One of the major developments in the world economy over the past three decades or so has been the rapidly growing share of the developing countries. Indeed, the rise of developing countries as significant drivers of global growth and trade has been recognised as the defining feature of globalisation. Another important related trend is that increasingly more trade is taking place between developing countries. While the traditional developed country markets remain important, intra-developing countries' trade, as well as Commonwealth trade with the developing countries, have been gaining prominence during the last two decades.

Out of the 54 Commonwealth member countries, 48 (including Bangladesh) are developing economies. Hence, in the context of the declining economic expansion of China - one of the major trading partners of the developing Commonwealth countries - it is of crucial importance to investigate whether Chinese sluggish economic growth and global trade turmoil have affected developing countries' significance in Commonwealth trade. The Commonwealth is not a trading bloc; nevertheless, trade between its members is substantial. Between 2000 and 2014, intra-Commonwealth merchandise exports more than tripled, from US$150 billion to US$463 billion. This section explores the trade deflection and the relative significance of the Global South in Commonwealth exports.

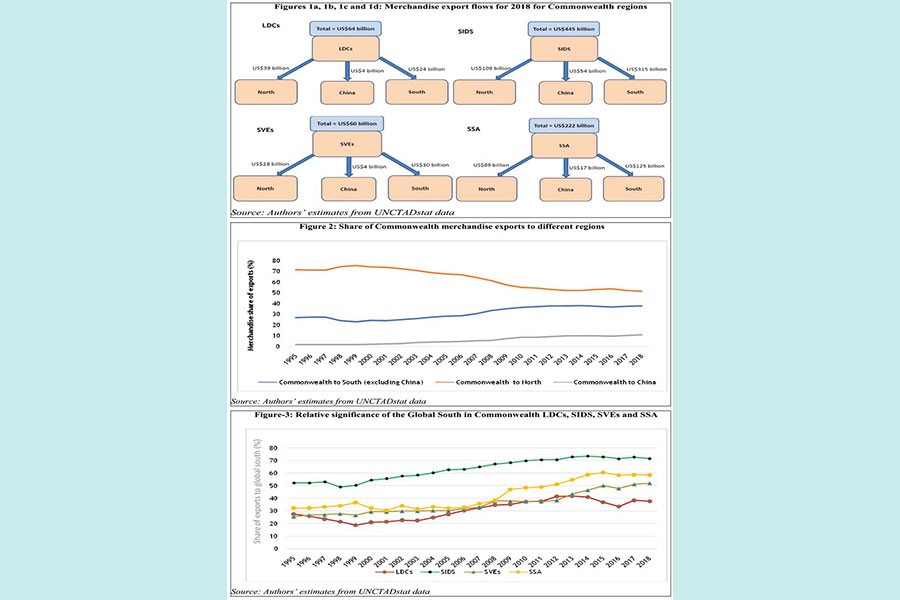

Figures 1a-1d show the merchandise export volume of our four developing Commonwealth regions to the Global North, the Global South and China in 2018. During 2018, out of the four regions, the Least Developed Countries (LDCs) exported a larger share of their exports to developed countries. For all other regions, the volume of exports to the developing world was substantially larger than that of exports to the Global North. This finding indicates a larger reliance on the Global South of the Commonwealth regions in terms of trade. Small Island Developing States (SIDS) have the highest export volume as well as share of exports to China (US$54 billion), followed by Sub-Saharan Africa or SSA (US$17 billion).

UNCTADstat 2020 data show that from the early 1990s to 2018, the share of Commonwealth merchandise exports to developing nations was always larger than the share to the Global South. During 1995, 71 per cent of exports from Commonwealth nations went to the Global North (Figure 21); the share of Commonwealth exports to developing nations was only 29 per cent, out of which only 1.7 per cent was exports to China. However, over the years, the relative significance of the Global North for Commonwealth trade has registered a secular decline, and the developing nations have an increasingly more robust significance in terms of destination for Commonwealth exports.

The modest 29 per cent share of Commonwealth merchandise exports to the developing economies in 1995 had increased substantially by 2011, to 45.5 per cent, with the Global North as a destination taking up 54 per cent. One interesting finding that can be gleaned from Figure-2 is that, between 2001 and 2011, the Commonwealth export share to the Global South (excluding China) and to the Chinese market improved remarkably, from 24 per cent and 2.3 per cent to 37 per cent and 9 per cent respectively. However, the significance of the Global South and the Chinese market for Commonwealth trade has been almost stagnant in the past decade. From 2012 to 2018, the share of Commonwealth merchandise exports to the Global South has been stuck at around 38 per cent; for the Chinese market, it has increased by only 1.8 percentage points, and only owing to slightly improved performance in 2017-2018.

Figure-3 shows the relative significance of the Global South for the four developing regions of the Commonwealth. Of the four regions, that with the largest share of exports going to the Global South is the SIDS, followed by SSA, SVEs (Small and Vulnerable Economies) and LDCs.

