The outbreak of Covid-19 has been declared as a global pandemic on March 11, 2020 by the World Health Organisation (WHO). The outbreak of Covid-19 has shaken the global financial markets. Level 1 market-wide circuit-breakers based on drops of 7 per cent from the previous close were triggered four times on 9, 12, 16 and 18 March 2020 in the US stock market to prevent larger crashes (World Economic Forum, 2020). This mechanism has been triggered only once in 1997 since its implementation in 1988. Dow Jones Industrial Average (DJIA) and S&P500 indices dropped by 33per cent and 29 per cent, respectively on March 20, 2020 from December 31, 2019, when the first confirmed case is reported by the World Health Organisation (World Economic Forum, 2020). Also, March 16 (12.93per cent drop) and March 12 (9.99per cent drop) were recorded third and sixth largest daily drops, respectively in DJIA (World Economic Forum, 2020). FTSE100, the UK main index suffered the worst quarter since 1987, recording a drop of 24.80per cent (The Guardian, 2020). Japan experienced more than 20 per cent drop from December 2019 high (Bloomberg, 2020).

Following such a huge worldwide impact, studies on the economic effects of Covid-19 have started to grow rapidly. This report highlights the effects of Covid-19 on financial firms (e.g., banks) compared to nonfinancial firms, financial contagion originated by them, and its implications on the portfolio design. This report covers both pre-Covid-19 period (January 1, 2013- December 30, 2019) and Covid-19 period (December 31, 2019-March 20, 2020). The report takes the starting date of Covid-19 period as December 31, 2019, the date when the first case of Covid-19 was reported to the World Health Organisation (WHO) by China. On the other hand, the report chooses the first date of pre-Covid-19 period as January 1, 2013, to not overlap with the global financial crisis (2007-2009) and European sovereign debt crisis (2010-2012). To investigate the financial contagion due to Covid-19 outbreak, the report focused on China and G7 countries for several reasons. First, China is a source of Covid-19. Second, China and G7 countries are among the most affected countries as they account for 68.19 per cent of total confirmed cases as of 20 March 2020. Third, China and G7 countries account for 61.11per cent of global GDP as of 2018 (World Bank, 2020).

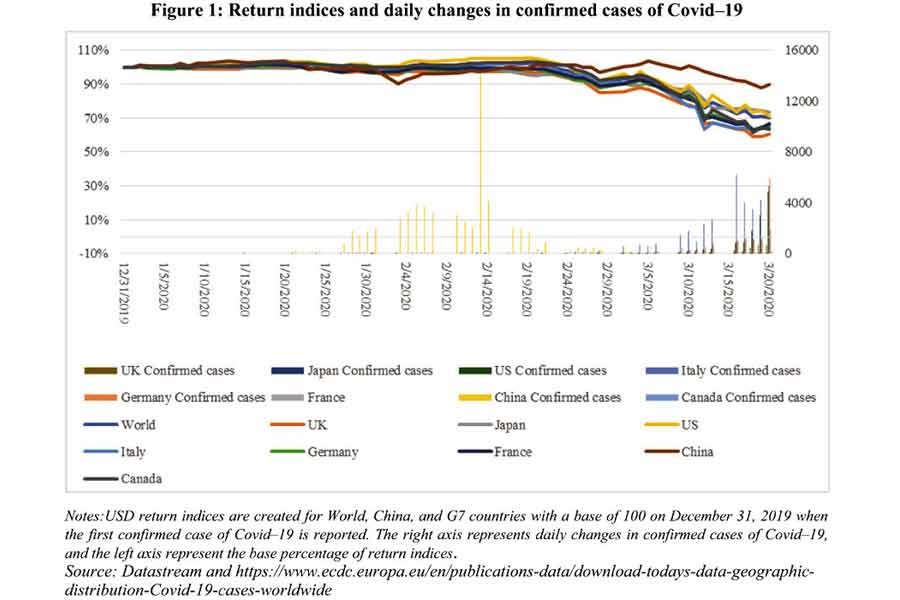

Italian financial firms experienced the highest negative return during Covid-19 period, while the UK had the highest negative return for its nonfinancial firms during the same period. Negative returns are associated with the number of confirmed cases in China and G7 countries (see Figure 1). The UK market return dropped by 40 per cent during the period (December 31, 2019-March 20, 2020). Similarly, market indices in other G7 countries experienced a significant drop during the Covid-19 period (see Figure 1). The volatility of financial and nonfinancial stock returns is higher during Covid-19 period compared to those during the pre-Covid-19 period. Correlations between Chinese and G7 (or world) financial and nonfinancial stock returns appear to be much higher during the Covid-19 period as compared to those during the pre-Covid-19 period, indicating the occurrence of financial contagion.

The report shows that China and Japan appear to be net transmitters of spillovers during the Covid-19 period. Hence, the role of Chinese and Japanese financial and nonfinancial firms in the cross-market transmission of shocks to G7 countries may be of interest to policymakers, regulators, practitioners, and other market participants.

The report offers direction to investors in optimising their portfolios and providing guidance to policymakers and regulators. During the Covid19 pandemic, not only international stock markets but also foreign exchange markets were volatile. The report shows that investors faced higher hedging costs during the pandemic. Higher hedging costs in equity markets combined with currency mismatches in portfolios have increased both market and credit risk for international investors. These developments force market participants (in particular banks) to reduce their risk-taking capacity and dampen the growth in both financial markets and global economies. In order to prevent these actions, policymakers should keep providing liquidity to international markets, as illustrated by the recent global swap arrangements made by the Federal Reserve.

Dr Md Akhtaruzzaman is with Peter Faber Business School, Sydney, Australian Catholic University, Australia. Professor Sabri Boubaker is with EM Normandie Business School, Métis Lab, France. Dr Ahmet Sensoy is with Bilkent University, Faculty of Business Administration, Ankara, Turkey.

[The article is based on a published article entitled 'Financial contagion during the Covid-19 crisis' in Finance Research Letters.]