Currently markets along with other equity markets throughout much of the developed world have spent the past eight quarters absorbing the blows of political attacks, scandals and trade barriers and riding the undulating sentiment of investors. The current phase of the market began with the U.S forging an all-out trade war with its largest trading rival, China, in February of 2017 and has since developed throughout various global and national macroeconomic developments: the yield curve inversion in 2019, proposed regulations against US-listed Chinese companies, President Trump's impeachment inquiry and so on. Due to the intensity of market movements and a slew of unprecedented market events occurring within such a short span of two years, most investors have likely focused on the near term, thus adopting a much more cautious, short-sighted view of the markets. Unfortunately, it has become time to break out of the cycle of fixation-yet another likely event looms large on the horizon to change the course of the US and global markets. The 2020 US Presidential election is scheduled to take place in November, a year from now, and it will hold interesting revelations for the markets; it will serve as the stern-bearer for the markets on a new American frontier.

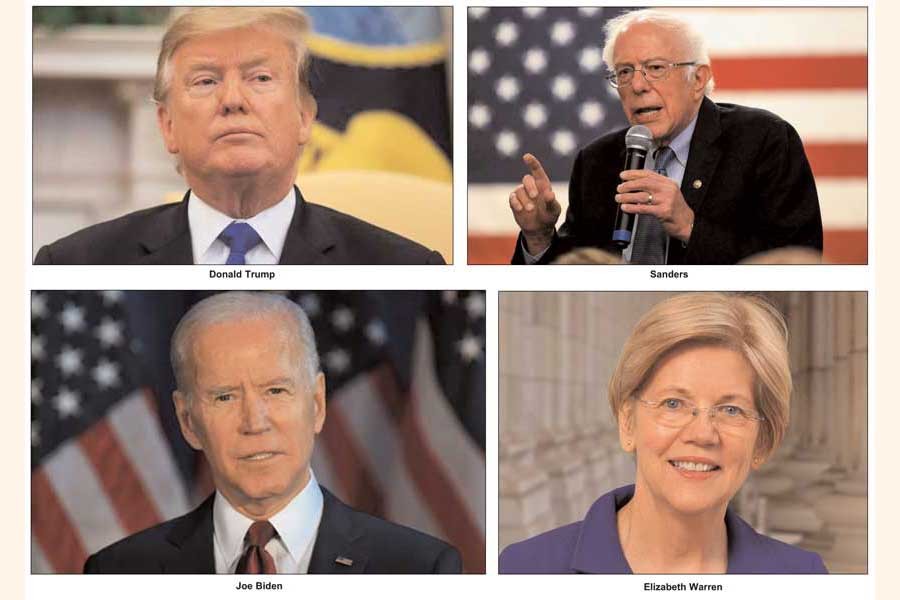

Although there are plenty of candidates at both the Democratic and Republican ends who are aspiring to run for the position of President, in a simplistic sense there are actually four individuals who hold a real chance of becoming the head of currently the most powerful nation in the world: current US President Donald Trump, Joe Biden, Elizabeth Warren and Bernie Sanders. The three democrats (Warren, Biden and Sanders) might belong to the same Party, yet they hold distinct policy proposals with different solutions to major problems of current times. On the other hand, President Donald Trump's economic policy should be crystal clear to most voters and spectators of the U.S elections. President Trump has continued with a similar policy throughout his time as President: boasting an 'America first' policy which concentrates on developing and supercharging the local economy with low-interest fueled debt while tackling the growing trade deficit rift with tariffs and trade quotas. President Trump has always been skeptical of engaging in and growing trade with large trading allies, especially China, and he has made tackling these 'unfair trade practices' the cornerstone of his economic policy; consequently, he has embroiled the US and China in a deeply acrimonious economic war. In spite of multiple attempts to come to a resolution regarding the conflict, the most recent of which was in September, the two decides had failed to reach a consensus that satisfies both of them. Thus, the current trade scenario remains rather grim-the US has placed tariffs on USD 550 bn worth of Chinese goods. In addition, President Trump is now threatening to rid the U.S equity markets of Chinese companies, a move that could wipe out 7% or about USD 1.5 tn from the US equity markets. Unsurprisingly, the President's brash attempts to rid Chinese influence from American Capitalism has led to accentuated volatility within the equity markets; this has led to US equity markets suffering at least 6 corrections in the last two years, losing about 10-20% of its value each time. If one conclusion can be drawn, it is that investors and money managers have become more defensive in their investments and diplomats throughout the world are secretly cursing the US in their sleep.

