Despite its healthy state in the early phase of the Covid-pandemic, the agriculture sector of Bangladesh was confronted with multiple challenges as the pandemic started to tighten its grip on the economy over the subsequent period. This had adverse implications for an early recovery of the sector, although the level and range of impacts varied across agricultural products and agro-based industries. This article examines the state of recovery of agriculture and agro-based industries by analysing performance of related indicators including distribution of agricultural and non-farm credit and production and export of agricultural products.

Following the 'purchasing managers' index', a composite index has been estimated to assess the level of recovery of agriculture and agro-based industries. Necessary data as regards selected agro-based entrepreneurs weres collected through limited perception survey. The index was employed to evaluate the pre-and-post Covid economic health status of agriculture and agro-based industries of Bangladesh. The index value was calculated by putting weighted proportions of respondents responding, up, same, and lower. The resulting index values are, therefore bounded between zero and 100. Data on agriculture production, export and credit during FY19, FY20 and several months of FY21 have been compiled to compare the performance of agriculture and agro-based activities during pre-Covid and Covid period with a view to appreciate the level of recovery.

PERFORMANCE OF AGRICULTURE AND AGRO-BASED INDUSTRIAL OUTPUTS: Agriculture sector of Bangladesh was impacted by the Covid pandemic during the second half of FY20 and first half of FY21. Available official data mainly provide information on agriculture production for the second half of FY20. According to the data, the agriculture production, especially that of rice and wheat during FY20 was higher compared to the previous year. However, the production of rice, particularly aus and aman rice during FY21 was adversely affected due to the consecutive floods which affected about one-third of the districts in the country. Approximately 2.57 million hectares of paddy fields were inundated which affected about 1.27 million farmers in 37 districts. An early estimate indicates that aman rice, which accounts for 36 per cent of total rice produced in the country, was 1.0 million metric ton less than the targeted amount. As a result, domestic stock of rice through public food procurement was significantly less at the end of December, 2020 (7.63 lac m ton as on January 14 , 2021 which was 15.70 lakh m ton as on January 16, 2020 - about 51.4 per cent less compared to the year before). Similarly, production of jute was adversely affected due to flood and production was 6.2 per cent less compared to that in the previous year. Domestic market prices of rice and jute posted a significant rise because of low production and delay in import (particularly rice). Food inflation although declining but still higher than the pre-Covid period (January-February, 2020).

Indeed, the agriculture sector of Bangladesh has witnessed a contrasting performance during Covid period, an early resilience during initial phase of Covid pandemic and weak performance in the following periods. Loss of production of rice and other agricultural crops mainly occurred due to flood which had no relationship with the Covid. Overall, the weak performance of agriculture sector at the end of 2020 portrays that the sector is yet to recover despite the fact that this didn't have direct interface with the Covid pandemic.

Export of agricultural products has somewhat improved in the first five months of FY21 (July-December, 2020) after the poor performance in FY20 (Figure 4.3). In other words, the export of agricultural products has yet to recover after the setback during the initial phase of Covid pandemic. During January-March, 2020 and April-June, 2020, export growth of agricultural products was -3.4 per cent and 24.8 per cent respectively, mainly due to fall in global demand and restriction of movement of goods by air and water transfer by major countries due to the Covid pandemic. In the subsequent period, while the cross-border movement of goods started, export earnings from agricultural products posted a rise - mainly from export of jute and jute goods (+37.8 per cent) during July-December of FY20 compared to the same period of the previous year and. Earnings from frozen and live fish and other agricultural products although negative (-3.7 per cent and -0.5 per cent respectively) had improved compared to that in FY2020 (-8.8 per cent and -5.2 per cent respectively). Overall, export performance during July-December FY20 reflects a sign of modest level of recovery. Since, the export of agriculture products comprises a negligible share of total agriculture production, the sector's performance will need to assess in view of domestic market situation.

Disbursement pattern of agricultural credit reflects the nature of investment in agriculture production. Since January, 2020, the growth of agriculture credit had gradually declined with a dip in April and May, 20. Over the following months, disbursement of credit started to rise and reached a high level in August, 2020, following which credit growth has declined. The changes in credit are mainly on account of decreased demand in large part of the country due to consecutive floods. Overall, disbursement of agricultural credit reflects a slow recovery in the agriculture sector. Given the sluggish trend in the disbursement of farm loan, Bangladesh Bank has slashed the disbursement target for the current fiscal year. According to the Central Bank's '2020-21 Agriculture and Rural Credit Policy and Programme,' target for growth of agricultural credit has been reduced to 9 per cent from the 10.7 per cent set for the previous year.

