Most of the companies that floated their stocks through book building methods in the past decade have experienced a significant decline in the post-IPO operating performance and seriously underperformed both their industry average returns and overall market return. Is this a random phenomenon or is that because of some systematic failures that can be described by the lack of regulatory oversight and opportunistic behaviour of other stakeholders such as issue managers, underwriters, and eligible investors (EIs) involved in the IPO (initial public offering) process?

Consider an example of the recent IPO of Walton Hi-Tech Industries Limited which is floating its stocks through book building method. As per this method, eligible institutional investors took part in the price discovery of the shares by bidding, and the cut-off price was set at Tk 315. The surprising thing is that the range of the bid price by the institutional investors was between Tk 765 and Tk 12. In the price discovery process, only eligible institutional investors can participate since they are supposed to be highly sophisticated and knowledgeable and they undertake professional due diligence to assess the value of the stock before they offer the price. Just imagine an institutional investor offered Tk 12 while another offered Tk 765 for the same stock! There must have gone something wrong with professional due diligence at least with one of the institutional investors; otherwise, such divergence is highly unlikely.

In Bangladesh, companies offering securities to the public must follow the Public Issue Rule 2015. As per rule, if a company wants premium, it must follow the book building method for price discovery whereas companies offering securities at par value follow the fixed price method.

In the last 12 years, Bangladesh Securities and Exchange Commission (BSEC), the regulator of the capital market in Bangladesh, has changed the public issue rule so many times that it has to rename it from Public Issue Rule 2006 to Public Issue Rule 2015 and most of the concerns for changes were centred on the book building method.

Still there remain subtle yet serious flaws in its pricing mechanism suggested in section 14(d) of the Public Issue Rule 2015. It suggests that the issue manager(s) shall consider the following methods for valuation of the securities:

(i) Net asset value at historical or current costs; (ii) earning-based-value calculated based on a weighted average of net profit after tax for immediate preceding five years or such shorter period during which the issuer was in commercial operation; (iii) Projected earnings for the next three accounting years with rationales of the projection, if not in commercial operation; and (iv) Average market price per share of similar stocks.

First of all, the rule remains silent about whether NAV (net asset value) should be considered based on the pre-IPO number of share or post-IPO number of share. Second, it says that securities should be valued based on previous earning but again it does not say anything whether that earning should be considered based on pre-IPO number of share or post IPO number of share.

For simplicity, consider this example; if a company has a net profit of Tk 40 and pre-IPO number of share outstanding of Tk 10, then Pre-IPO earning per share (EPS) is Tk 4. If the relevant industry Price Earning (P/E) multiple is 15 times, the value of the stock should be Tk 4x15 = Tk 60. But look carefully, if the company offers 10 shares to the public, its total number of shares after IPO is 10+10 = 20. According to the post-IPO number of shares, EPS would be 40/20 =Tk 2 and that is what IPO investors will have for each share until the company uses new money to generate extra income. According to Post-IPO EPS, price should be Tk 2x15 = Tk 30 and but if security is priced based on Pre-IPO, definitely there is going to be overpricing of the IPO and the transfer of wealth from the new IPO investors to the existing owner of the company. But all the companies that floated shares with premium used Pre-IPO number of shares to justify value which does not go with the best principle of forward-looking estimate of valuation.

The third criterion suggests that the company should justify the value of its stocks based on projected earnings or based on discounted cash flow (DCF) in the future. This is the most fundamental tool for valuation because investors pay price for stock for future cash flow, not for what happened in the past.

Unfortunately, none of the companies in the last 10 years or so has used that forward-looking estimate of DCF analysis to back up their valuation because, according to industry insiders, the BSEC has an unwritten rule to forbid the use of DCF to justify value. This is because there are lots of risks involved in assuming to project future cash flow and shrewd investment bankers and issuing company can take advantage of that flexibility. Shrewd investment bankers and the issuing company heavily misused the DCF method of valuation back in 2008-2010 when our market was in bubble mode. The BSEC can allow use of DCF to justify IPO offer pricing by holding issue managers and issues accountable for any unjustified deviation from their projected investment or financing plan. This will help the market better understand future earning power of the company and hence intrinsic value for each of the stock today.

