Digitalisation has in the past few years enabled developing countries in particular to leapfrog on financial inclusion. Countries like Kenya, Ghana, Rwanda and Tanzania have made great advances in connecting their citizens to financial systems by leveraging on mobile phone technology.

As the world has grappled with the Covid-19 pandemic, with closing of borders, curfews, lockdowns and other movement restrictions, digitalisation has come to the rescue. Online shopping and entertainment, digital financial services, virtual meetings and events have taken centre stage in lives and livelihoods globally.

DIGITAL SOLUTIONS: Policymakers at the onset of the pandemic took emergency measures to support and facilitate digital activities. The Central Bank of Kenya waived charges and expanded the limit for low-value mobile money transactions. This led to a significant increase in both value and number of transactions, mostly of $10 or less, helping to cushion the most vulnerable households, and attracting more than 1.6 million additional customers. In Rwanda, all charges were waived in March. By the end of April 2020, the weekly value of all kinds of mobile money transactions increased by 450 per cent from pre-pandemic levels.

Businesses also moved quickly to leverage the power of digital technology. In China, Ant Group partnered with more than 100 banks to launch the Contactless Loans initiative to help small and medium enterprises recover from COVID-19. In Brazil, the central bank is launching PIX, an instant-payments system expected to become widely available this month. In India, Riskcovry, a Mumbai-based start-up, introduced a coronavirus insurance policy for businesses that want to offer their employees hospitalization and lost-wages coverage.

Fortuitously, for the last 18 months, as part of the United Nations Secretary-General's Task Force on Digital Financing of the Sustainable Development Goals , we explored how digitalization can help tackle the world's most urgent development challenges. Covid-19 only amplified its mandate. The pandemic has hindered the implementation of the Sustainable Development Goals (SDGs), particularly in health and education. Getting back on track will be imperative to achieve a global recovery.

HOW CAN DIGITALISATION HELP: We have three recommendations to share.

First, placing people at the centre of the global financial system. Digitalisation must be driven by the needs of the people and work for them. For instance, Kenya introduced in 2017 a mobile-based digital bond dubbed M?Akiba to mobilize micro-savings of as little as $30 to finance government. Remarkably, 85 per cent of investors were participating in the government securities market for the first time.

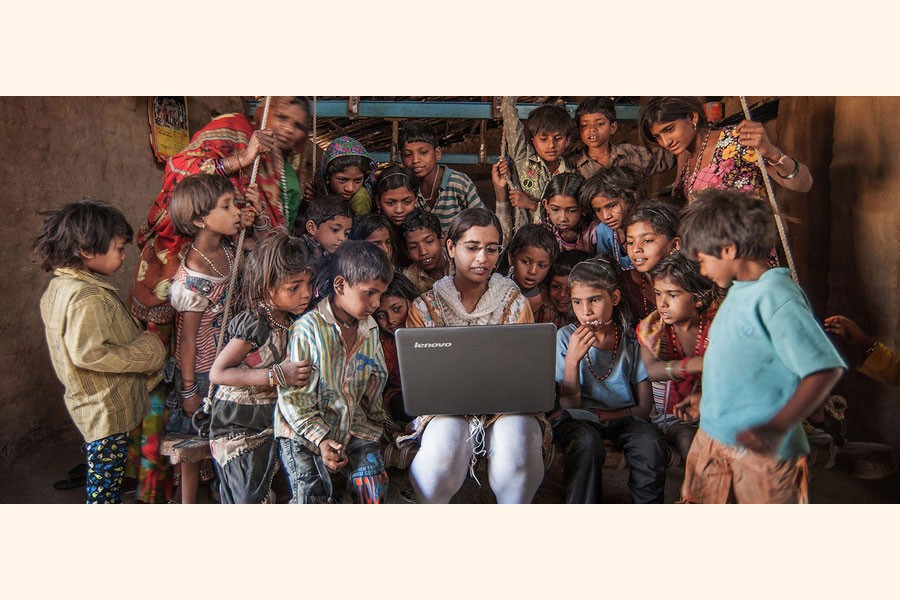

Second, connecting citizens to mitigate the digital divide. Over 700 million people lack broadband connectivity, while over a billion lack formal identification. Countries must invest in digital infrastructure and digital identity so their citizens can access online services. Coupled with that, there has to be investment in numeracy and financial literacy. International co-operation will be needed to support these efforts. The International Monetary Fund (IMF), World Bank and other international organisations are working with the private and public sectors globally to help countries.

Third, strengthen the governance of global digital financial platforms. The so-called Big Techs are transforming the delivery of services globally including in developing countries. Covid-19 has accelerated this trend as they get more entrenched in everybody's lives. However, developing countries have not been at the table when the governance of these platforms is discussed. One of the taskforce's key initiatives is the Dialogue on Global Digital Finance Governance, that seeks to facilitate a balanced and more inclusive dialogue, particularly involving developing nations, on better aligning Big Tech governance to the Sustainable Development Goals.

DOWN THE ROAD: As we build a digital bridge to the future, we must stay focused on the resultant risks. Cybersecurity, and data privacy and security are the greatest threats to vulnerable citizens using digital services for the first time. We must mitigate these risks and protect their information and their hard-earned money.

The pandemic crisis presents the greatest opportunity to enhance the lives and livelihoods of citizens. Governments, the private sector, international organisations and citizens must take up the challenge of increasing digitalisation and dare to make a difference. The moment is now!

Dr. Patrick Njoroge is the ninth Governor of the Central Bank of Kenya (CBK), and has been in office since June 19, 2015. Ceyla Pazarbasioglu is Director of the Strategy, Policy, and Review Department (SPR) of the IMF.

The article first appeared in IMF Blog