By definition, capital market is a vast term. It includes stocks, bonds, derivatives and others. But unfortunately, the capital market activities in Bangladesh are almost limited to banks, merchant banks, stock brokerages, asset management companies and so on.

But when it comes to the bond market, it is under-developed. There are eight debentures in the market. But apart from the Govt. T-bonds, according to the Dhaka Stock Exchange (DSE) statistics, there are only two corporate bonds and all belong to the A-category. So, it is clear that the bond market is simply under-developed here.

In 2010-11 commercial banks invested in the stock market beyond the limit and resultantly the market crashed. This over-exposure of banks to long-term loans and the subsequent market crash left them with inadequate funds to meet the people's primary need for commercial loans as working capital and import credit. Some of the banks lent long-term and substandard large loans against profit margins. Later they could not recover the money and finally they were in deep trouble. As a result, they could not lend large and long-term loans despite being important stakeholders in the money market. If the bond market was developed enough, they could take recourse to it to tide over the situation.

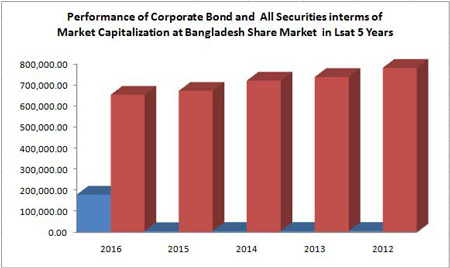

The capital market in Bangladesh is dominated by securities or stocks as is seen in the Bar-chart 1. We see the share of corporate bonds is very small, only two compared to eight debentures and 221 govt. treasury bonds in the market. They account for 560 while corporate bonds, debentures and govt. treasury bonds altogether account for only 229 in the current market. The statistics show clearly that the capital market in Bangladesh is fully equity-based.

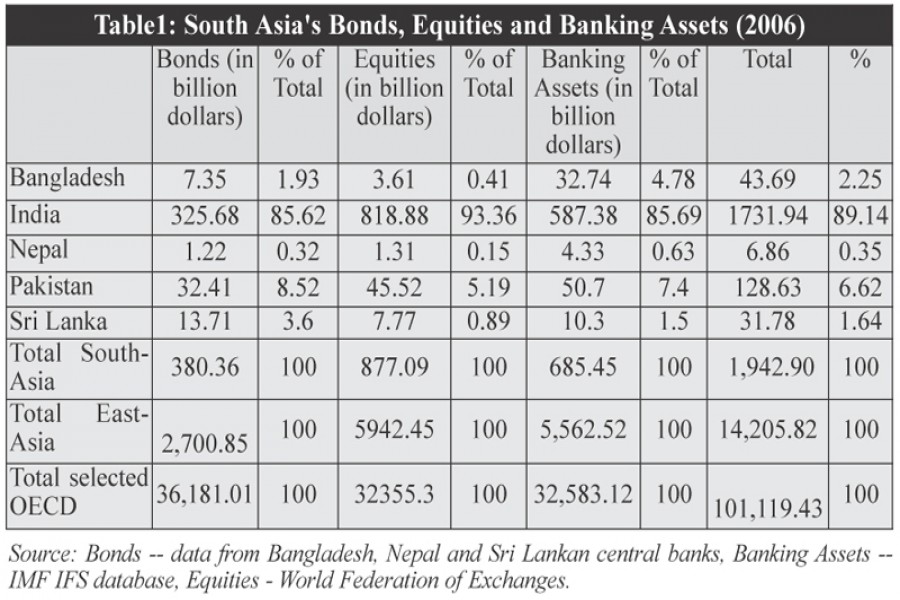

If we look at other South Asian markets, we see our capital market is lagging far behind them (See Table1).

According to the Bangladesh Securities and Exchange Commission report for 2011-2012, there were debentures worth Tk 140 million of eight companies listed with the two stock exchanges of the country. In order to increase the depth of the market, trading in the government treasury bonds was introduced on the two local stock exchanges with effect from January 2005. But there was no transaction in the bond market even in the fiscal year (FY) 2010-2011.

Figure 1: Portion of long-term debt instrument

Figure 2: Performance in terms of market capitalisation

Figure 3: Corporate Bonds' performance in terms of Turnover

The Figure 2 shows the corporate bonds' performance in terms of market capitalisation. As is seen, the securities dominated the market cap in the last five years. As of December, 2016, 221 government treasury bonds, two corporate bonds and eight debentures were listed with the DSE. But bonds are not yet popular. The Banking and Financial Institutions Division of the Ministry of Finance, the Bangladesh Bank, the Bangladesh Securities and Exchange Commission and the National Board of Revenue are working together to establish a strong bond market.

But the Figure 3 clearly indicates that the turnover of corporate bonds compared to equities is very poor. For instance, the percentage of the financial sector's total turnover including mutual funds was 18.56 per cent in 2016 with the corporate bonds contributing only 0.01 per cent.

