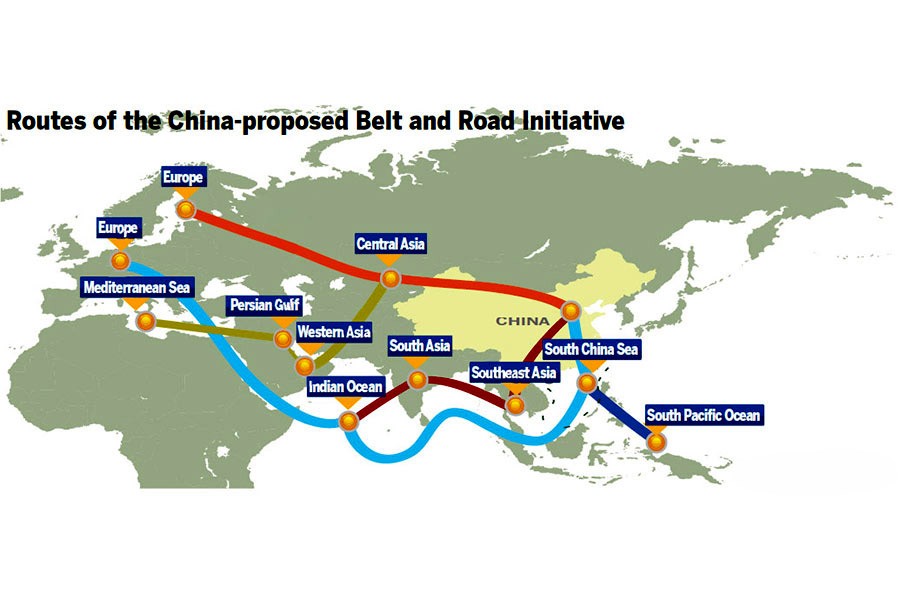

The 'One Belt, One Road' (OBOR) initiative is a foreign policy and economic strategy of the People's Republic of China. The term derives from the overland 'Silk Road Economic Belt' and the '21st-Century Maritime Silk Road', concepts introduced by Chinese President Xi Jinping in 2013.

Trade liberalisation opens the door to additional opportunities and stronger productivity growth. Trade and investment brings in new ideas, innovations, technologies, and better research which ultimately improve products and services. European Union (EU) statistics indicate that 1.0 per cent economy openness results in 0.6 per cent rise in labour productivity in the following year (WTO Statistics 2013). This means that openness in the market has a direct connection with labour productivity. However, some analysts observe that as a regional trade agreement (RTA), the South Asian Free Trade Area (SAFTA) is too little and too late. On the other hand, the North American Free Trade Agreement (NAFTA) and MERCOSUR, are moving fast towards dismantling trade barriers.

In the two decades following NAFTA's establishment, trade between the US and Mexico increased by 506 per cent, between the US and Canada increased by 192 per cent, and between the US and non-NAFTA countries increased by 279 per cent (CRS NAFTA 2013). In 2000-2014, NAFTA's total trade rose from US$ 1349 billion to US$ 2400 billion, MERCOSUR's from US$42 billion to US$ 108 billion, the EU's from $3348 billion to US$ 7800 billion, and ASEAN's (Association of Southeast Asian Nations) from $185 billion to US$608 billion, whereas South Asia's rose from $6.3 billion to US$51.3 billion (WTO Statistics, 2017).

Researcher Baldwin explain RTA expansion through domino theory. According to this theory, change stimulated by the creation, extension, or deepening of a preferential trade area aggravates economic actors in non-participating nations to employ inclusion pressure. Though there are lobbies both for multilateral and regional approaches due to trade blocs' discriminatory practices, it is difficult to lobby for regional approaches.

