The importance of investment in economic growth is well acknowledged both in theory and empirical literature. No country has been able to accelerate economic growth without significantly increasing the investment-GDP ratio. However, there are disagreements among economists and policy-makers about the composition of investment, i.e. the share of private and public investment in total investment. Two views dominate in this regard. One view argues that public investment has a crowding out effect on private investment. That means, with the rise in the public investment the private investment may fall. In contrast, the other view argues that public investment can be complementary to private investment. Thus, the rise in the public investment can be conducive to the rise in private investment. The inconclusive nature of the results of the empirical literature is, however, also driven by the differences in the methodology used in these studies in different country contexts.

The data on public investment share in GDP is available for 91 countries. Figure 1 presents the average percentage share of public investment in GDP for those 91 countries for the years during 2013-2017. With a share of 20.77 per cent, Republic of Congo is at the top of this list, while with a share of 0.98 per cent, Sudan is at the bottom of the list. The top ten countries with the high shares include Republic of Congo, Iraq, Rwanda, Equatorial Guinea, Venezuela, Ethiopia, Timor-Leste, Djibouti, Burkina Faso and Mozambique. In contrast, the bottom 10 countries include Sudan, Yemen, Lebanon, Guatemala, Russia, El Salvador, Armenia, Serbia, Philippines and Croatia. Among the five South Asian countries, Bhutan has the highest share (10.86 per cent), followed by Bangladesh (6.82 per cent), Nepal (5.78 per cent), Pakistan (3.74 per cent), and India (per c ent).

While looking at the pattern of the cross-country differences of the share of public investment in GDP and GDP growth rate, as plotted in Figure 1, it appears that in the recent years (2013-2017), 19 countries exhibit shares of public investment in GDP at 5 per cent or more as well as GDP growth rate of 5 per cent or more. Among these countries, 10 are from sub-Saharan Africa, two from Latin America, two from South Asia (Bangladesh and Bhutan), and two from Southeast Asia (Malaysia and Myanmar). If we consider the 6 per cent GDP growth rate as the cut-off mark with public investment share in GDP at 5 per cent or more, there are only eight countries (Rwanda, Ethiopia, Djibouti, Lao PDR, Myanmar, Guinea, Bangladesh and Cote d'Ivoire). This suggests that the association between public investment share in GDP and GDP growth rate is not straightforward.

