The small and medium enterprise (SME) loan means financing provided by financial institutions in small and medium industries. Financial institutions provide loans to small and medium industries for arrangement of working capital, business expansion and capital machinery procurement. In order to take forward the SME sector in Bangladesh and implement SME loan management and special initiatives in this sector, Bangladesh Bank introduced a new division named SME and Special Programme Division on 31-12-2009. The SME and Special Programme Division has taken a number of schemes, programmes and policy initiatives for the development and expansion of small and medium enterprises.

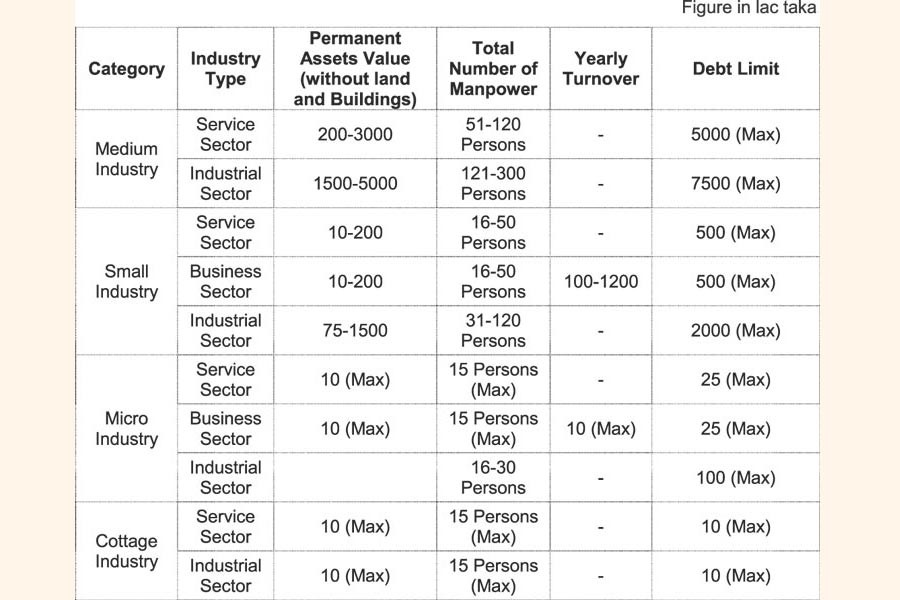

In the light of the SME and Special Programme Division Industrial Policy-2010, on June 19, 2011, the inclusion of SMEs for bank/non-bank financial institutions is given below:

Bangladesh Bank and SME Foundation have taken a number of schemes and programmes to ensure facilities including funding for the development and expansion of SME institutions. Various commercial banks and financial institutions are coming forward to fund SME institutions. It has been playing a significant role in raising economic growth, employment generation, creating new business sectors, reducing poverty, reducing rich-poor divide and regional discrimination, ensuring equality of women and empowering them.

The importance of small and medium industries in the development of a developing country like Bangladesh is immense. Currently, most industries in the country are covered by the SME sector. In addition, to achieve the ability to produce import substitute products, its role is also increasing rapidly.

Bank Asia SME has already taken a number of schemes and programmes to create entrepreneurs and enhance the skills of entrepreneurs. Currently, the bank is in agreement with the Bangladesh Bank, the SME Foundation, the IDA and the ADB in relation to the repatriation fund for the development of Asian SME sector. Apart from this, various steps have been taken for the purpose of providing loan on easy terms, setting up Agent Banking, SME /Agriculture Branches, introduction of UFFPs, introduction of special facilities for women entrepreneurs and introduction of special facilities for women entrepreneurs.

For example, the Bank Asia has taken measures for SME entrepreneur creation, skill development and development of entrepreneurs. The measures are as follows:

* In each branch of Bank Asia, a separate SME help desk and women entrepreneurs are employed to provide special benefits.

* SME/Agriculture Branch has been established for expansion of SME business.

* Special loans for women entrepreneurs in small and medium industries have been introduced. A women account system has been started where women are getting the loan facility on easy terms.

* Bank Asia is committed to promote sustainable and competitive facilities through innovative development, technological advancement and expansion, enhancing the efficiency of entrepreneurs and marketing the products across the country under the Cluster Development Policy.Under this programme, loans for electric and electronic, cooling, weaving industries, jamdani sarees, bamboo and bin, ready-made garments, potteries etc. were given to the cluster.

