The government and the community expect that business organizations, in particular, should create as many jobs as possible for the working-age population with a view to utilising human resources of the country. Banking business is considered to be one of the most organised sub-sectors of the overall service sector. It has to focus on personalised customer services and thus needs skilled and potential manpower despite huge dependence on artificial intelligence. This article first focuses on job creation capacity and standard, and then glimpses the scenario of our banking industry's contribution towards creation of jobs. It may be mentioned that the government has specific time-based targets of job creation to be fulfilled by the private businesses or organisations in different sectors of the economy.

The banking industry of Bangladesh has phenomenally expanded. We have now 63 banks comprising 9 State-owned banks (SOBs), 40 Private commercial banks, nine Foreign banks (FBs) and five non-scheduled banks. Scheduled banks hold deposits of Tk.1139832 crore, have advances worth Tk.951448 crore, and operate a wide network of branches numbering 10396 (of which urban 52 per cent and rural 48 per cent).All the scheduled banks together operate 100 million deposit accounts and and 19 million loan accounts. 58 scheduled banks including foreign banks have 182610 employees (including 4091 employees in FBs).

Deposits constitute the main source of fund for advances to be invested to generate income in a bank. Performance as regards job creation can be measured on the basis of the amount of deposit amount designated for a person employed (or deposit per job). As for example, Bank X employs 1 person against deposit of TK. 50 million, and Bank Y employs 1 person against deposit of Tk.30 million. Here Bank Y creates more jobs i.e., its job creation capacity (JCC) is higher and can be considered to be a better performer in respect of job creation. In this connection, one may contend that a bank may have incurred loss or has been continuing to suffer loss and cannot employ more. Of course that is another issue to be considered when practical evaluation will be made. Apparently, if we compute this ratio and compare among many banks, we can at least explore the symptoms of poor and strong job creation performance.

A bank's job creation capacity is governed by many factors. The most influential ones include degree of automation, productivity and profitability, growth of deposits and advances, government target for job creation, owners' attitude etc. Careful consideration is necessary to decide the proportion of labour, and capital (i.e. machinery, equipment and technology) in view of our labour-abundant economy. So, there may be a dialogue between the bankers and the government as regards how to maximise the level of employment generation. However, the job creation capacity evaluation requires a suitable standard. The standard for banking is to be set by specifying how much deposit should create job for one person. As far as our knowledge goes, such a standard has not been fixed, so far. Another thing is worth counting. A single standard may not match with the characteristics of each type of bank. So, multiple standards may have to be developed.

A bank's job creation capacity is governed by many factors. The most influential ones include degree of automation, productivity and profitability, growth of deposits and advances, government target for job creation, owners' attitude etc. Careful consideration is necessary to decide the proportion of labour, and capital (i.e. machinery, equipment and technology) in view of our labour-abundant economy. So, there may be a dialogue between the bankers and the government as regards how to maximise the level of employment generation. However, the job creation capacity evaluation requires a suitable standard. The standard for banking is to be set by specifying how much deposit should create job for one person. As far as our knowledge goes, such a standard has not been fixed, so far. Another thing is worth counting. A single standard may not match with the characteristics of each type of bank. So, multiple standards may have to be developed.

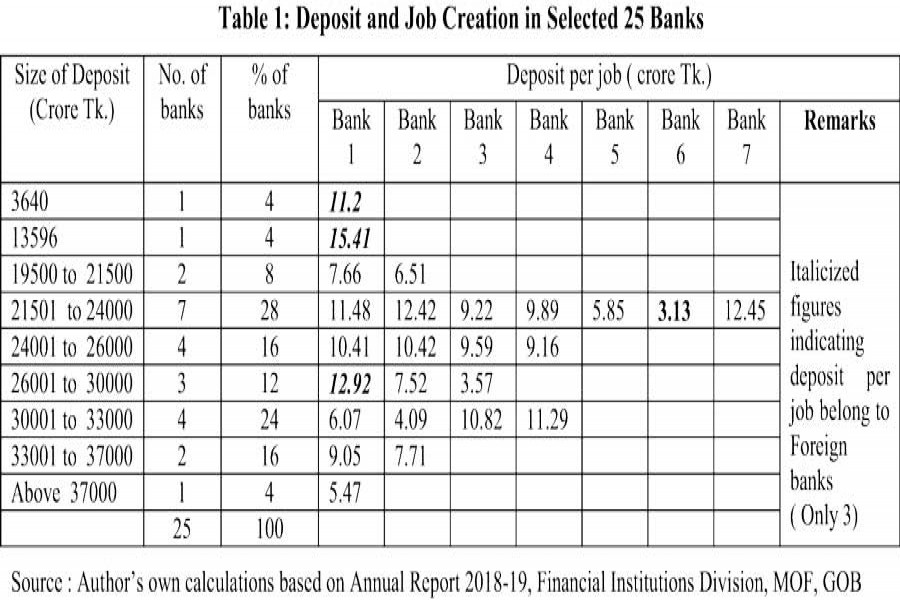

A preliminary survey (based on secondary data) of selected 25 private commercial banks (including three foreign banks) has been made. The following scenario of job creation status in our banking sector is obtained:

Table 1 shows that the lowest amount of deposit per job is Tk. 30.13 million which may be apparently regarded as the highest capacity of a bank to create a job. Contrarily, it is observed that the highest amount of deposit per job is Tk. 150.41 million (a foreign bank).This may be generally considered to be the lowest capacity of a bank to create a job. It is obvious that the banks are not following any uniform and suitable standard for creating jobs. Despite the deposit sizes within a group of nearest range, average deposit per job significantly varies among the group members. There exist variations among the different bank groups formed on the basis of deposit size.

Table 2 presents the total scenario of employment in the scheduled banks of the country. It is seen that on an average there is close similarity of deposit per job used as criterion for creating jobs among three categories of banks -- SOBs, PCBs and IBs. The same criterion agrees with the sector's average (6.32) too. Here non-scheduled banks have not been included.

What matters most is the highly significant inter-bank variation of job creation rate or capacity. Research needs to be carried out to have a comprehensive view of banking sector employment generation and to determine job creation standard for planning and control by the government. As part of the government-business relationship, contractual obligations for the bank owners and management should be created in order to enforce and monitor contractual compliance, evaluate and control banks' initiatives for maximising job opportunities.

Haradhan Sarker is former Financial Analyst, Sonali Bank & Retired Professor of Management.