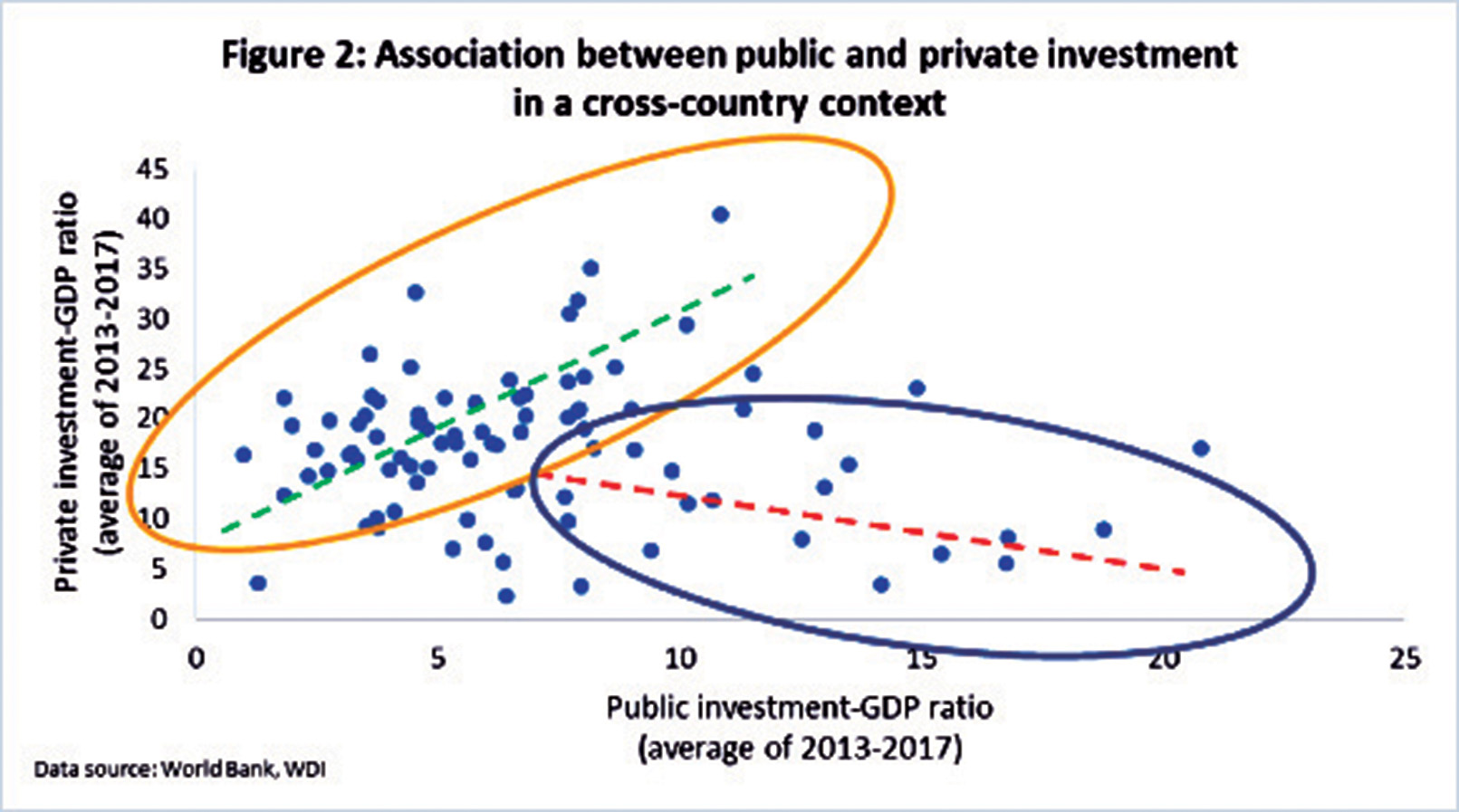

Furthermore, the scatter-plot between the ratios of public investment to GDP and private investment to GDP (Figure 2) suggests that there are two different trends as far as the association between the public and private investments in a cross-country context is concerned. For the countries with public investment to GDP ratio of less than 7 per cent, there seems to be a positive association between the ratios of public investment to GDP and private investment to GDP. However, for countries with excessive public investment to GDP ratio (more than 7 per cent), there seems to be a negative association between public and private investment.

The aforementioned analysis underscores the need for a discussion on some critical factors which are important to make public investment conducive for private investment. While it is true that public investment is the main channel for the formation of public capital stock, an adequate level of public capital can have a positive impact on economic growth depending on the capacity and nature of public capital to attract or crowd-in private capital. The crowd-in effect can only occur when public investment furnaces such a public capital stock that increases the rate of return of private capital.

One of the critical channels through which public investment may play a role in increasing the rate of return of private capital is infrastructure development. The importance of infrastructure originates from the fact that it provides key intermediate consumption items in the production process for almost all activities in the economy. Therefore, an adequate supply of infrastructure through public investment has the potential to crowd-in private investment. However, when it comes to infrastructure development through public investment, there are two important issues which need to be in order to ensure the crowd-in effect of private investment.

First, not only the quantity, but also the quality of the infrastructure is equally important. In many developing countries, due to institutional deficiencies, infrastructure projects suffer from huge cost and time over-run, which can discourage private investment. The high cost of infrastructure projects and uncertainty in the timely delivery of such projects may reduce the rate of return of private investment.

Second, while several supply-side constraints related to weak infrastructure can restrict potential private investments in new and emerging sectors, some of these constraints are broadly 'general' in nature and some are critically 'sector-specific'. Interconnection and complementarities between general and sector-specific infrastructures are key elements for increasing service efficiency, supporting the adoption of innovative technologies, and the promotion of private investment in those sectors. However, there is a tendency in the developing countries to excessively emphasise on the broad general infrastructure, i.e., enhanced supply of electricity, improvement in roads, improvement in port facilities etc. that causes the development of critical sector-specific infrastructure largely overlooked. Embarking on developing broad general infrastructure are relatively easy, whereas solving sector-specific infrastructure problems involves identifying priorities in the policy-making process and addressing a number of political economic issues. However, failure to deal with sector-specific infrastructure problems leads to a scenario where a large number of potential growth-enhancing sectors may fail to enjoy the benefit from the improvement in broad general infrastructure. This can discourage private investment.

Dr. Selim Raihan is Professor, Department of Economics, University of Dhaka, Bangladesh, and Executive Director, South Asian Network on Economic Modeling (SANEM). [email protected]