Over the past decade, growth rate of the Gross Domestic Product (GDP) has been at the centre of attention of economic policy discourse in Bangladesh. However, Centre for Policy Dialogue (CPD) has also been emphasising that qualitative and distributive aspects of GDP growth are no less important than mere growth figures. In view of the Covid-19 pandemic, the importance of credible estimates of GDP has assumed heightened importance as it has significant implications for economic policymaking at a crucial time. The estimates of GDP have been under scrutiny for past several years due to its apparent disjuncture with several other key macroeconomic and development correlates including private sector credit, revenue mobilisation, import payments for capital machineries, energy consumption, export receipts, employment generation etc. The recent release of GDP estimates for FY20 has sparked another fresh round of discussions and debates.

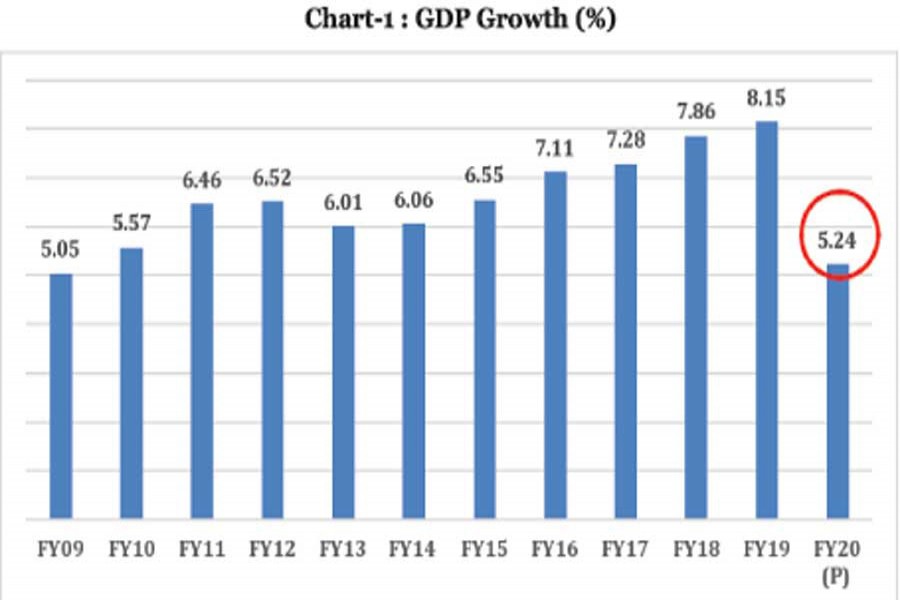

THE EARLY PROJECTIONS AND GROWTH DEBATE: In view of the ramification of the pandemic for the Bangladesh economy in FY20, there was a general consensus among experts and practitioners that the GDP growth rate will be significantly lower than the planned target of 8.20 per cent. The Ministry of Finance (MoF) prediction of 5.20 per cent was an outlier when compared to other independent estimates - CPD had earlier estimated that GDP growth in FY20 will not be more than 2.50 per cent. The World Bank in April this year projected that GDP growth would range 2.0 per cent to 3.0 per cent, while IMF projected 3.80 per cent in June this year. Surprisingly, the provisional estimates of GDP growth (5.24 per cent) has turned out to be very close to MoF prediction of 5.20 per cent presented at the budget time! There is no doubt that all economic activities of the country were affected prominently during the almost two-month long 'general holiday period', at varying degrees concerning all sectors of the economy. CPD, while estimating its growth projection, identified five sectors which were hit hardest. These are: manufacturing; construction; hotels and restaurants; transport, storage and communication; and community, social and personal services. The anecdotal information and trends observed since the outbreak of the pandemic would also confirm this.

IS BANGLADESH AN OUTLIER?: Comparing official GDP growth rate figures across countries remains a difficult task for several reasons. The fiscal year is often different for different country. Impact of the Covid-19 pandemic on the economy was felt at somewhat different times in different countries. The pre-conditions (in terms of economic performance) varied across countries. However, almost all countries have experienced deceleration, in varying degrees, in terms of growth performance. For many countries, GDP has indeed shrunk (e.g. UK, USA, Singapore etc.). Pakistan in FY2020 (July-June) is likely to register (-) 0.40 per cent GDP growth. The economy of Vietnam during Jan-Jun of 2020 was able to grow by only 1.81 per cent. India has not released its Apr-Jun quarter GDP estimates yet, but a significant contraction is apprehended. In view of the above, even if the Bangladesh economy could grow by 2.50 per cent in FY20 (as projected by CPD), it is likely to be one of the fastest growing economies in the world.