* Banks are giving loans through the complete uprising system as the first financial institution in Bangladesh to provide fast funding to Asian SME sector. In this process, loans to more than 4,000 small entrepreneurs have been added which adds a new dimension to banking services.

* Employment opportunities for two thousand and more than five hundred educated youth have been created in the rural areas through Agent banking activities. Apart from this, it has been possible to provide banking services to the marginalized people through Agent Banking Channel, which has been instrumental in achieving the growth of the rural economy.

* With the aim of expanding the small and medium industries, the Bank has taken measures to showcase the products of the customers in the fair of Asia, which is an important role in the product marketing of customers.

* To promote the business management of cottage, micro and small entrepreneurs, the bank is generating income from the Asia-based entrepreneurship development wing.

The role of small and medium industries in the overall economic development of developing countries like Bangladesh is undeniable. Because of the shortage of labour and production time is short, it is able to contribute rapidly to increase national income and create jobs. The elimination of extreme poverty and the role of women in this field can play a pivotal role in equality and empowerment of women. SME sector is playing an important role in the economic development of many prosperous countries of Asia. Our neighboring countries are also focusing heavily on SMEs. The SME is the employment generating machine that can be a tool to achieve economic growth, reduce income discrimination, and reduce poverty. In our country, SME funding is expanding in various industrial factories and business commerce. Presently, the contribution of 25 per cent is made by the SME sector to the GDP of the country. Since the employment of a large number of people is being created for managing the organisation, it is certainly possible to eliminate unemployment by giving loans in this sector.

SME loan constraints:

* Lack of customer's business

related account.

* The inability to bear the risk

of the business of the customer

* Absence of business

succession.

* Long term lending sanction.

* Lack of adequate security.

* Non-cooperation and timekeeping

of the authorities to provide

necessary documents for

conducting business.

* Lack of business related training.

Solution:

lMake the entrepreneurs

aware of

saving the business contracts

properly.

* Increase the competitiveness of the entrepreneurs and ensure sustainable development.

* Reduce the risk of the business, start the insurance system.

* Succeeding a single service center where entrepreneurs get different approvals.

* Support the development of the working environment of small and medium industries.

* Providing information services related to marketing SME products in local and international markets.

* Support of SME entrepreneurs for mutual relations development and assistance in building bridges and establishing interconnection between SME entrepreneurs and consumers.

* Encouraging the banks through introduction of Credit Guarantee Scheme facility.

If there is any right after the five basic rights of the people that is the right to get banking services. There are a lot of financial institutions to entrepreneurs who have overcome through their hard work and efforts numerous obstacles from the marginal stage. Entrepreneurs of this stage cannot meet the requirement of their business by taking loans from moneylenders and NGOs. Besides, due to shortage of accumulated deposits and long concurrence of the loan process, financial institutions are deprived of necessary banking services.

The following measures should be taken:

* Develop a digital platform to increase the scope of business of entrepreneurs based on entrepreneurs from which the buyer can easily contact each other.

* The establishment of a Region Based Dairy Museum (Chilaar Plant) with the help of the Social Development Local and Foreign Assistance Organization, which will guarantee the collection and sale of small entrepreneurs' products in the dairy production industry.

* In order to increase the sales of entrepreneurs' products through internet, e-commerce system has been established to provide customers with such an organization.

* Under the Credit Guarantee Scheme, funding of entrepreneurs by local and foreign aid organizations.

Above all, financial lending institutions will come forward to create new entrepreneurs and will provide necessary suggestions for their business or industry's success and supervise the post-lending debate. In this regard, all concerned, such as government, private, semi-government, autonomous and related licensing organisations, all financial lending institutions, have to adopt liberal policies.

All concerned must understand that SMEs' development is the biggest means of development and employment of the country. SMEs will create self-employment and employment opportunities for others. It should be kept in mind that those big businessmen or industrialists of today were also small once. Today, the small businessmen or industrialists have built a large number of industrial empires through hard work and persuasion.

The writer is Deputy Managing Director - Small, Medium and Retail Banking at Bank Asia Limited, Corporate Office, Dhaka.