Forth criterion says that the company should back up the valuation of its stock based on average market price per share of similar stocks. This rule does not say anything about how the issue manager identifies similar stocks. Two companies operating in the same industry might have a completely different sort of product and distinct business risks. So what issue managers do in most cases is, they find companies in the same industry that have relatively higher P/E or P/NAV multiples and use that valuation metrics to justify the higher valuation of the IPO.

Some issue managers take the average multiple of the last six months, some take the multiple of the last one year or even two years, some take the multiple of the peer companies (again defined by them), and some take the multiple of overall industry or even overall market to back up the price. Basically, in most cases, they choose the options that fetch a higher valuation of IPO.

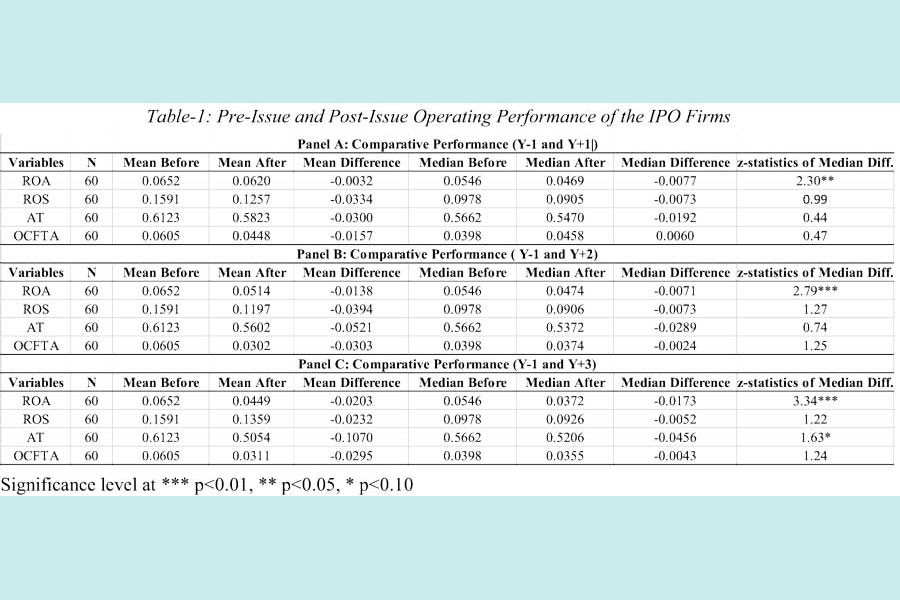

The BSEC has done a very bad job of approving IPO with premium through the book building method. The clear evidence can be found looking at the post-IPO operating performance and relative price performance of those companies once they go listed in the stock exchanges. It is always the case that general investors burned their hand because eligible investors who bid up the price to higher valuation sell their holding after their initial lock-in period and then price immediately fell below the offer price in the IPO in many cases. As a practical demonstration, the table-1shows the comparisons between the pre-IPO and post-IPO operating performance of all the non-financial firms, which floated IPOs from 2008 to 2015

As observed from the table-2, post-IPO operating performance measured in terms of return on asset (ROA), return on sales (ROS), asset turnover (AT) and operating cash flow to total asset (OCFTA) for the next three years after IPO declined significantly. The decline is more pronounced as times go by once companies get listed.

The probable cause for poorer performance in the Post-IPO period could be that firms offering securities with premium inflated their pre-IPO earnings more aggressively, resulting in subsequently drastic fall in Post-IPO performances faster than the operating performance of firms offering securities without premium.

The expectation is that the BSEC will bring its IPO valuation methods outlined in the public issue rule 2015 at level with other developed capital markets and hold key stakeholders such as issue managers and eligible institutional investors involved in the process accountable by requiring them to more disclosure, follow-up actions. This will enhance transparency and credibility of the market mechanism and is likely to minimise the case that common investors lose money even in the primary market.

Md Sajib Hossain, CFA, is a former Fulbright Scholar at Syracuse University, USA, and currently an Assistant Professor at Department of Finance, the University of Dhaka