Bangladesh is a country of 165 million people and consumes about 3.0 million tonnes of oils and fats as per statistics of 2018. Due to insufficient indigenous production, almost 90 per cent of these annual requirements of oils and fats are met through import. During the last couple of years average per capita consumption of oils and fats increased at least by a kilogram, which is the biggest growth among all the developing countries. In 2018/19 the average per capita use of oils and fats is seen approaching 18 kgs., marginally below the level of India. Steady economic growth during recent years in pace with increase of population roughly by 1.7 million per year is contributing mainly to the aforesaid increase in intake of oils and fats. The under-mentioned table will provide a detail picture of the consumption trend of oils and fats during last 5 years.

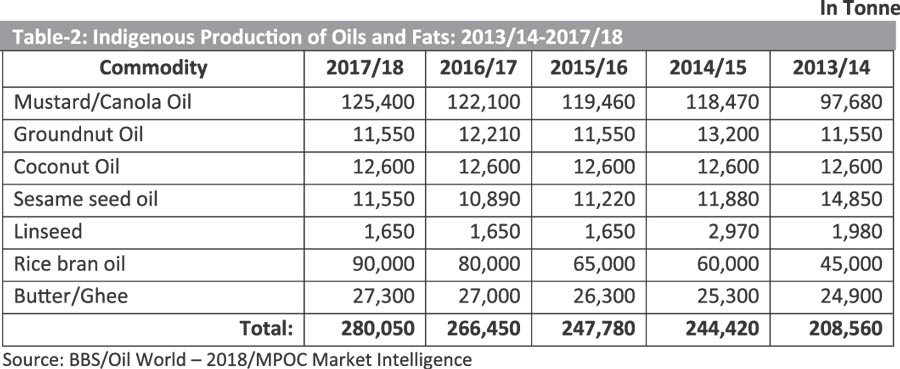

Against the above-mentioned increase in consumption vis-a-vis import, local production of oils and fats is most stagnant since last decade mainly due to insufficient land for production of oilseed crop. Gradual diversion of cultivated land for cash crop production, availability of land for oilseeds production is shrinking further and accordingly dependence on import in meeting the annual demand for oils and fats is posting an upward trend and this trend will continue in coming years too. The under-mentioned table will provide an idea about the local production during the period of 2013/14 to 2017/18.

Besides the above, annually, on an average, 125,000 to 150,000 tonnes of soyabean are also produced in the country, but the entire production of the same goes into poultry feed production and has no contribution to edible oil output of the country.

To meet the annual demand, a little over 2.9 million tonnes of oils and fats, which include the oil extracted locally from imported oil seeds, namely, soyabean and mustard/canola, were imported in the country in 2018, of which soyabean oil, palm oil and canola/mustard oil are the major, which constitutes almost 99 per cent of the total annul import of oils and fats of the country. The Table-3 would provide a clearer picture about the import trend of oils and fats in the country during 2014 to 2018.

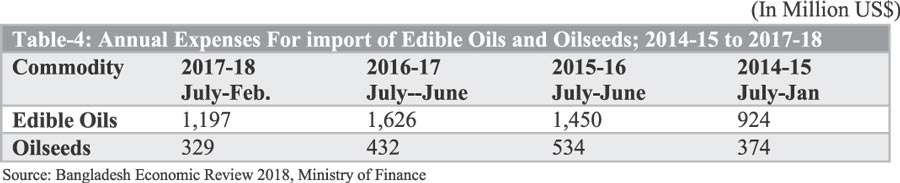

Presently, at clearing and forwarding (C & F) level, Bangladesh spends about US$ 1.6 billion annually for import of edible oils while yearly spending against import of oilseeds is about US$ 450 million, on an average.

The annual wholesale traded value of edible oils and fats consumed in the country is about Taka 208.75 billion (US$ 2.5 billion @ Taka. 83.50 per US$), which in the retail market is about Taka 230.0 billion (US$ 2.75 billion). Since almost 92-93 per cent of the local requirement of edible oils is met through import, local price of edible oils and fats fluctuates in pace with the price trend of respective oils and fats in the international market. It may be mentioned here that annually about 500,000 tonnes of edible oils are sold in consumer packs while the remaining quantity of oils is sold in the loose form. Refined soybean oil is the leader in the consumer pack market while refined palm olein dominates the loose trade of edible oils.

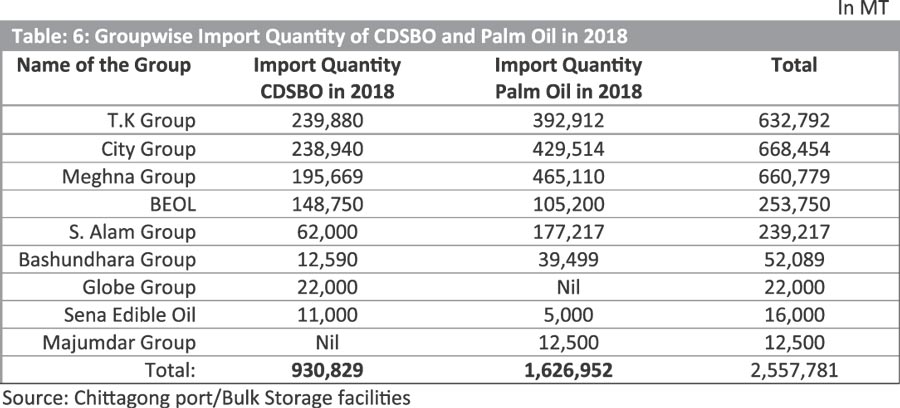

For long there had been nine major edible refining groups who were active in the sector. Among them, T.K. Group, City Group and Meghna Group were the major players controlling almost 60 per cent of the total oils and fats market of the country. Among others, the annual import quantity of Bangladesh Edible Co Ltd. although was not significant compared to the aforesaid three groups, but brand value wise they are leading. The under-mentioned table would provide a clearer picture about the import trend of CDSBO and palm oil in 2018.

Bashundhara Group, Sena Edible Oil, Globe Edible Oil and Majumdar Group entered into the edible oil refining business in 2018. MEB Group, S.A Group, Mostafa Group, Nurjahan Group, each of whom owns multiple numbers of refinery and were active in edible oil refining sector for long, are now closed mainly because of financial reasons and reentering into the edible oil refining business by them is bleak.

It is expected that by 2019, the total annual import of oils and fats would cross 3.0 million tones. Consumption of oils and fats in the country is increasing in pace with economic growth and increase of population. As revealed by World Economic League (WELT)-2019 recently, Bangladesh, which is now 43rd economy in the globe, is set to become the 24th largest economy of the world in the next 15 years. Since consumption of oils and fats is directly related with economic growth, which increases the purchasing power of the population, it is mostly likely that consumption vis-à-vis import of oils and fats will continue to increase in coming years too.

Writer is Regional Manager of Malaysian Palm Oil Council (MPOC) and looks after Bangladesh and Nepal market.