A continuation of the era of Trumponomics-something more tangible than what most would think-would likely be a continuation of the current economic and financial cycle, with volatility in the equity markets remaining at decade highs complemented with softening local economic data, indicating a deceleration in the overall economic growth of the U.S. However, a much darker economic world views might unfold; a further drawn out tariff war with China, sudden midnight economic manifestos made public on twitter and Presidential scandals will continue to rock and create instability in a slowly debilitating nation. Additionally, the public as well as corporations will be lending unprecedented amounts of money due to record low interest rates. The end product is all but obvious- an overheating of the economy.

On the other end of the spectrum are Elizabeth Warren and Bernie Sanders, two individuals who represent themselves as bringing a completely new view to American politics, a philosophy that is more so a three-parts-to-one melange of communism and capitalism: socialism. Consistent with the current era of populism, both candidates have adopted populist stances on their respective issues, ranging from decreasing defense spending to revamping tax policies and fighting corporate America. Borrowing some populist appeal strategies from the guru himself- President Donald Trump- both Sanders and Warren have introduced visions of a fair, equal America where immigrants and citizens have an equal opportunity to redeem their share of the American growth story. To start their presidential agenda, Sanders and Warren aim to intensify the fight against the 'Big Banks', large merchant and retail banks like Morgan Stanley, Goldman Sachs and Bank of America, which underwent massive structural changes after the 2008 financial recession to stabilize the Ameircan economy. In particular, both candidates want to repeal the Glenn-Steagall Act of 1999, which allowed the Big Banks to pursue both retail banking and merchant banking under the banner of the same company. This consequently centralized the control of the US financial industry in the hands of a few American financial institutions, who have influenced the policies and legislation that have determined the financial landscape of America. Thus, many politicians have come to disapprove the control these private corporations have on the financial infrastructure of America. Due to the large amount of assets managed by these banks and their immense financial capabilities, they can indirectly impact the lending rates and liquidity requirements for banks; this gives them the ability to adjust the playing field to favor their own interests instead of the consumers. A repeal of the Glenn-Steagall Act would divide the Big Banks into separate financial institutions. Large banks like Bank of America would be forced to divide their retail and merchant banking sector into separate companies, thus eliminating the monopoly power held by such banking institutions.

However, both candidates seem to neglect the impact of this repeal on the state of the US equity markets and US dollar. A break up of the large banks would drive a fairly large amount of investor capital in these banks into other assets, many of which could be outside the US. Consequently, the ensuing sell-off in US equity markets could trickle into other highly sentimental industries, like technology. A large sell-off in the US markets is very likely to diminish investor interest in the US as a whole, which could lead to a softening of the US dollar. Ultimately, if America wishes to maintain the economic throne it has held for so long, repealing the Glenn-Steagall Act should not be done. While it is high time to regulate the US financial industry, restructuring the large banks is an audacious move that will only bolster the hatred Wall Street holds for federal regulations

Sanders and Warren have also vouched to lead the modern anti-trust campaign against US multinationals. The top of their agenda consists of breaking companies like Amazon and Facebook to eliminate the monopoly power these corporations hold over key American markets. The two address very timely concerns regarding big US tech firms outcompeting -their smaller rivals and hence eliminating competition in their respective industries; it is truly something that is denying the competitive nature of free markets and helping establish an oligarchy of sorts. In addition, the two aim to dismantle the large agribusiness firms in the US, such as National Beef and Tyson foods, which currently hold the majority control of their respective business. In fact, only four agribusiness firms in the US manage and control 85% of the agricultural products that are sold in U.S. markets. Yet again, addressing the problem of monopolies in America is not an easy one as it will require new, modernized legislation that will replace the anti-trust eras of a bygone economic era. The two acts designated to prevent large US firms from establishing monopolies in their respective industries are the Clayton Act and the Sherman Act, which are roughly 100 and 130 years old respectively. Monopolies during the early 20th century were vastly different; they were obviously designed to eliminate the competition within the industry, but they were designed to hike the prices of goods unfairly, at a significant disadvantage to consumers. Thus, corporations would be able to maintain their sales even while ramping the price of their products exorbitantly. Yet, in the modern age, companies like Amazon, Facebook and Google fight the competition within their own fields by engaging in fierce pricing battles; thus, companies with the lowest price products maintain the majority control over the market.

