Optical goods are the products that include different optical instruments like lens, camera obscures, magnifiers, lasers, microscopes, optical discs, optical fibre, projectors, optical toys, refractrometres, photography equipment etc. Among these good range of products, Bangladesh produces some optical, photographic, medical instruments as per HS (Harmonised System) code 90-98. In the fiscal year 2017-18, the size of such exports reached US$ 83 million. But $128 million exports in the previous fiscal 2016-17 shows about 35.5 per cent decline within a single year. From the available sources, it is seen that optical goods are mostly produced by the industries set up in the export processing zones (EPZs).

In the export statistics of EPB (Export Promotion Bureau), there is no specific mention of export through EPZs. Export through EPZ in the FY 2017-18 stood at $7.2 billion or 20 per cent of the total exports, while the figure was $6.7 billion in 2016-17. The government this year has set a target $44 billion, of which $40 billion will come from goods and the remaining $4.0 billion will come from services. If we consider at least $8.2 billion from the Economic Zones, actual national export stands at $31.8 billion.

Some Japanese companies in the Chittagong EPZ are producing optical goods for their own countries, importing all raw materials and sending back the same to their country. They are employing a good number of Bangladeshi workers and enjoying tax holidays and other related facilities offered by this country. There are industries in the Uttara EPZ and Dhaka EPZ also.

Industries in the EPZs are producing some high value-added products, but remain totally aloof from the mainstream. Transfer of knowledge remains impossible. These EPZs do not engage in any collaboration or export-import with any domestic company in Bangladesh, nor do they export to any other country or company other than their assigned ones. Industries in the Nilphamari EPZ are exporting to different countries of the world, including the US. These industries are very much concerned about their IP (intellectual property) issues and do not like to disclose the information of their products.

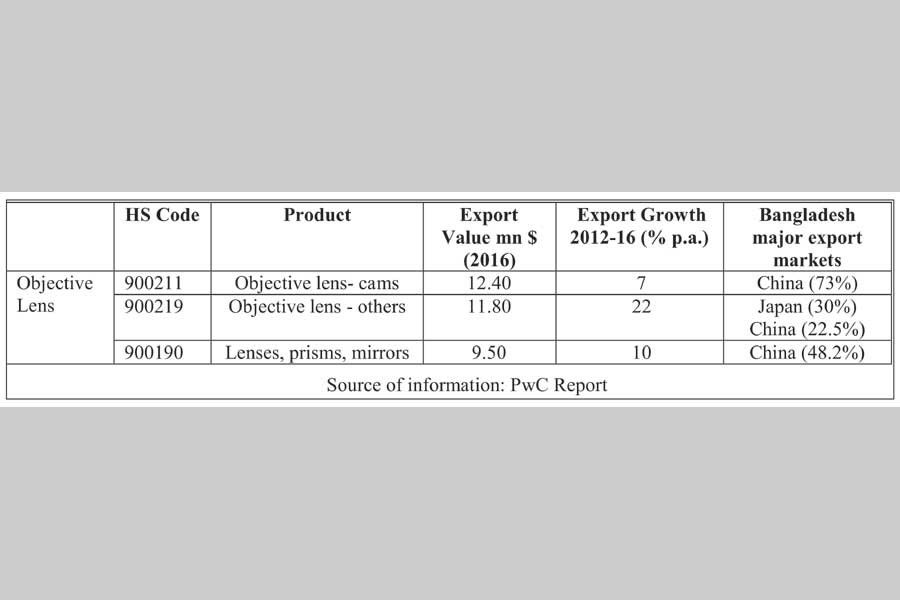

Export products under optical goods include objective lenses for projectors and other devices, and LED-based goods. The export growth is mostly driven by foreign direct investment (FDI) from Japanese investors who are shifting the manufacturing base to Bangladesh. Non-metallic components e.g. optical glass, silicon wafers are imported depending on the type of products being manufactured. Their export of 2016 is shown below:

Export of optical goods appeared in the EPB sources might be exported by the EPZ companies. EPB may like to preserve the details of updated export statistics from the EPZ companies and may reflect with acknowledgement in their statistics.

Local industries tried to produce optical goods and optical frames in a limited scale, but could not move further because of absence of adequate quality certification bodies, protection of intellectual property rights etc. The national standard and testing organisation do not have any standard with regard to ensuring qualities of these products. IP protection is also not available. China can produce these products at a very cheaper price and the design are copied very frequently. Industries in the EPZs are also very cautious about their property rights and do not like to disclose their products because of fear for copying.