From the SIDS and LDCs during 2000-2013, the export share to developing nations increased without disruption from 54 per cent to 73 per cent and from 21 per cent to 42 per cent, respectively. Since 2013, for these two regions, the relative significance of the Global South has been almost stagnant.

For both SSA and the SVEs, during 2001-2011, the relative significance of the Global South improved considerably. During 2001, the share of exports to developing economies from Commonwealth SSA was 31 per cent; by 2011, this had risen by 18 percentage points to 49 per cent. The same share for the SVEs had increased from 29 per cent to 37 per cent. Despite the contraction in the volume of trade for these two regions during the post-2011 years, the relative significance of the Global South continued to increase. From 2011 to 2018, the export share to developing economies from SSA and SVEs grew by 10 and 15 percentage points, respectively. Hence, we can conclude that, even though during the 2010s the Global South's relative significance for Commonwealth trade has been almost stagnant, for Commonwealth SSA and SVEs this significance has continued to increase. These findings imply a trade deflection of Commonwealth SSA and SVEs to other developing nations resulting from China's economic slowdown during the post-2011 years.

Data show that the share of Commonwealth export to China increased, whereas that to the developed economies declined. The share of exports to Asian developing countries, excluding China, and African developing nations, also rose during this time period. However, during the sluggish years of 2012-2016, the share of Commonwealth exports to China declined; a similar trend can be observed for the share to developed economies. Nevertheless, Commonwealth nations were increasingly involved in exporting to developing Asian and developing African countries. Given that most SSA countries and many exporting developing Asian countries are members of the Commonwealth, we can say that, after 2011, in the face of reduced import demand for raw materials in China and sluggish growth in the exports of Commonwealth member countries, intra-trade of the Commonwealth nations increased. In 2012, Commonwealth member countries exported 10 per cent and 28 per cent of merchandise exports to China and developing Asian countries, respectively; in 2016, the export share to China had declined to 9.4 per cent and that to Asian developing economies had increased to 29.3 per cent.

WAY FORWARD: Over the past decade, the global trade landscape has gone through several fundamental changes, which, like most regions of the world, have affected Commonwealth trade significantly. These structural changes in global trade offer a wide range of opportunities in addition to a broad array of challenges for the Commonwealth member countries. From the discussion above, we can conclude the Commonwealth, more specifically, SSA and the SVEs, have suffered significant adverse impacts on their exports as a result of China's slowed economic growth. However, the structural changes in the economy and the labour market in China, coupled with increasing wage rates, may lead to several opportunities for the Commonwealth economies in terms of their comparative labour advantage.

In order to address the impacts of slowed trade, Commonwealth policy makers should undertake structural reforms to increase productivity and growth in all sectors of the economy. In the face of the growing wage rate in China, the devalued renminbi and less emphasis on investment, China's firms can be provided with incentives and Commonwealth countries can invest in infrastructure to attract more FDI from China.

However, Commonwealth countries should also be cautious in making deals with China of tying natural resources and minerals to financing key infrastructure and incentivising Chinese firms. One example of a precarious situation arising from such an experience is of Angola, an oil-rich nation, which had to send oil to China in exchange for financing major infrastructure and incurred a large loss as a result of the slump in commodity prices worldwide. Hence, one major issue with such barter deals is that contracting countries are not assured of obtaining a certain amount in exchange for the bartered commodities and are thus exposed to volatile market conditions. One way the Commonwealth, more specifically Commonwealth SSA, can capitalise on itself is to implement the continental free trade agreement.

Many Commonwealth countries can engage in currency devaluation to improve export volume, as suggested by the IMF. A weaker currency may reduce import demand in favour of domestically produced goods in Commonwealth member countries. This may also reduce unemployment and accelerate economic growth. However, in doing so, governments should undertake additional measures to dampen the inflationary tendencies in the economy induced by currency devaluation. Moreover, Commonwealth country governments should focus on governance and trade facilitation measures, which may enable Commonwealth countries to cope with sluggish trade growth.

The FDI climate in the Commonwealth regions should also be fostered, to increase FDI flows among Commonwealth member countries. Additionally, the Commonwealth should encourage its members to engage in more intra-bloc trade in the face of declining trade with China. Trade costs are already 19 per cent lower when two trading partners are both from Commonwealth member countries. Commonwealth trade linkages with China can also be improved if the Commonwealth can accrue benefits from China's sweeping Belt and Road Initiative. This initiative was set up by the Chinese government in 2013 as a global development strategy to expand global trade links and connect China to the rest of Asia, Europe and Africa through infrastructural development and investments in nearly 70 countries.

Dr. Syed Mortuza Asif Ehsan, Assistant Professor, Department of Economics, North South University, Dhaka, [email protected]

Dr. Salamat Ali, Economic Adviser-Trade Economist, Trade, Oceans and Natural Resource Directorate at the Commonwealth Secretariat.

[The article is based on International Trade Working Paper-20202/04, published by the Commonwealth Secretariat]