The price of any commodity depends on the interaction between its demand and supply. In a market economy all decisions regarding quantity of commodity, money, investment, production, consumption and distribution are determined by the price set by the supply and demand forces. The allocation of resources in the factor markets are also guided by the factor price. After the evolution of money, commodities were exchanged by money and the value of money is determined by price (exchange value of commodity): when price goes up, the value of money declines. However, a market economic system may vary from non-regulated or non-government intervention ("free market" or laissez-faire) systems to a degree of regulation or controlled for providing public goods for public services. Government plays an active role in correcting market failures and promoting social welfare. The planned economy is contrasted with market economy where all decisions for production distribution exchange etc are determined by an integrated economy-wide economic plan. The economy's means of production are owned and operated by the state. A mixed economic system is where market and controlled economy operate side by side.

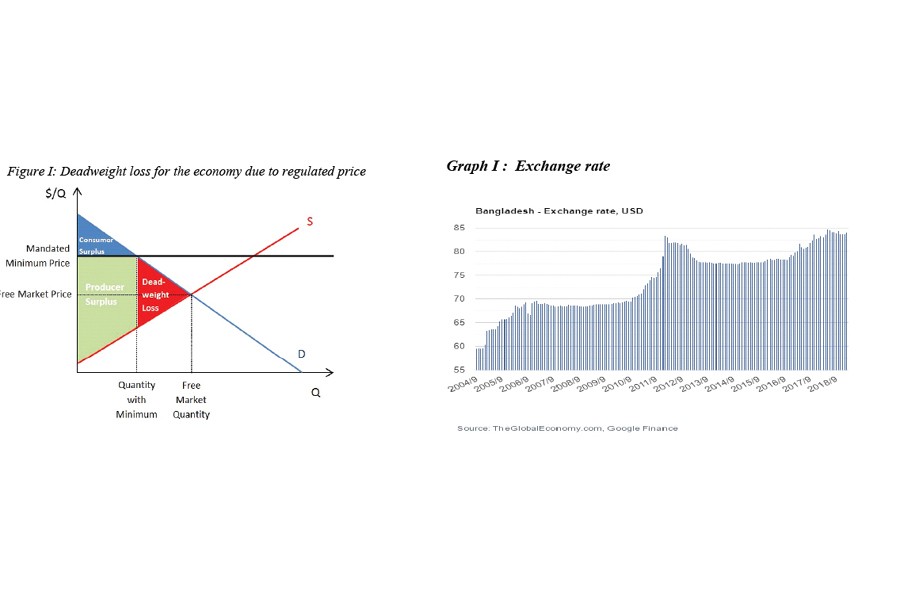

Theoretically, free-market economy refers to an economic system where prices for goods and services are set freely by the forces of supply and demand and are allowed to reach their point of equilibrium. Here quantity demanded is equal to quantity supplied without intervention by government policy. Laissez-faire is a more extreme form of free-market economy where the role of the state is limited to protecting property rights and ensuring social welfare. In a market economy, price determines the value of commodity and service and their optimum amount to be traded in the market. Production, consumption and distribution are determined by the market equilibrium. However, market may fail due to the existence of negative externalities, imperfect information, unfair competition etc, where governments can intervene and correct the market by establishing price ceilings or price floors in specific markets (such as minimum wage laws in the labour market). Government can also use fiscal policy to discourage certain consumer behaviour or to address market externalities generated by certain transactions (Pigovian taxes, environmental taxes etc). The East Asian model of capitalism involves a strong role for state investment and it takes an active role in promoting economic development through subsidies, the facilitation of "national champions", and an export-based model of growth. Examples may be cited for the economies of Singapore, Japan, Taiwan, South Korea and China. Economist Joseph Stiglitz argues that markets suffer from informational inefficiency and the presumed efficiency of markets stems from the faulty assumptions of neoclassical welfare economics, particularly the assumption of perfect and costless information, and related incentive problems. If the price is set by intervention in the market, the market will operate at suboptimal levels and the market distortion produces inefficient allocation of resources. Both consumer surplus and producer surplus will be decreased and there will be deadweight loss for the economy due to regulated price. (See Figure I)

If the exchange value of foreign currency in Bangladesh is noted, the existence of a dualism would be observed in the market. A country's foreign exchange market allows its currency to be exchanged for other currencies in order to facilitate international trade, remittances inflow and other financial transactions. The role of this market mostly depends on the exchange rate regime persuaded by the country. After the independence of Bangladesh in 1971, taka was pegged with pound sterling but it was brought at par with the Indian rupee. But there was a rapid decline in the value of taka against foreign currencies and in May 1975, it was substantially devalued. Bangladesh adopted a regime of managed float in 1976 which continued up to August 1979, when a currency-weighted basket method of exchange rate was introduced. The exchange rate management policy was again replaced in 1983 by the trade-weighted basket method and the US dollar was chosen as the intervention currency. Bangladeshi taka was declared convertible for current account transactions in terms of Article VIII of the IMF Articles of Agreement which reflected a turning point in the country's foreign exchange management and exchange rate systems. By this time a secondary exchange market (SEM) was allowed to grow parallel to the official exchange rate and this resulted in curb market.

