There is a wave of revisions and terminations of Bilateral Investment Treaties (BITs) in many developing countries for the last few years. The main reason for the move is unbalanced nature of Investor-State Dispute Settlement (ISDS) mechanism incorporated in the BITs. Many developing countries find that the current practices of ISDS seriously undermine their national interest. In the name of protecting foreign investors' interests, such dispute settlement mechanism compels the sovereign nations not only to compromise their regulatory authority, but also to pay hefty compensations to foreign investors.

India terminated BITs with more than 60 countries which is about half of the total such terminations globally during 2010 and 2018. The termination is unilateral in nature. Countries like Brazil, South Africa and Argentina have joined the rally. By terminating the BITs, they are trying to replace those with new ones in some cases. These are known as model BITs. The move has created a new debate on the impact of Foreign Direct Investment (FDI) and called for reformation of the current dispute settlement process.

BIT is basically an international agreement between two countries to set up 'rules of the road' for foreign investment in each other's territories. The first BIT in the world was signed between Germany and Pakistan in 1959. Before that, there was Friendship, Commerce and Navigation Treaties (FCNs) mainly promoted by the United States (US). The main difference between FCN and BIT is that the later puts emphasis on alternative dispute resolution (ADR) procedure which is known as ISDS mechanism. BITs incorporate provisions allowing investors to move the International Centre for Settlement of Investment Disputes (ICSID) in case of violation of their rights under the treaties. The scope to move the ICSID means they can avoid host countries' courts for any dispute resolution. ICSID is one of the five organisations of the World Bank Group dedicated to providing facilities for conciliation and arbitration of international investment disputes.

BITs AND BANGLADESH: There is no designated official source from where one may get to know the status of BITs signed by Bangladesh with other countries. The Bangladesh Investment Development Authority (BIDA) website says nothing about it. The Bangladesh Bank website provides only names of the partner countries of BITs but the list is not up-to-date.

However, the United Nations Conference on Trade and Development's (UNCTAD) Investment Policy Hub which is a global virtual platform to avail detailed information on different international investment agreements, investment policies and laws and ICSID provide information on BITs across the countries.

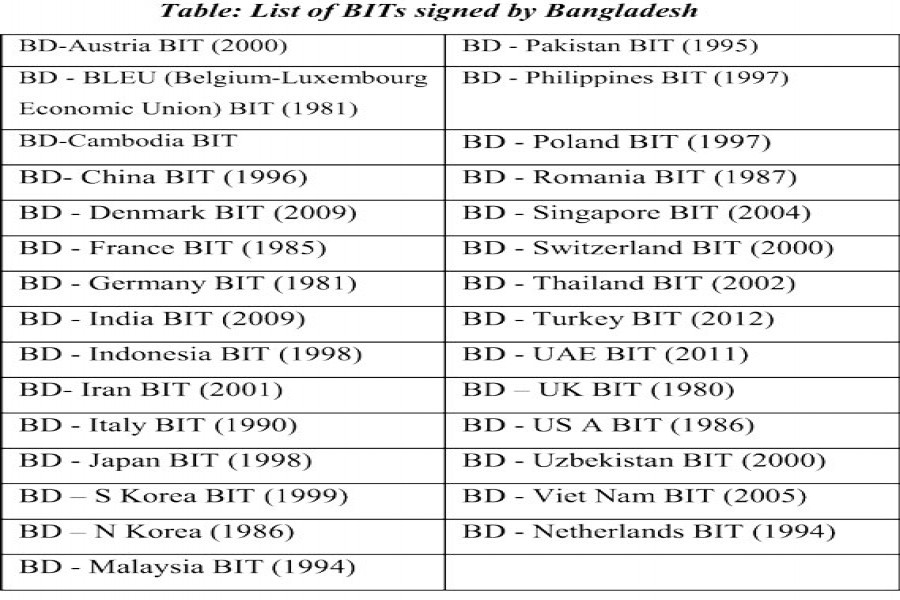

According to these two hubs, Bangladesh currently has 31 BITs of which 24 are now in force (Table-1). With Thailand and Turkey, there are two BITs each. BIT signed with Thailand in 1988 has already been terminated and replaced by a new BIT signed in 2002. The first BIT with Turkey was signed in 1978 but it never came into force. Without formally terminating it, the two countries later signed a fresh BIT in 2012 which is yet to come into force. The country has also signed four Treaties with Investment Provisions (TIPs) and three of these are now in force.