A DEEP DIVE INTO THE BBS PROVISIONAL ESTIMATES: Let us recall the preamble of GDP estimates by the Bangladesh Bureau of Statistics (BBS). The provisional estimates of GDP (national accounts) are usually released in May of a fiscal year. At the time of these estimates, at best eight to nine months' data are available. BBS did not prepare the estimates in May this year when the country was under the 'general holiday' in view of the pandemic. On August 10, 2020, the BBS released the provisional estimates on its website. According to follow-up news reports, the BBS has considered data for about nine months (July 2019-March 2020). This implies that the provisional GDP estimates could not capture the significant adverse impacts of the Covid-19 pandemic.

Nevertheless, 5.24 per cent GDP growth in FY20, as estimated by the BBS, is the lowest in last decade. On the other hand, in view of the current context, it is surprisingly high! Indeed, the fall in industries sector growth rate contributed significantly to the fall in GDP growth rate. Resilience of agriculture and services sectors are perhaps more by design! Crops and horticulture experienced more drastic fall. It is important to remember that production data for Aus and perhaps also Aman were considered for the crop sector, and not Boro which is the major crop. While the manufacturing sector was struggling even before the pandemic struck, the fall in growth rate for construction sector was not significant. It was surprising to see that growth of the services sector, against all odds, did not fall by any significant margin. The more affected sectors as identified by CPD (i.e. hotels and restaurants; transport, storage and communication; and community, social and personal services) did not experience any major fall in growth. It needs to be asked if the resilience of the services sectors as depicted above, is 'resilient' by design. The growth estimates for these sectors may not align with what happened in the performance of the real economy.

Curiously, even during a year of pandemic, private investment registered a notable growth. Private investment as a share of GDP increased to 23.63 per cent in FY20 from 23.54 per cent in FY19 - which required a nominal growth of 10.40 per cent. It may be recalled that MoF (during budget) predicted that private investment as a share of GDP was predicted to decline to 12.70 per cent in FY20. A rise in private investment is indeed unexpected when the entrepreneurs have been struggling to keep the existing production capacity fully operational. Public investment as a share of GDP, on the other hand, also increased to 8.12 per cent in FY20 from 8.03 per cent in FY19. Overall, investment as a share of GDP increased to 31.75 per cent in FY20 from 31.57 per cent in FY19. On the other hand, this implied a significant deterioration in productivity. The Incremental Capital Output Ratio (ICOR), in a single year has risen to 6.06 in FY20 (the highest since FY02) from 3.87 in FY19 indicating falling productivity of capital.

DO GDP ESTIMATES CONSIDER REAL TIME CREDIBLE DATA: To understand this paradox, one would need the estimation methodology and data sources used for GDP estimation. As a matter of fact, other than industries sector (except for construction) and crop sector, GDP estimates for majority of the sectors do not consider real time credible data. Indeed, more than half of the provisional GDP estimates are not based on credible real time data. This is also reflected when the variations of sectoral GDP growth rates are examined. A simple standard deviation test for sectoral GDP growth rates shows that growth rate of services sector was by far the most stable. It may not be due to the resilience of the subsectors; rather it originated from the weaknesses in the estimation process.

There is a serious need to take urgent steps to address the weaknesses in the data for estimating a credible GDP growth. A number of surveys will need to be conducted on a regular basis. For example: (i) Annual Establishment & Institution Survey (AEIS); (ii) Private commercial mechanized transport survey; (iii) Survey of Private Education Services in Bangladesh; (iv)Survey of Private Health Establishments; (v) Survey of Non-profit Institutions Serving Households; (vi) Farm Forest Surveys. These surveys have not been conducted over the last decade. There is a need to improve data quality from a number of government agencies-- for example, Livestock Department, Directorate of Fisheries etc.

