Can we say for certain that recovery of farm credit disbursed by the banking sector of Bangladesh continues to exhibit improving trends? Are the statistics on recovery position consistent in several publications of Bangladesh Bank (BB) and with the findings revealed in Rural Credit Survey 2014 conducted by Bangladesh Bureau of Statistics (BBS)? The central bank frames agricultural and rural credit programme and policy every fiscal year. As per policy, different banks of the country implement disbursement of loans to different types of farmers. Bangladesh Bank's policy and programmes are highly diversified and comprehensive, but the approach to recovery dimension as well as credit disbursement process seems to be still conventional.

Credit recovery is such a critical factor as indicated by borrowing farmers' repayment behaviour and capacity as well as policy maker's concern for financially-handicapped small holders. When loan is repaid and recovery tends to increase, a lending bank gets satisfied. It is observed from agricultural credit statistics that credit recovery position has been gradually improving. But evidentially, a question crops up: how far true are the upward trends? There is no reason for the policy maker, the Bangladesh Bank, to be complacent.

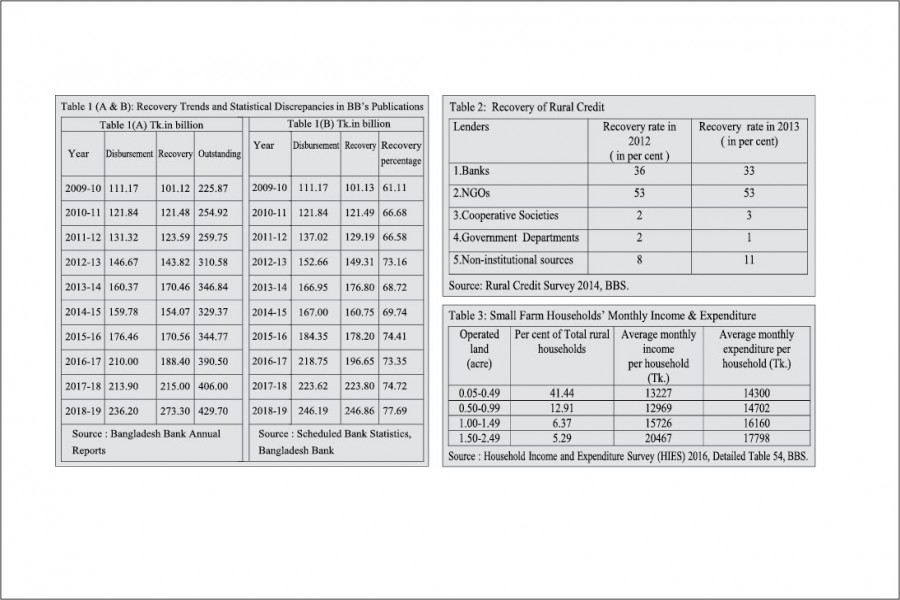

Table 1 (B) shows recovery rate is improving over the last 10 years. Its reliability is questionable if we justify the rate with the help of Table 1 (A).The recovery rate of 77.69 or 78 per cent may be considered as an example for verification. This rate means that 22 per cent of credit disbursed prior to 2018-19 remains outstanding at the end of 2018-19. It is further assumed that current year's disbursement is due to be recovered in the following year as one-year repayment period is allowed for short-term loan which is more than 80 per cent ( the rest is term loan) in total rural credit. Dues for recovery in 2018-19 may be calculated taking roughly 80 per cent (short-term loan) and 4 per cent of previous year's disbursement and the amount stands at Tk.180 billion. Outstanding amount in 2018-19 should equal current year's disbursement plus 16 per cent (Term loan) of previous year's disbursement and the amount stands at Tk.270.42 billion. Actual outstanding amount exceeds by Tk.159.28 billion which is unrecovered and 88.49 per cent is against due for recovery of Tk.180 billion. Thus, the symptom of very poor recovery is perceivable.

Understandably, the central bank's recovery figures are highly inconsistent and vitiated by arbitrariness. It is true that the central bank just compiles the information received from the lending banks. But is it not the responsibility of the Bangladesh Bank to analyse the recovery statistics together with other relevant information for policy-making purposes? Accounting for credit recovery does not appear to be properly done. Banks' published recovery rates are also in contradiction with that as shown in Table 2.

Table 2 demonstrates that banks' recovery rates found from the survey were 36 per cent and 33 per cent in 2012 and 2013 respectively, but the corresponding rates shown by the central bank were around 67 per cent and 73 per cent . Differences lie at the peak and are beyond explanation.

That most of the farmers have no adequate capacity to repay the loan is obvious from Table 3. Operated land with 0.05 acre to 2.49 acres refers to small farmers. The table indicates that 60.72 per cent ( operated land upto less than 1.50 acres) of rural households fall under deficit groups since expenditure is higher than income. One may, however, argue that deficit level is insignificant. The majority of our farmers are mainly paddy growers. Government-set paddy price is taken into account while calculating farmers' crop income. Few farmers get the government-procurement price which is higher than the actual market price. As a result, income of the most of the farmers are overestimated. Besides this, previous debts and unexpected outflows of fund are not considered. It is practically not possible for smallholders to manage required fund for investment from own source or to repay any loan after meeting family expenditure. Against this backdrop, it may be presumed that overall recovery progress is on paper only, not in reality. It is, no doubt, a great dilemma for both farmers and lenders.

The Bangladesh Bank reviews policy and programmes on agricultural and rural credit but carries out no research on its recovery and borrowers' repayment capacity. A field-based research can discover the nature and dynamics of a farm household's income generation, and credit repayment capacity, which may give new inputs regarding the financial condition of small farmers in particular. It is learnt that a lending bank, in practice, realises past dues on credit, and then disburses new loan to farmers. Net credit flow to farm production would dry up significantly.

Research on regular basis is needed to pragmatise credit policy and programmes especially for the resource-poor farmers. The system of agricultural and rural credit recovery accounting, reporting, and analysing should be revamped. Household-level relevant database must be developed in phases. The issue of poor recovery performance needs to be addressed with economic logic. Policy maker's attitude towards recovery of agricultural credit should neither be too lenient nor be too rigid and mechanical. Credit policy should aim to enable a small farm household to generate adequate income by providing the household with supervision-based multi-purpose credit package.

Haradhan Sarker, PhD, is ex-Financial Analyst, Sonali Bank &

retired Professor of Management.