Can we designate a household that is indebted and deficit-ridden as financially well? One may need to take loan but the question is whether he/she has repayment capacity or is able to generate fund to repay as per terms of the loan. Is such information available from Household Income and Expenditure Surveys carried out by Bangladesh Bureau of Statistics (BBS) on regular basis? Income and expenditure of households are, therefore, the two important financial requisites of livelihood. Data on income distribution pattern, range of income, income groups, income-expenditure relationship, indebtedness, and income differences across different income groups can tell us about how well we are at least financially. A family expects to have a minimum level of financial wellness. Given this, let us see what we find from the report of Household Income and Expenditure Survey (HIES)-2016.

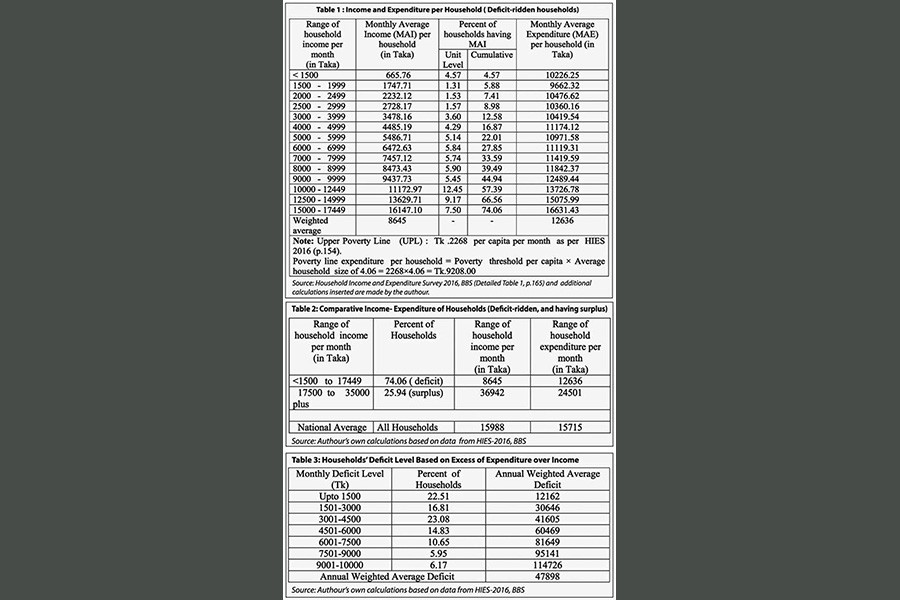

It is observed from Table 1 that income levels of 74.06 per cent of total households are less than their corresponding expenditure levels indicating a deficit in family budget of every income group. As per HIES-2016 findings, 98 per cent of expenditure is consumption-related, no capital expenditure is included therein. On an average, expenditure is 1.46 times income. It is seen that at least 39.49 per cent of households are unable to afford the minimum cost of upper poverty line expenditure, i.e. Tk. 9208 since their income levels range from Tk. < 1500 to Tk.8999 (average levels too lie below the upper poverty threshold). Income adequacy is very clear. These households are still far from financial wellness (not free of deficit). Besides this scenario, households with income from 9000 to 17449 constituting 34.57 per cent lie above the poverty line, but are deficit-ridden. Hence, they also lack financial wellness.

Table 2 shows a comparative scenario of deficit-ridden and surplus - bearing households of the country. The average monthly income per household of deficit group is 23.40 per cent of surplus group's average income. On the other hand, deficit group's income accounts for 54.07 per cent of national average income. Therefore, it is evident that three-fourths of the total households of Bangladesh were in financial distress while only one-third of the households were enjoying financial soundness five years back. Had not the detailed statistical table been analysed, the real financial condition of the majority of the people would not have been known.

Financial wellness simply refers to a financial status when annual average household income is at least 25 per cent higher than a household's annual average expenditure to meet the aggregate of minimum consumption as well as non-consumption expenditure threshold determined by BBS using upper poverty line. The 25 per cent higher income is defined as one that allows for yearly inflation adjustment and minimum level of non-recurring expenditure. Table 3 shows that more than three-fourth of the deficit-ridden households have to sustain a huge amount of deficit ranging from Tk. 30646 to 114726. Average deficit of all deficit-ridden households amounts to Tk.47898. However, HIES report says nothing about how the deficits were financed.

There were many objectives of HIES-2016. Two of them are relevant for the ongoing discussion- (i) Collect data on credit and repayment situation and practices and (ii) Collect data on crises at household level, impact and strategy for management. 29.30 per cent of households took loan and average loan per household was Tk. 37743. No information on the purpose for which the households obtained loan was reported. The report is also silent about repayment capacity or repayment of loan. The survey did not focus on households' cumulative indebtedness level while this is of paramount importance to assess the financial viability of a household. Facing deficit can be termed as one type of crisis as fund procurement is generally difficult. This sort of 'deficit' is not included in crises. It may be pointed out that collecting data on crisis management was first introduced in the survey of 2010 and accordingly continued in the Survey of 2016 too.

Despite COVID impacts, our production wheels are moving. Per capita income has been on the constant rise since long. BBS is preparing for carrying out Household Income and Expenditure Survey (HIES)-2021. The final report on HIES-2016 was published in June, 2019. Neverthless, the survey findings have still profound implications though the data date back five years. Proper policies and strategies for income growth of deficit-ridden poor households in particular largely depend on insightful analysis of past data on income and expenditure reported in the survey of 2016. Reportedly, COVID-19 has led to erosion of people's income by way of cut in pay and joblessness, but we notice no interim survey on the impacts by BBS.

There is an urgent need to expand data coverage on family financial management through national surveys. Determining financial status such as financial wellness and viability is extremely necessary for framing policies and strategies. Therefore, we require detailed additional data on loan operations including previous overdues, use of loan fund, loan repayment capacity, deficit financing, expenditure (recurring and non-recurring with major items of outflows), etc. HIES- 2021 project is going to be implemented. The questionnaire should be redesigned to collect inclusive data on households' financial dimensions. It is never possible to expect effective planning without unbiased, well-designed and timely data generation system.

Haradhan Sarker, PhD, is ex-Financial Analyst, Sonali Bank & retired Professor of Management.