WHAT DO UPDATED TRENDS IN PROXY INDICATORS TELL US: The provisional estimates of GDP significantly rely on budget data from the government - a large part of the budgetary allocations remains unspent and undermines GDP data quality. While the GDP estimates could not capture the updated data, a short review of recent trends (particularly during the last quarter of FY2020) of some proxy indicators may be useful.

• Total export declined by (-) 51.2 per cent during Apr-Jun quarter of FY20. Quantum index of industrial production (QIIP) for large and medium manufacturing industries declined by (-) 24.50 per cent in April 2020.

• Only 76.80 per cent of original ADP could be spent (80.70 per cent of RADP) in FY20 according to IMED data - in nominal terms (-) 1.70 per cent lower than last year.

• Again, private sector credit recorded 8.60 per cent growth as of June 2020 - the lowest in the decade.

• Rural credit in Jul-May of FY20 dropped by 12.0 per cent; while, SME loan declined in Jul-Mar by 1.30 per cent. Term loan increased by on 4.6 per cent during Jul-Mar period.

• Net FDI, in FY2020, declined by (-) 42.5 per cent.

• In FY2020, import of capital machinery declined by (-) 33.80 per cent.

• Import of other key capital-intensive items also declined sharply [Clinker: (-) 11.60 per cent; Iron, steel & other base metals: (-) 4.8 per cent; other capital goods: (-) 18.1 per cent].

• In April, total revenue collection declined by (-) 34.6 per cent. Finally, according to MoF data, only 50.40 per cent of the allocated budget could be spent up to April.

HOW USEFUL IS THE PROVISIONAL GDP ESTIMATES FOR POLICYMAKING: The provisional estimates of GDP did not capture the impact of Covid-19 pandemic on Bangladesh economy in FY20. The provisional estimates of GDP should not inform the policymaking in the coming months as it does not provide a reliable assessment about the actual health of the economy. The provisional estimates of GDP indicate that Bangladesh economy was already losing its steam even before the Covid-19 pandemic. The weaknesses in GDP estimation and dearth of real-time data were exposed by the GDP estimates in the time of pandemic when there is a heightened need for credible real time data. The government's own initiatives in the form of stimulus packages and expanded safety net programmes do not tally with the GDP growth narrative.

The government must appreciate the value of data integrity. Policymakers need to acknowledge that credible and up-to-date data provides a strong foundation for sound and effective policymaking. The government/BBS should take urgent steps to generate credible and updated data. The final GDP estimates should be informed by the reality on the ground. BBS must be adequately strengthened with both financial and non-financial resources to conduct required surveys annually (even if it is on a limited scale) so that GDP estimates are credible. BBS should also scrutinise data provided by other government agencies to ensure the quality of the data used for GDP estimations, as it is mandated by the Statistics Act, 2013.

It is now critical to take necessary steps to conduct GDP estimation on a quarterly basis and at the subnational level - this will provide more transparency and can guide the policymakers in real times. BBS should make background data and calculation available for GDP and other indicators for transparency and better accountability.

The need for updated data should not be limited to GDP estimations - the fiscal budgetary data should be assessed at the earliest to review the national budget. Data should be adequately prioritised in view of the Covid-19 pandemic, GDP should not be 'the indicator' to understand the health of the economy and monitor the path of recovery. The government should take immediate steps to revive Annual (if not quarterly) Labour Force Survey and expedite the Household Income and Expenditure Survey to assess the employment and poverty (and inequality) situation. Indeed, the recovery performance of the economy should be measured in terms of employment, poverty and inequality trends. Disaggregated data should be prioritised in view of attaining the SDGs aspiration of 'leave no one behind'.

Independence of the BBS is critical for restoring credibility of official data. BBS should be endowed with adequate financial resources to undertake the needed tasks. CPD, to this end, reiterates its earlier suggestion to constitute an Independent Statistical Commission to guide and steer the transition towards greater data reliability and integrity.

The write-up is prepared on the basis of 'Provisional Estimates of GDP Growth in FY2020: CPD's Reaction' presented on virtual press briefing on August 16, 2020. [www.cpd.org.bd]