We are not aware about the total demand of optical goods and lens in the country used for spectacles, but it is true that these products are abundantly in the local markets. There are some unofficial channels that are in place at the cost of the efforts of local producers, who tried to take efforts to produce these products locally but failed tremendously because of cheap imports.

Optical goods are being used in the country largely. We are not aware of the sources of these goods, but there is no dearth of availability of these products in the market. Camera, magnifiers, lens for the projectors, spectacles etc. are all available in the market. Spectacle lens, if can be produced in the country, could be a good source of services to the people. A good number of people in the country is using spectacles, poor segments are suffering from different eye-related diseases face problems for having spectacles because of its cost. Some NGOs (non-governmental organisations) have come forward to support disabled and distressed people supplying reading frames to this segment. Home-grown lens are difficult with shops in the city being fully decorated courtesy of beautiful fashionable glasses with a good range of costly glasses along with colourful high price tags. People supplying spectacles seem to be unaware about the supply of lens and they say that it is available in the market. Different types of optical goods are imported with lens being one of those.

Bangladesh's foreign trade statistics show relevant information of the country available upto the year 2015-16. It is seen that the value of lens, mirror and similar type of products under HS code 9002; frame, mounting, spectacles under HS 9003 and spectacles, goggles under HS 9004 stood at $20.80 million. There are different other types of optical goods being imported in the country as finished products or for the purpose of assembling.

While we tried to understand the amount of import of some other optical goods, such as import of goods under 900211 like objective lens for cameras, projectors or photographic enlargers or reducers, it was found to be worth about $2.0 million in 2015. Import under 900219, which is objective lenses (excluding for cameras, projectors or photographic enlargers or reducers), was about 16.43 million in the country. Import of products under 900190 items such as lens, prism, mirror and other optical elements of any material, unmounted (excluding such elements of glass not optically worked, contact lens and spectacle lens) was 0.25 million in 2013, but the same has been reduced to almost zero now. These information have been gathered from the sources of ITC Trade Map. Information under the same HS code is not possible to gather from the available BBS (Bangladesh Bureau of Statistics) statistics. From the BBS statistics, it has been possible to gather 04 digit and 08 digit information and it is difficult to understand the detailed nature of the product and which are finished and raw materials.

It seems from the above statistics that official import of optical goods is not that much high, but there is a significant use of optical products across the country. Contact lens, spectacle lens are available. These are imported or produced in the country. Camera, computer, hospital equipment are using optical goods. Information is not easily available as the manufacturing sector and the importers are not structured.

Local traders do not have any collaboration with the EPZs or the local manufacturers. They mostly import readymade spectacles and adjust the power in the glasses here.

BUILD is conducting a study on exploring the export possibilities of optical goods from Bangladesh. In order to understand a sectoral profile, information is the most important part. But it is very difficult to get and gather these information. Whatever information is available, those is confusing. HS code related problems are long standing. Some of the very important products imported are always kept in the category of 'others' making the issue more complex.

High-quality components of optical goods are metal/alloys, machineries, non-metallic components-optical glass, silicon wafers, and some special chemicals. Optical glasses are first ground and polished. As per product requirements, often the lens are grinded for multiple times to ensure the finest quality. Polishing is also done until the lens loses its smoky look, and is fully polished and transparent. Uncoated glass is then coated and assembled to create optical lens. The coating process is typically done in a vacuum chamber to ensure that the environment for the lens is dust-free. Thus in case of optical glass cutting, shaping, grinding, polishing and centering are all labour-intensive activities with high sophistication. Uncoated lens then needs to be coated that needs some raw materials, then it becomes ready for assembling with a view to preparing optical lens.

Skilled workforce is required to man the assembly line and operate the machinery. Such workforce is not adequately available here in Bangladesh. Most of the SMEs employed unskilled workforce, who are trained on the job by a relatively experienced, yet under-qualified supervisor. This affects the productivity and export readiness of the SME units. The lack of skilled workers has led many SMEs (short and medium enterprises) to delay upgrading their outdated machine.

Optical goods as an export product has not been targeted and identified properly. Such goods have got a good presence in the country, but sectoral entrepreneurs are not coming up in a big way in absence of proper policies. Even if a few have come, they could not sustain because of presence of huge informal trade and quality control issues. Import substitute policy cannot be the response for industrialisation, there is a serious need for proper research and development (R&D) for innovation and sustenance of industrial development.

Ferdaus Ara Begum is CEO of Business Initiative Leading Development (BUILD), a joint collaboration of

DCCI, MCCI and CCCI. [email protected]