The outbreak of Covid-19 forced the world to witness serious economic emergencies, social constraints, financial crisis, and loss of lives. The wave of coronavirus creates a threat to the global and domestic economic and financial stability worldwide. Developing and emerging economies worldwide are turning quickly to the right path after the devastation done by the crisis. The cumulative death of the countries reaches 3.3 million, and the global economy faced a loss of around $400 billion. This pandemic showed vulnerability in the health care system and has caused irreversible destruction to the psychological health of all economic actors and sectors. Almost all the world countries were forced to order lockdown to contain the spread of this pandemic and enforced social distancing. All these measures converted into a severe challenge to the middle- and low-income people. The standard market system collapsed, and economic equilibrium changed.

In Bangladesh, the first case of Covid-19 was detected on March 8, 2020. After the first detection, the number of infections increased every day. The government initiated a lockdown of the country to counter the disease. Most of the cases were concentrated in the big cities like Dhaka, Chattogram, etc. the economic growth of Bangladesh was experiencing robust growth throughout the last decade. The financial systems of Bangladesh were impacted as the majority of the people were forced to stay home during the lockdown. A lot of people who lost their jobs are still unemployed at this time. The government and the country's central bank immediately responded to contain the crisis and declared several financial and fiscal stimulus packages. All these things were very much helpful to keep the economy vibrant and maintain financial stability. In 2021, during the second wave as well, Bangladesh Bank incorporated various targets that will help both Govt. and Non-govt. sectors. Industries like agriculture, Pharmaceuticals, Industries, and food producing organizations continued their operation and supported the country even during the pandemic and therefore needs maximum support from the authority. Realizing this, the central bank in its' latest monetary policy has set a target for disbursing BDT.176,000 Cr to the Non-government sector as loan.

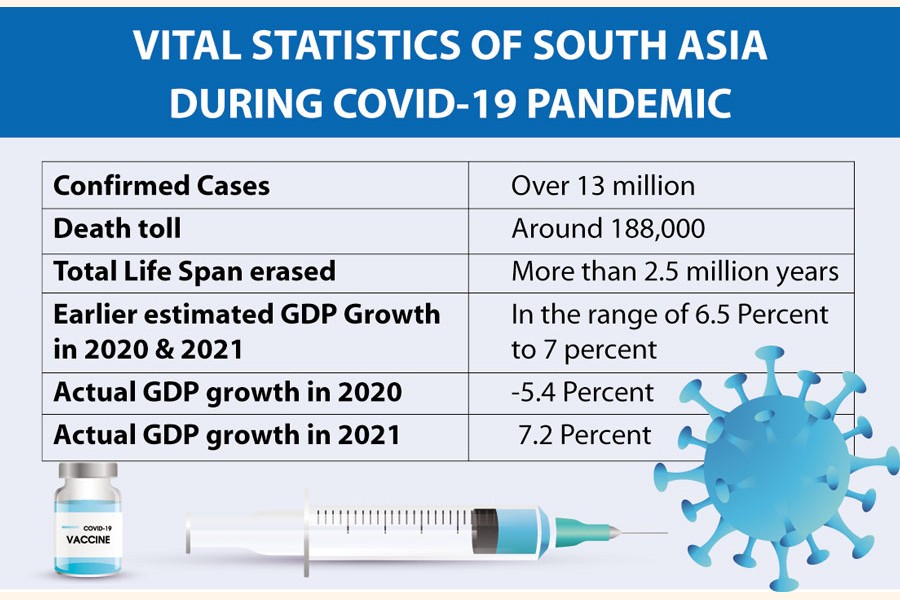

Here we discuss about the economy of Bangladesh and how the country has been affected by this Covid-19 pandemic and how it is faring currently as per information provided in 'South Asia Economic Focus', Spring 2021 which is published by the World Bank Group.