Disbursement of credit in the non-farm sector reflects the same trend during January-November, 2020. After the fall in the demand for credit during the initial period of the pandemic, it had started to rise in the following months. However, this was stalled after August, 2020. During July-November, 2021, non-farm rural credit plummeted by 6.25 per cent compared to that of the previous year.

VIEWS OF AGRI-BUSINESSES ENTREPRENEURS: Agri-business entrepreneurs' views regarding business recovery has been analysed based on a sample perception survey conducted in early February, 2021. The respondents replied to a set of structured questions prepared to calculate a composite index of recovery.

According to the composite index, the state of agri-business is almost at par with the pre-Covid situation. Majority of components have experienced deterioration during the early phase of the pandemic. A significant drop in new orders was observed during June 2020 due to nationwide lockdown and limited level of economic activities. However, the situation of new orders has quickly recovered and reached pre-Covid level. Similarly, the output level has reached pre-Covid period during December 2020. The employment level in agro-based enterprises is still behind, although this has recovered well since June, 2020. Better performance is observed in the case of suppliers' delivery time. Overall, agro-based enterprises have reached the pre-Covid level at the end of December, 2020. This is mainly attributed to changes in output, employment, orders and suppliers' delivery time.

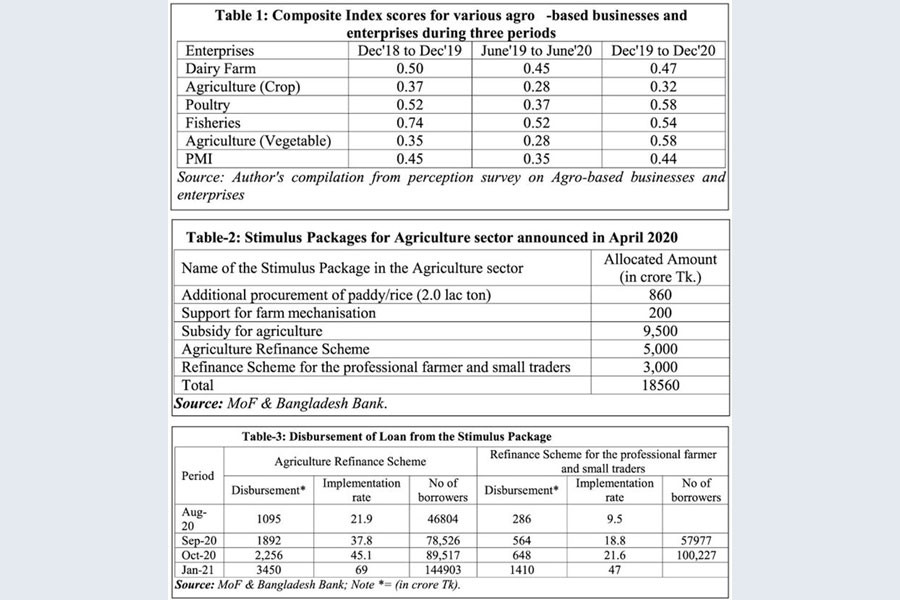

Recovery performance is not the same across the different agro-based businesses and enterprises (Table-1). The highest level of recovery was observed in case of business of vegetable production and poultry sub-sectors, both of which reached the pre-Covid level (during December, 2020 vis-à-vis December, 2019). A moderately better recovery was observed in case of dairy farming; however, it has yet to reach the pre-Covid level. Crop-production and businesses were hit at a moderate level but was still behind the of pre-Covid benchmark level. Fisheries subsector's recovery was at the slowest pace - over production, and lack of rise in demand for fishes are the main reason behind this. Fisheries sector has faced significant losses due to supply shortages of feed during the pandemic period and consequent rise in prices of fish meals/feeds. Besides, the 'Amphan' storm damaged about 149 thousand hectares of agricultural land and fish farms in 26 districts, including nine districts under the Khulna and Barisal divisions (UNDP, 2020).

