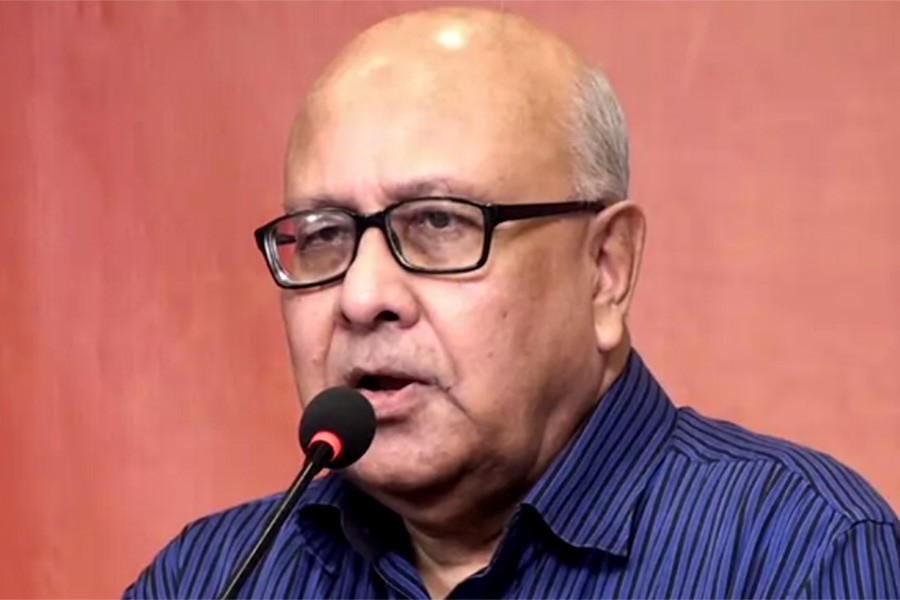

Veteran banker, Khandaker Ibrahim Khalid is no more. Although he recovered from Corona virus infection, he finally succumbed to old age complications. We pray to the Almighty for the peace of his departed soul and also convey our condolences to his bereaved family members.

Ibrahim Khalid was a legendary banker with successful role in the fields of country's central bank and in the commercial banks as well. As a banker he has had the opportunity to contribute in the both areas of the industry i.e., regulatory aspect and market players' aspect. He was deputy governor of Bangladesh Bank and successfully played the role of CEO of some commercial banks including nationalised ones.

As Deputy Governor of Bangladesh Bank, he has set the example of stringently regulating the banking industry. Similarly, when he was leading commercial banks as CEO, he proved his worth in successfully running profit-making commercial banks strictly complying with rules, regulation and laws. Position of any bank was not important for Ibrahim Khalid as thoughts and ideas for streamlining country's banking sector was his only aspiration. He realised that irregularities and anomalies were ruining the country's banking sector but no effective measures were in place to mend the wrongs. This made him frustrated. Thus whenever he got the opportunity in television talk-shows or discussions, he expressed his frustration over the deteriorating banking sector in the country. He believed that some pragmatic measures, particularly empowering the Bangladesh Bank, modernising credit system to prevent bad loan, streamlining and managing longstanding non-performing loans (NPLs), and establishing good governance in running the banks could bring back the banking industry on its right track. Ibrahim Khalid was not alone; many experienced bankers also think in the same way but they do not express their views whereas Ibrahim Khalid publicly expressed his views with the intent to draw attention of the concerned authority. I myself also strongly believed and followed his ideology and have written many articles on these issues in the local newspapers. Having been inspired by Ibrahim Khalid's views about the country's rising NPL and based on some country's experience in managing NPL, I wrote a series articles with specific recommendations in the local newspapers, but unfortunately, these failed to draw attention of the concerned authority.

Ibrahim Khalid used to believe that only Prime Minister, Sheikh Hasina's direct initiative and supervision could resolve the problem of country's banking sector. His perception was that the anomalies in the banking industry had reached such a proportion that neither the Bangladesh Bank nor the Finance Minister alone would not be able to solve this problem. In this connection, his view was very clear-- comprehensive reform in the banking sector under direct supervision of Prime Minister could be the most appropriate solution.

Ibrahim Khalid was the symbol of practising discipline, rules and regulation in all areas of his work. He never breached any law nor allowed any irregularity in his long banking career. When he was assigned with the responsibility of investigating the share market scam, he had to encounter many undue pressure and political influence which he defied and submitted his report. Undue pressure and political interference are very common phenomenon in discharging professional responsibility in our country but this could not dissuade him from what he thought he should do. With unflinching dedication he was successful in setting the benchmark of carrying out professional responsibility staying above all kinds of influences. Even he did not compromise his ideology just to keep his position, instead preferred to leave the position so as not to entertain undue pressure. At the fag end of his career he took the responsibility of CEO of a private commercial bank where he faced difficulty to perform in complying with rules and regulation, so he decided to discontinue.

Ibrahim Khalid has left immense contribution in resolving many problems in country's banking sector. Compared to his contribution, he did not receive any formal recognition except Bangla Academy honorary fellowship. However, he has created innumerable bankers and followers in the country who will remember him for his ideology and strong voice for the betterment of the banking industry.

Nironjan Roy is a banker based in Toronto, Canada.