Currently the fastest growing economy in South Asia, Bangladesh made rapid progress in development over the past two decades, reaching lower-middle-income country status in 2015. Rapid GDP growth was supported by a demographic dividend, sound macroeconomic policies, and acceleration in readymade garment (RMG) exports. Meanwhile, job creation and growing remittance inflows contributed to a sharp decline in poverty. The COVID-19 pandemic impacted the economy profoundly. A national shutdown from March to May 2020 resulted in severe supply-side disruptions in all sectors of the economy. On the demand side, losses in employment income dampened consumption growth, although remittance inflows provided some buffer. The government's COVID-19 stimulus program provided firms with access to working capital and low-cost loans to sustain operations and maintain employee wages in FY20 and FY21. From June 2020 onward, movement restrictions have been progressively lifted, and transit and workplace movement patterns returned to pre-pandemic levels by October. Officially recorded infections peaked in July 2020 and declined gradually in subsequent months only to peak again in July 2021.

After a substantial deceleration in growth in FY20, early signs of recovery emerged in the first half of FY21 (July to December 2020). Following a 16.8 percent decline (y-o-y) in FY20, exports rebounded in the first half of FY21 as RMG export orders were reinstated. On the demand side, growth was primarily supported by private consumption, underpinned by a recovery in labor income and remittance inflows. However, a contraction in capital goods imports (-19.1 per cent, y-o-y) suggests that private investment has not yet normalized. Inflation decelerated from 5.6 per cent in FY20 to 5.3 percent by December 2020, as food and non-food prices moderated. Keeping this inflation rate in mind, to protect the interest of the general public Bangladesh Bank has also set a minimum deposit rate which cannot fall below the inflation rate. Current Monetary policy is accommodative and expansionary in its stance. However, growing risk aversion among commercial banks, a cap on lending rates, and rising non-performing loans limited the transmission to lending rates. Private sector credit growth continued to decline, falling from a high of 13.3 per cent (y-o-y) in December 2018 to just 8.4 per cent (y-o-y) by June 2021. That's why special emphasis has been given to this sector in the latest monetary policy.

Estimated poverty rose sharply in FY20 amidst substantial job and income losses. However, household surveys point to a gradual recovery in employment and earnings and a decline in poverty in the first half of FY21. Food security improved across the country, with the greatest increase in Chittagong.

The economy is expected to continue to recover gradually. Given the significant uncertainty pertaining to both epidemiological and policy developments, real GDP growth for FY21 could range from 2.6 to 5.6 per cent depending on the pace of the ongoing vaccination campaign, whether new restrictions to mobility are required and how quickly the world economy recovers. Over the medium term, growth is projected to stabilize within a 5 to 7 per cent range as exports and consumption continue to recover, and investment rises, led by externally financed public infrastructure investments under the recently adopted 8th Five-Year Plan. The recent surge in official remittance inflows is unlikely to persist if (i) the net outflow of migrant workers slows in FY21 (as visa issuance in the Middle East declined during the pandemic) and (ii) the reliance on formal payment channels subside (as normal travel resumes). If weakness in revenue collections persist, the fiscal deficit is projected to remain at 6.0 percent of GDP in FY21, moderating over the medium term with tax reforms and expenditure prioritization. Sustaining the economic recovery and further reducing poverty will depend on the implementation of the government's COVID-19 response program, including credit programs in the banking sector.

Bangladesh has a special opportunity to use agriculture in overcoming the upcoming challenges in the post-Covid-19 era. Almost 87 per cent of the rural population get at least some income from agriculture. The government, realizing the potential of agriculture, has included it in the stimulus package. Our Prime Minister has already declared to cultivate every pieces of unutilized land for ensuring food security in the future.

We can certainly use these agricultural products along with others to counter the demand in the upcoming years which are bound to be challenging. According to the World Bank, Bangladesh has great potential to raise agriculture-generated incomes, increase agricultural productivity and make it more resilient to climate change and improve the nutritional value of crops. We need to take this into consideration. Along with all these, a strong supply chain will be of utmost importance so that the product can reach the final consumer whether at home or abroad. In this way, Bangladesh will be well-placed to fight the economic woes in the years to come.

The writer is Chief Financial Officer, Mercantile Bank Limited,

E-mail- [email protected]