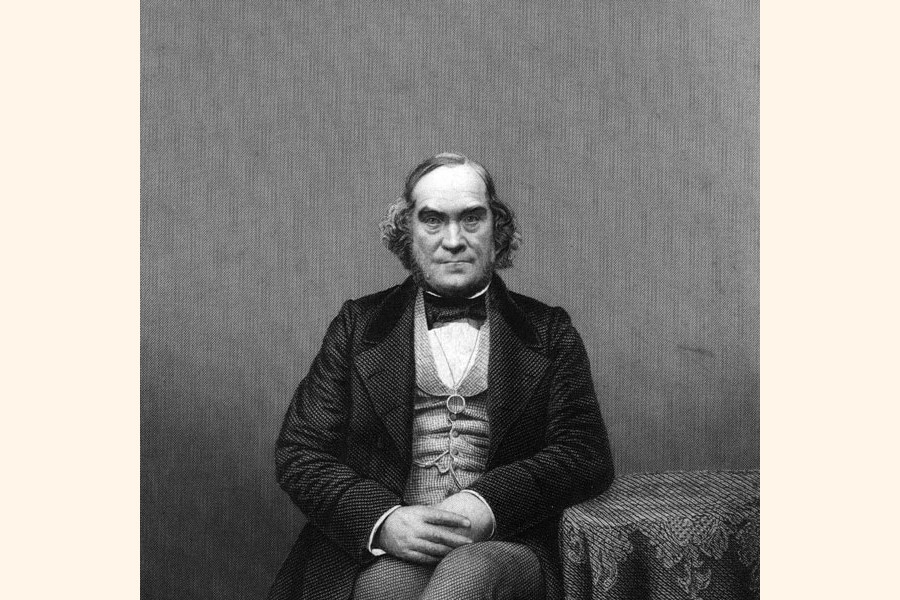

James Wilson, known as father of the modern budget system in the subcontinent, is no more but his budgeting wisdom is. He died on August 11, 1860 in Kolkata. He placed the budget for the Indian subcontinent in Kolkata for the fiscal year 1860-61 under the British Empire. This is the first budget of India. It was his only budget as he died serving the finance nine months only. But it stands out as a gospel in this most vital exercise in economy.

The budget has many implications for the economy of the Indian subcontinent. It gave birth to the modern taxation system in the region. The self-assessment tax-return system was an important creation of the budget. The style of placing budget, debates, and scrutiny the finance bill or the West Minister approach was actually invented by Wilson in the region.

But the pioneer of the modern taxation system and finance in the sub-continent --- now India, Pakistan, and Bangladesh --- has never been recognised for his innovations in fiscal and monetary policies. To my mind, the main reason is he came to the sub-continent at a time when there was "the great mutiny" in 1857 and subsequent political and economic developments. The people of the sub-continent darkened the contributions of the scholar out of patriotism. During the period, the Indian economy, especially the fiscal side, had a wide deficit because of increased expenditure on the military.

Since 1853-54 till 1856-57, there had been a deficit every year. Then came the Mutiny, when, in the struggle for British ruler's existence, the expenditure was uncontrolled and lavish. The deficit for 1857-58 was 8.0 million sterling; that for 1858-59, 14 million; and the estimated deficit for 1859-60 was upwards of 10 million

Chandra Prakash Bhatia, a tax researcher in India wrote a book on Wilson's life and works, is probably the first to highlights the contribution of Wilson. Titled as India's First Budget and The Birth of Income Tax the book was published in 2015. Google search showed little any documents relating to the life and contributions of the great economic thinker of the nineteenth century.

Wilson was born on June 3, 1805 at Hawick, Roxburgshire, a small border town of Scotland. He was the fourth surviving boy among the family of five boys and five girls, not uncommon in those days. Their mother died while delivering her fifteenth baby. James was brought up by their eldest sister Catherine, for whom he had special love and respect all his life.

As a student, Wilson, a political economist and visionary who always thought ahead of his time, was calm and learned his lessons easily and showed little aptitude for outdoor group activities.

It is he who introduced income-tax ceiling, ratifying the tax-free threshold at Rs 200, i.e., the tax was payable when the income reached Rupees 200. This created dissatisfaction among the elite of the subcontinent.

Actually, he wanted to diversify the sources of revenue to feed the budget deficits amounting to around 36 per cent as a result of heavy military expenses during the period. He wanted to mobilise funds from businesspeople. Still, we are also dependent on the businesspeople for mobilisation of taxes.

Before preparing budget he used to conduct a survey on the state of the economy. He would act in accordance with the findings of the survey. This system is not in practice now but pre-budget consultation with the stakeholders is in place for long.

The British-Indian economist, however, had kept agriculture outside the tax system that more or less still remained outside the tax system in Bangladesh, too. Rather many economies still provide adequate subsidies on the real sector, considering food security and involvement of huge population of the economies.

He introduced the paper currency in the subcontinent, thus revolutionising the money market. And he then introduced for the first time in India a scheme of government currency. It was praised by many at the time.

He intended to change the budget estimations. The present practice of estimation is his invention.

The Finance Member, Wilson placed the budget statement on April 7, 1860, at the Council of India in Kolkata. On July 24, 1860 income tax bill was passed.

Wilson introduced the state guarantee for the state-owned enterprises, which is still in practice in sub-continent economies, including Bangladesh.

Wilson was in favour of initiating reforms during crisis period. He came to the sub-continent during economic-crisis period. He rightly reformed the tax system at that time. Earlier, revenues were mainly mobilized from the farmers, which was called 'Khajna' introduced by Lord Cornwallis through sunset law.

The tax system in Bangladesh is controversial. Taxmen are often accused of involvement in corruption. The tax system is still not people- and business-friendly. There is a crisis in recent years in terms of revenue collection and providing efficient services. To my mind, the ideology of the great scholar may be considered a guide for conducting a robust reform in the taxation system in Bangladesh.

Wilson, by many accounts, was the house of business ideas. The modern Standard Chartered Bank is also another creation of Wilson. He obtained a Royal Charter from Queen Victoria in 1853 for promoting a bank called `The Chartered Bank of India, Australia, and China.' The Bank opened branches in Calcutta and Bombay in 1858. It grew up and in 1969 merged with `Standard Bank of British South Africa' and the joint company came to be now known as Standard Chartered Bank.

Wilson left us giving an invaluable legacy of 162 years old. He died on August in 11, 1860. As finance minister, he worked for just nine months. He was laid to rest at Mollick Bazar Cemetery in Kolkata, the capital city of Indian province West Bengal. But the observance of his death anniversary is important in the sense that the legacy we belong to is the creations of Wilson. And he deserves the right to get his works recognized. After a long time, neighbouring India has realised it. India observes July 24 as income tax day in memory of the great finance minister, politician-businessman, and revolutionary thinker since 2010.

[The writer acknowledges the assistance of Mr. ASM Lukman, a Deputy Secretary of the Ministry of Finance, and Mr Chandra Prakash Bhatia of India in writing the piece].