In Bangladesh, multiple exchange rates were allowed under different names of export benefit schemes such as, Export Bonus Scheme, XPL, XPB, EFAS, IECS, and Home Remittances Scheme till 1990. This led to a wide divergence between the official rate and the SEM rate. The duality gradually gave rise to a number of conflicting regulations, poor risk management, and various implicit or explicit government guarantees to the users of foreign exchange. This resulted in a number of macro-economic imbalances prompting the government to adjust the official rate in phases and to liquidate its difference with the rate at SEM. The two rates were finally unified in January 1992, the first step towards currency convertibility was taken on July 17, 1993 and this marked the beginning of a relatively open foreign exchange market in the country. Until then, the Bangladesh Bank used to declare mid-rate along with the buying and selling rates for dollar applicable to authorised dealers (ADs). It was found that the spread was Tk 0.10 initially which gradually widened to Tk 0.30.

At present, the system of exchange rate management in Bangladesh is to monitor the movement of the exchange rate of taka against a basket of currencies through a mechanism of Real Effective Exchange Rate (REER) intended to be kept close to the equilibrium rate. The players in the foreign exchange market of Bangladesh are the Bangladesh Bank, authorised dealers, and customers. The Bangladesh Bank is empowered by the Foreign Exchange Regulation Act of 1947 to regulate the foreign exchange regime. It, however, does not operate directly and instead, regularly watches activities in the market and intervenes, if necessary, through commercial banks. From time to time, it issues guidelines for market participants in the light of the country's monetary policy, foreign exchange reserve, balance of payment and overall macro-economic situation. Guidelines are issued through a regularly updated Exchange Control Manual published by the Bangladesh Bank. Exchange rates of taka for inter-bank and customer transactions are set by the dealer banks, based on demand-supply interaction. Bangladesh Bank (BB) is not in the market on a day-to-day basis, and undertakes US dollar purchase or sale transactions with dealer banks at prevailing inter-bank exchange rates only as needed to maintain orderly market conditions. Bangladesh Bank has taken a number of steps to stimulate or activate the inter-bank foreign exchange market such as (i) Bangladesh Bank has stopped sales and purchases with ADs of any currency other than the US dollar to encourage inter-bank cross currency transactions; (ii) Bangladesh Bank has raised its transaction threshold to US$ 50,000 with values in multiples of US$ 10,000, for its deal with ADs in order to encourage inter-bank deals and to dissuade frequent recourse to transactions with the central bank (exchange rates for Bangladesh Bank's spot purchase and sales transactions of US dollars with ADs is decided on a case-to-case basis, Bangladesh Bank does not undertake any forward transaction with ADs, and ADs are free to quote their own spot and forward exchange rates for inter-bank transactions and for transactions with non-bank customers); (iii) Bangladesh Bank has abolished foreign exchange holding limits; (iv) Bangladesh Foreign Exchange Dealers Association (BAFEDA) has been formed and a Code of Conduct for treasury operations and inter-bank foreign exchange market has been formulated; (v) ADs have been allowed to maintain with Bangladesh Bank FC Clearing Accounts in Euro, Japanese Yen, as well as US dollar & Pound Sterling.

The authorised dealers are the only resident entities in the foreign exchange market to transact and hold foreign exchange both at home and abroad. Bangladesh Bank issues licences of authorised dealership in foreign currencies only to scheduled banks. The amount of foreign exchange holdings by the authorised dealers are subject to open position limits prescribed by Bangladesh Bank, which itself purchases and sells dollars from and to the dealers on spot basis. The size of such transaction with Bangladesh Bank is required to be in multiples of $10,000, subject to a minimum of $50,000. In addition to authorised dealers, there are registered money-changers to buy foreign currencies from tourists and sell them to outgoing Bangladeshi travelers as per entitlement. Their excess holdings beyond the permitted balance are required to be retained with authorised dealers. Some service institutions like hotels and shops have also obtained limited money changing licences to accept foreign currencies from the foreign tourists. But these are to be sold to authorised dealers. Transactions by customers take place mainly to satisfy customers' demand for individual needs and to facilitate export, import and remittances.

Since May, 2003 with the floating of BDT, foreign exchange market of Bangladesh entered into a new phase with deregulated characteristics. In their dealings for the first time, market players were free from government or Bangladesh Bank intervention. Although, there had been a fear of adverse consequences of floating, the market responded rationally to the change in foreign exchange dealing system. It was observed that the value of one dollar increased by around Tk 1.00 to Tk 61.30 in the market amid a buying pressure caused by the speculator. However, this situation might be due to the closure of most of the money market around the world. It was recorded that Bangladeshi taka gained in first interface with international market in Floating Exchange Rate (FER) regime. From the trend, it was revealed that Bangladesh taka maintained its strength against US dollar throughout the first week after the float, although the exchange rate of dollar showed somewhat upward bias. The strong supply position, particularly, adequate supply from the authorised dealer reasonably offset the strong demand for dollar. However, in the informal market, as before, dollar was traded a bit higher compared to the inter-bank market. It may be mentioned that Bangladesh Bank had taken necessary cautionary steps to avert possible erratic behaviour of the market. To this end, the vigilance team of Bangladesh Bank visited the commercial banks to monitor the market behaviour. However, the local call money market on the other hand depicted a high trend after the float. High investments by few banks along with withdrawal of excess fund from the market by the Bangladesh Bank through 'reverse repo' might have led to fund crunch in the local currency market which exerted positive influence in foreign currency market. Possibly, there might have been a seesaw effect between the rise of call rate and fall in foreign currency price. The exchange rate of USD from 2004 to 2018 is shown in Graph I.

It can be said that in order to outweigh or minimise deadweight loss (occurred due to intervention) the market forces should be allowed to play. Still minimal control or government intervention is required in order to correct the market in case of market failure. Bangladesh Bank as apex body of the country's financial system should take prudent policy to maintain the market-based foreign exchange rate.

Dr Md Moniruzzaman is an Associate Professor at the Bangladesh Institute of Governance and Management (BIGM).