In our financial system the Bangladesh Bank sells the treasury bills and bonds to protect any short-term cash crunch of the government. The maturity period for such treasury bills are 28 days, 91 days, 182 days and 364 days. On the other hand, treasury bonds help tackle the budget deficit and ensure long-term financing. Maturity periods for treasury bonds are five years, 10 years, 15 years and 20 years. In this case the Bangladesh Bank is authorised to hold auction for treasury bonds. There is an auction committee that can determine the bond interest rate during the bond cycle. Any primary and secondary market investors can buy this type of bonds through any bank that must pay the interest at the set rate after every six weeks.

Now the question is how to transact in bonds in the primary and secondary markets. Investors lack knowledge about how to sell bonds in the capital market, because there is a difference between equity selling and bond selling. Another factor is that calculating the bond price is not an easy task. The bond involves the coupon payment as well as the principal amount.

There is a blame game between the Bangladesh Bank and the primary dealers. The BB partly blames the financial institutions serving as primary dealers (PDs) for the under-performing bond market. But the PDs blame the existing government fiscal policies, which are not conducive to the growth of this particular type of market. Rather, they are discouraging the investors. The PDs say the high savings rate and the low interest rate on government securities are the main obstacles to growth of the bond market. This has aggravated due to inefficiency and poor participation in online trading.

To develop a vibrant and dynamic capital market there is no other option but to promote the bond market. For this purpose the government appointed 15 primary dealers (PDs), mostly leading banks and financial institutions. Unfortunately, due to lack of adequate policy support and other problems, PDs are yet to play their due role, though the journey began in 2008. According to Bangladesh Bank officials, PDs are not considering the bond market as another window of earnings, even though some bonds offer lucrative returns -- 10.5-12.88 per cent -- for terms ranging from five to 20 years. They have so far taken little initiatives to lure investors into bond trading. Sometimes even PDs show unwillingness to put government bonds on offer for sales in the secondary market. Rather, they hold bonds to meet their reserve requirements.

An efficient bond market is important for managing public debts and bank liquidity and for efficient conduct of the monetary policy. A vibrant domestic bond market can reduce the country's dependence on short-term foreign currency borrowings and also help the country accelerate its economic activities. One of the problems in Asian countries is that they are too much dependent on short-term foreign currency borrowing which is dangerous.

The bond market in Bangladesh is characterised by its low-base, non-diversified products, lack of tailor-made securities etc. The government should encourage state-owned enterprises (SOEs) to raise funds by issuing corporate bonds from the market. It should stop providing financial assistance to the SOEs.

It is surprising to note that Bangladesh, which is much larger than Nepal in terms of population, land area and other parameters, has the smallest bond market in the region.

The Bangladesh Foreign Exchange Dealers Association (BAFEDA), the common platform of all banks involved in foreign exchange transactions, has already introduced the Dhaka Interbank Offer Rate (DIBOR), a benchmark necessary for a bond market. On December 18, 2012, the central bank introduced an online trading platform to buy and sell government securities, including treasury bills and bonds with support from the World Bank.

In 2014 the government planned to float $ 2.0 billion sovereign bonds to collect funds from the international market for building infrastructure like the Padma Bridge. The US-based investment bank Goldman Sachs and German Deutsche Bank AG offered to help the government of Bangladesh raise up to $ 3.0 billion from the international bond market by issuing sovereign bonds for the nation's different infrastructure projects.

On August 18, 2014 the government issued a circular announcing an amendment to the Bangladesh Government Islami Investment Bond Rules-2004 to widen the borrowing opportunity for financing large projects, including the Padma Bridge. In line with the revised rules, the Bangladesh Bank issued a circular asking all scheduled banks and non-banking financial institutions to take necessary measures to that end. Accordingly, the Islami bond titled Bangladesh Government Investment Bond will be traded under Shariah rules and regulations. Shariah-based banks, financial institutions or any other organisation, any individual and non-resident Bangladeshi will be able to buy the bond. The redemption periods have been fixed at three and six months. Each bond will be worth at least Tk 100,000. This Islamic Investment Bond will be auctioned and there will be a profit-sharing ratio instead of interest. Shariah rules do not permit payment or receipt of any interest by any individual or institution. Investment by banks and financial institutions in Islami bonds will be considered as fulfillment of their statutory liquidity requirement (SLR). Hopefully those initiatives will help revamp the bond market to a great extent. A stable, well-functioning bond market is an important part of the financial market structure.

Another interesting and important point is it is easy to interlink the economy through a strong bond market. A lot of factors are there in the macro-economy, including GDP (gross domestic product) growth rate, exchange rate, inflation, government budget deficit and the trend of private sector credit disbursement. Unless those factors are effectively addressed, a strong bond market cannot be developed. There is three-pronged relation involving the bond market, stock market and macro-economy.

Md. Toufique Hossain is a stock market analyst and financial market columnist now serving as a Faculty at the Royal University of Dhaka. He authored "Bangladesh Share Market: Looking ahead after two big crashes".