Bangladesh signed its maiden BIT with the United Kingdom in 1980 and the latest one was signed with Cambodia in 2014 which has not come into effect as yet. Foreign ministers have signed most of the BITs on behalf of Bangladesh. A few exceptions are there. For instance, in 2009 the then industry minister of the country signed the BIT with India.

Long-term implication of BITs is yet to get adequate attention of the country's policymakers. Low level of FDI may be a reason. Annual net inflow of FDI stood at $3.61 billion in 2018 which was $2.15 billion in 2017 and $2.33 billion in 2016. Researches, however, suggest that there is no strong correlation between inflow of FDI and number of BITs.

SAIPEM, CHEVRON, NIKO: But when any investor-state dispute arises, the importance of BITs is felt. Bangladesh faced at least three such disputes. These were the arbitrations of Saipem, Chevron, and Niko.

Saipem, an Italian energy company, sued Petrobangla in 1990 and got verdict in 2003 in its favour through International Chamber of Commerce (ICC) commercial arbitration mechanism. But Petrobangla refused to pay compensation to Saipem as it moved to High Court which imposed interim injunction. Later, Saipem invoked the Bangladesh-Italy BIT and moved to ICSID. The body ruled in favour of the investor and asked Bangladesh to pay $6.30 million as compensation against $12.50 million claimed by Saipem.

Chevron, a US-based multinational energy giant, moved the ICSID in 2006 against Petrobangla's deduction from Chevron's earning from gas selling. It also claimed refund of $240 million from Petrobangla. Bangladesh initially avoided the arbitration process. Later, it joined and made its submission. After hearing the arguments of both the sides, ICSID gave its verdict in favour of Bangladesh.

Niko, a Canadian energy company, entered into a joint venture with BAPEX (Bangladesh Petroleum Exploration and Production Company Limited) in 2003. The company was responsible for two blowouts in 2005 in Bangladesh allegedly due to its negligence in Tengratila gas field operation. Petorbangla sued the company for damage in 2008 in Bangladesh court. But Niko moved ICSID urging to exonerate itself from the liability of any damages caused by the blowouts and to realise its arrear gas bill from Petrobangla. ICSID arbitrator awarded verdict in favour of Niko as BAPEX's flawed submission favoured Niko instead of Bangladesh. The final decision, however, is still pending.

The potential risk of investor-state dispute may also be observed from a brief analysis done by two Indian law teachers (Prabhash Ranjan and Pushkar Anand in The Wire in October, 2016). They argued that Indian investor, the National Thermal Power Corporation (NTPC), can drag Bangladesh to arbitration in case the country adopts sovereign regulatory measures to mitigate the adverse environmental consequences of the Rampal thermal power plant.

Bangladesh has experience about ISDS-related risks. Nevertheless, in a bid to attract FDI in large amounts, it may feel tempted to sign new BITs. Before signing any such BIT, it needs to do its homework exhaustively to avoid any unbalanced provision, especially on ISDS mechanism. Meanwhile, a thorough review of the existing BITs is in order.

There is a global initiative on reformation of ISDS through the United Nations Commission on International Trade Law (UNCITRAL). Bangladesh needs to participate in it. The commission is responsible for progressive harmonisation and unification of the international trade laws. Six working groups are active now; one of these is on investor-state dispute settlement reform. Bangladesh is not one of the current 60 members of the commission, but there is an opportunity to join as an observer.