Ultimately, many US conglomerates are not exploiting consumers-rather they are providing unprecedented, price-efficient amenities. If we take the example of Google, we see that the company is providing services like Google Docs, Google Drive and Youtube, really technologically advanced cloud-based applications, at no cost to the consumers; they may be dominating the competition in the advertisement industry, but they are not forcing consumers to buy grossly overpriced products because Google is controlling the majority share in the industry. Thus, breaking the big American firms may come at a consequence-consumer benefits. Consumers may lose the benefits they have enjoyed for a long time and instead they could just have a larger number of choices in front of them. As a result, breaking large tech firms will not benefit the consumer, but it will only open the playing field for more small businesses that are looking to expand their consumer base.

With a resumé that is unmatched to all other candidates, Joe Biden is a definite favourite for the 2020 US Presidential election, and he has aligned his policy to combat many of the pressing issues in America-large corporates, anti-trust, healthcare and the lot- but a general fear circulates among Americans that Biden will replicate Obama's model for presidency, that his presidency will only strengthen and continue Obama era policies. And Americans may be speaking the truth this time. While President Obama was a Democrat, he didn't align his views and policies with the far left, instead pursuing reform through gradual measures. While most Americans had expected Obama's administration to tackle certain issues such as taxes and predatory corporates, his tacit approach to managing these problems didn't allow him to accomplish giant strides in these regards. Joe Biden's policy is similar-a goldilocks policy of being not too submissive and not too aggressive. Biden has aligned himself with the 'modern American dream' of boosting American industries, increasing job creation in the economy to maintain current levels of unemployment and tackling large American corporations that are threatening local American businesses and industries. His policy will strip American corporates of the tax benefits they currently enjoy, increasing corporate tax levels to pre-2017 levels, and he assumes a rather stoic stance on anti-trust by stating his administration would conduct further investigations into large American corporates. However, Biden doesn't outline specific plans as a way of combating large American corporate behemoths, but he instead revolves his policies on the Clayton Act, Sherman and Packer and Sockyards Act, all policies that are around 100 years old. This approach of tackling modern issues by applying acts from bygone eras may not necessarily damage the American economy, but it will accomplish little other than maintaining the current status quo. While Biden might force US trade agencies to conduct more deeper analyses into the practices of American corporates, these agencies will be analysing these corporates on rubrics that are a century old, which don't address modern problems with global trade.

As for the current global trade scenario, Biden doesn't wish to weaponize tariffs and utilize tariffs as a way of coercing nations into accepting trade deals that are one-sided and favor America. Yet in contrast, Biden has endorsed American first principles; he advocates generating American jobs and developing American industries, and skillfully represents himself as a stern supporter for American economic independence. Biden claims the US doesn't need to shift its focus to China, and that supporting and financing American industries will tackle international trade problems by itself- he neglects China's dominance in the market. While bolstering local industries will definitely benefit the local economy, the American and Chinese economies are intertwined; Biden's policies have neglected America's economic war with China and have disregarded China as a global superpower. If there is one thing Biden must do, it is to acknowledge China's dominance in trade at the world stage-and adapt his foreing policies with that in mind.

As for other aspects, Biden distances himself a little from the other two candidates. For healthcare, Biden proposes extending and adjusting Obamacare (the Affordable Care Act) to insure more Americans while reducing prescription costs. As for education, the candidate proposed free college tuition for 2 years at public colleges and universities across the US; he also proposed increasing teacher pay. Lastly, similar to President Trump's current policy, Biden has proposed to increase military spending and deploy more troops in Syria and the Middle East to quell terrorist organizations.

The US economy is hovering around uncertainty for the time-being, and although the numbers and metrics may represent the American economy as a prospering one, cracks are already starting to develop. US GDP growth has started to slow, and the Federal Reserve Bank in response has lowered lending rates three times in four months-this indicates flaws and cracks in the economy. So while corporate America might be posting record high profits, and while the American economy might be generating more jobs than expected, the trade and aggressive economic policies of the current administration have already set the wheels in motion for an economic crisis. In order to avoid another economic meltdown, America should elect leaders who accurately comprehend the economic scenario and are willing to negotiate compromises and concede certain national objectives in order to protect the national and global economy.