The year 2020 began with doubts whether it would be possible to sustain socio-economic advancements attained during the last few years. The reason is the depressing state of major indicators such as negative export-import growth, large revenue deficit, falling private sector investment, rising non-performing loans (NPLs) recorded in the last quarter of 2019, and the impending fear of a global economic recession.

However, the government was optimistic that the depressing trend of these indicators would be reversed and Bangladesh would have another great year - with respect to growth and poverty reduction.

The optimism has, however, now been seriously dented with the severe onslaught of Covid-19. It has virtually stalled all economic activities all over the world. The countries as well as multilateral agencies have already started to estimate the economic and social costs of the pandemic.

The preliminary estimates that emerged from numerous sources are frightening. JPMorgan slashes its USA GDP (gross domestic product) forecast for next quarter (i.e., second quarter) to 25.0 per cent contraction and an imminent recession despite 'Herculean' stimulus measures equivalent of US$2.0 trillion. The title of the OECD Interim Economic Assessment (published on March 02, 2020) is "Coronavirus: The World Economy at Risk". Similarly, Moody's cuts India's economic growth from 5.30 per cent to 2.50 per cent for 2020. Similar dire projections emerged from other reports and briefs.

Bangladesh's economy will not be spared. The impacts of Covid-19 on economic growth, job losses and upsurge in poverty are expected to be large. The projected GDP growth of 8.2 per cent for 2020 may decline by 0.2 per cent to 0.4 per cent according to preliminary estimate of Asian Development Bank (ADB) released on April 03. However, ADB Country Director in Bangladesh Manmohan Parkash said in a statement, "If a significant outbreak occurs in Bangladesh, the impact could be more significant. The outlook will be updated as more information becomes available."

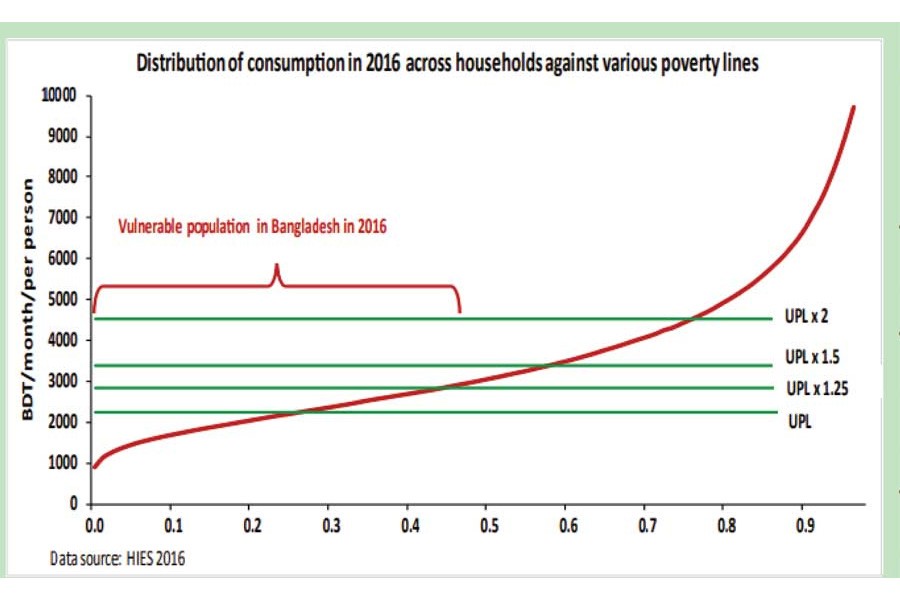

The robust economic growth of 6.0 per cent to 7.0 per cent during the last decade helped Bangladesh to win its fight against poverty - mainly through employment generation channel. Jobless rate is likely to surge leading to a sharp rise in poverty. According to current projections (before Covid-19), poverty rate still is 20.0 per cent implying that almost 32 million people are poor. Poverty measurement uses a poverty line threshold to identify poor persons. If per capita income is lower than the poverty line even by Taka 1.0, he or she is considered poor. Like many other countries, Bangladesh adopts a low poverty line for poverty measurement - suggesting large numbers of the population, who are vulnerable, are not counted as poor.

Reduction in economic growth and rise in jobless rate inevitably lead to a sharp increase in the poverty rate. The number of vulnerable persons (see figure) - who need assistance - may double from 20.0 per cent to 40.0 per cent in 2020 (perhaps for a short and temporary period). Poor and vulnerable groups in Bangladesh lack savings and resources to fend off a crisis like the Covid-19 pandemic.

Like many other countries, the Bangladesh government has also proposed a series of measures and stimuli to buttress the deleterious consequences of the Covid-19 pandemic. These initiatives are welcomed. Supports are also being provided by the private sectors, non-governmental organisations (NGOs) and development partners (DP). Addressing the health risks and economic perils of the vulnerable population should be the main focus of government stimulus measures. The size of the stimulus may eventually need to be around 3.0 per cent to 4.0 per cent of GDP.

Bangladesh will announce its budget for the next fiscal year (FY 2020-21) in June 2020 - amid Covid-19 pandemic. The budget should reorient the focus from channelling resources from traditional sectors such as energy and physical infrastructure to social protection, poverty alleviating programmes, health insurance and universal health coverage, and programmes for Small and Medium Enterprises (SMEs). The government may increase the current social protection allocation of 2.2 per cent of GDP to about 5.0 per cent of GDP. Employment generation and poverty alleviation programmes should attract higher allocation. The health sector budget should permanently be increased to 3.0 per cent of GDP from the current allocation of less than 1.0 per cent of GDP.

Along with fiscal measure (tax and subsidy) and utility measures (lower rates), Bangladesh Bank may create a special fund to support the SMEs to fend off the Covid-19 economic crisis. A major plus point in the case of Bangladesh is that fiscal and monetary instruments are already in operation (even though they may not be highly efficient) through which these stimuli can be implemented. Operations of digital financial service providers such as bKash, rocket, and Nagad will be the key conduits of fast and efficient low-cost fund transfers avoiding human contact.

Another advantage in Bangladesh is the presence of an effective cluster of CSOs (civil society organisations and NGOs. They along with the government can play an important role in beneficiary identification, delivering the resources to the poor and vulnerable populations, and monitoring the stimulus implementation. Effective and timely disbursement of funds is decisive to tackle the economic and social perils of Covid-19.

Value for money (VfM) of public fund is generally low in Bangladesh. This is the time to break this trend to have high VfM of the proposed stimulus and measures to be proposed in the next budget.

Following steps may help to improve VfM: (i) coordinated planning to pull all the resources (public, private, NGO and DP) for maximising the prioritisation and allocation; (ii) creation of a dedicated cell within the Planning Commission for Covid-19-related projects to approve projects within 10 days for the speedy delivery of cash, goods, and services; and (iii) extension of support from Bangladesh Bank for quick approval of loans for SMEs for effective and timely disbursement of funds.

To conclude on an optimistic note, Bangladesh is well known for beating apprehensions and it is presumed that Bangladesh will emerge as a stronger nation withstanding the Covid-19 perils.

Dr. Bazlul Haque Khondker is Chairman, SANEM.