FACTORS RESPONSIBLE FOR THE CHANGING RECOVERY SITUATION CONCERNING AGRO-BASED ENTERPRISES: Agriculture sector has experienced a mixed trend in terms of recovery. On the one hand, agriculture production, particularly crop and fisheries sector have been recovering at a slow pace; on the other hand, agro-based enterprises and businesses have recovered well and were able to reach the pre-Covid level. The prolonged flood during 2020 had a major detrimental impact on crop cultivation which in turn caused a slow recovery. Majority of agro-based industries and agri-businesses have quickly recovered because of the government decision in spite of attendant risks, to open the economy early (in June 2020). Various supports provided by the government such as launching of the free train service 'Krishak Bondhu Postal Service (KBPS)' by the Bangladesh Post-Office, with support of the Bangladesh Railway, for transporting agricultural products to the wholesale market of Dhaka and increase in DAP fertiliser production had some positive impacts on recovery of the agriculture sector.

Various stimulus packages announced by the government were not able to ensure the expected benefits for the farmers (Table-2). Allocation for additional procurement of rice was not realised due to poor procurement response from farmers and rice millers. Allocation for farm mechanisation is in the process of implementation. Allocation for agriculture refinance scheme (Tk 50 billion) and for professional farmers and small traders (Tk 30 bilion) was yet to reach the target - only 69 per cent and 47 per cent have so far been implemented (Table-3). Lack of interest of banks as regards disbursement of credit is a major constraining factor which hindered timely disbursement of credit. Due to slow progress, the central bank has extended the timeline for disbursement of loans twice and had refixed the target date on March 31, 2021. Out of 43 banks which had signed an agreement with the central bank for disbursement of funds for the agriculture sector, 16 banks have disbursed less than 30 per cent of the targeted amount. Even if this is fully realised, the allocation of the fund could cover only less than 2 per cent of total farm households of the country. Due to procedural difficulties and other complexities, farmers and small traders are not being able to access loans through formal banking channels.

Overall, the performance of the agriculture and agri-businesses during the Covid period is more influenced by natural calamities than by the pandemic induced disruptions in the domestic value chains. The sector has shown its moderate level of resilience during the early phase of the pandemic, particularly in case of rice production; however, the poultry, milk and fisheries sub-sectors were moderately affected due to pandemic. Agriculture production was mainly disrupted due to consecutive floods and cyclone Amphan and decline in production of rice, jute and vegetables in the following periods. These caused lower level of domestic supply of agricultural products which had inflationary impact in the market and that has continued afterwards. The recovery of the agriculture sector is better compared to that of manufacturing and services sectors; however, the sector has experienced an inflationary pressure during the recovery period which would continue in the coming months. The study showed that the agriculture and agro-based industries have almost reached the pre-Covid level particularly in case of production, employment, orders and suppliers' delivery time etc. Despite that, few sub-sectors are still lagging behind such as fisheries. Majority of agro-based industries and agri-businesses have quickly recovered because of the government decision in spite of attendant risks, to open the economy early (in June 2020).

Various stimulus packages announced by the government were not able to ensure the expected benefit for the farmers due to procedural difficulties and other complexities. In this backdrop, government needs to change its rice procurement strategy by sequencing the procurement plan - the first step should be to complete procurement of paddy from farmers directly from farmers from rural haats and bazzars and then procure rice. The procedural difficulties need to be eased in accessing subsidised credit by farmers and rural non-farm enterprises. The government should involve micro-finance organisations to disburse credit to rural enterprises.

Dr Fahmida Khatun is Executive Director, Centre for Policy Dialogue (CPD); Professor Mustafizur Rahman is Distinguished Fellow, CPD; Dr Khondaker Golam Moazzem is Research Director, CPD; and Mr Towfiqul Islam Khan is Senior Research Fellow, CPD.

[Research support was received from: Muntaseer Kamal, Syed Yusuf Saadat, Md. Al-Hasan and Kamruzzaman (Senior Research Associates, CPD); Mr Abu Saleh Md. Shamim Alam Shibly, Mr Tamim Ahmed, Ms Nawshin Nawar and Mr Adib Yaser Ahmed (Research Associates, CPD); and Helen Mashiyat Preoty and S. M. Muhit Chowdhury (Research Interns, CPD)]