The non-preferential rules ultimately become ineffective because every country is entitled to most-favoured nation (MFN) status. Former World Trade Organisation (WTO) Director General Pascal Lamy has observed:

"There is no more the notion of country of origin for manufactured goods as the various operations, from designing the products to manufacturing components, assembling and marketing, have spread worldwide by forming international production chains. Nowadays, conceptually, products are/should be tagged 'Made in the World' rather than 'Made in the UK' or 'Made in France.' What we call 'Made in China' is indeed assembled in China, but the commercial value of the product depends on numerous countries that led its assembly in China in the global value chain, from designing to manufacturing and organising the logistical support to the chain. To put it in simple words, the manufacture of goods and services can no more be considered 'mono-located,' but rather, 'multi-located.'"

It is time to discover new channels so that accounting and statistical systems can consider the new international trade geography in an economic system. According to American Economist Tom Friedman, earlier trade system crashed under the influence of globalisation and internationalisation of production relations. The old mercantilist views of 'us against them' and 'resident against rest of the world', have lost much of their meaning. Lamy's proposition is rooted in his 'Made in the World' idea as a mode of assessing any trade based on its value rather than from the originating country.

While China dominates foreign investment policy, South Asian Association for Regional Cooperation (SAARC) 'leader' fails to deliver significant investment. This causes constant political strife with Pakistan and leads many member countries to insist on merging [in RTA sense] with China. The demand for merger cause India discomfort because it has long enjoyed the status of the biggest economy. This status automatically grants it policy-making power within the region. In the concluding speech of the 18th SAARC summit in 2014, Indian Prime Minister Narendra Modi conveyed that India has a vision to develop SAARC. Modi proposes its growth on five pillars -- trade, investment, assistance, co-operation and people-to-people connections. China also envisions integrating [in RTA sense] with South Asia. It is ultimately beneficial for all parties if these two fast growing economies join together to foster regional development. But New Delhi and China have conflict over India's north-eastern border region. Ultimately, India's desire to dominate the region leads to resisting China's integration and all parties lose the potential benefits.

Pakistan lobbies for increasing China's SAARC status from observer to dialogue partner or full member. The message is that China will counterbalance India. Sri Lanka and Nepal also want China's upgrading in status or inclusion in SAARC to weaken India and, thereby, disrupt the association's equilibrium. Beijing can easily take the advantage of the gap between SAARC member states. Beijing may capitalise on the support of Islamabad, Sri Lanka, and Nepal. It is worth noting here that, China's investment in the regions like Africa and Latin America negatively affects environmental sensitivities and labour laws. The region could become vulnerable if SAARC fails to establish clauses on environment and labour issues.

India has free trade agreements (FTAs) with Sri Lanka, Nepal, and Bhutan and participates in the South Asian Free Trade Area (SAFTA) with seven other South Asian counties, while China has one South Asia FTA, with Pakistan. Starting in 2001, China created preferential RTAs with India, Sri Lanka, and Bangladesh under Asia-Pacific Trade Agreement (APTA). However, such arrangements are in respect of certain goods. Similarly, India also has preferential market access to both Bangladesh and Sri Lanka under APTA. However, it remains a weak trade agreement.

Since the mid-2000s, China's trade link with South Asian region has resulted in inflows of loans and aid. The loans are mainly for developing infrastructural projects such as ports, highways, bridges, and power plants. China has overtaken traditional donors of countries like Pakistan, Sri Lanka, and Bangladesh. For example, since 2009, China has emerged as the largest donor to Sri Lanka. China invests in Pakistan, specifically in military training services. India does not have the ability to prevent China's growing influence. The South Asian countries are dependent on China's financial assistance because they directly benefit from deep trading and investment links. Professor S.D. Muni identifies that India's policy towards China revolves around containment, conflict, competition, and cooperation. This causes India's policy towards China to remain confused and diluted as it follows lobby interests. However, the relation between the giants should change under Modi leadership.

In 2012, China's trade with SAARC countries was US$25 billion, whereas, India's trade was $17 billion. China is the largest trading partner of Bangladesh, India, and Pakistan and is the second largest trading partner of Sri Lanka and Nepal.

Dr. Syed Neyamul is Joint Commissioner of Customs & VAT, NBR, IRD, Ministry of Finance, Bangladesh. Views expressed in the article is of writer's own.