As a businessman and investor, you should know why firms are making transactions with related parties and how it impacts the performance of a firm.

The probing of scandals like Enron, KMK and Mailyard provide evidence that in all three incidents, controlling shareholders used related party transactions (RPTs) to generate profits for satisfying their own needs, which further reduced the quality of earnings. Related party transactions are transactions carried out between the company and its affiliates, key managerial personnel, promoters and shareholders. Related party transactions include loans, deposits, investments, advances and other type of transactions such as sale of assets, acquisition of assets, purchase and sale of goods with related parties.

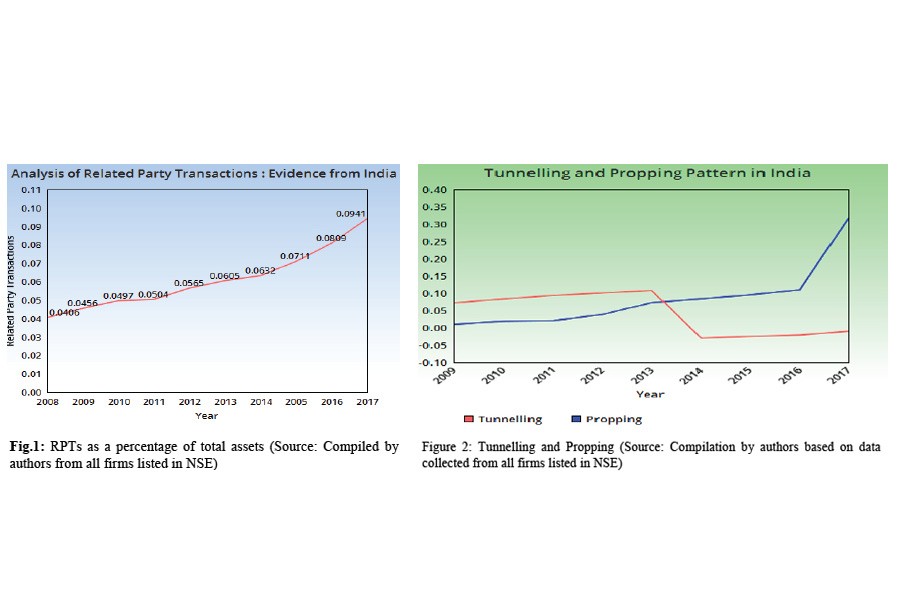

In recent years, RPTs have been increasing in Asia. Related party transactions in Indian firms have increased from 0.4 per cent to 0.9 per cent of total assets over the last decade. Firms prefer to engage in RPTs with affiliated firms because of tax shield and these transactions can reduce transaction cost. India being a developing economy is characterised by high ownership concentration and weak legal enforcement which enable firms to engage in more related party transactions. In case of family-owned firms, controlling shareholders may appoint their family members or trusted members in the management cadre to encourage RPTs, which in turn could result in expropriation. Firms can use RPTs for achieving economies of scale, for efficient capital allocation to their affiliated firms and to overcome financial constraints.

Do related party transactions improve firm value? Normally, RPTs are considered unfavourable, but there are two views: either abusive or efficient. RPTs enable firms to experience discounting by the market and at the same time, enable investors and managers to use RPTs to maximise their own welfare. But this negatively impacts firm value. Under the efficient view, RPTs can be used as an instrument to improve the operational efficiency and financial statements of the group companies. Under such scenario, RPTs have a positive impact on firm value. Hence, some RPTs can destroy and some create firm value: But then the question arises, 'what type of RPTs create firm value?'

Related party transactions can be classified in two categories: Tunnelling and Propping. Tunnelling is the transfer of resources from the company to the controlling shareholders, while propping refers to transactions between the firm and related parties that are likely to benefit the firm. Tunnelling includes transactions such as asset acquisitions, asset sale, equity sale, cash transfer to related parties for purchase of goods and services. Propping includes transactions such as loans and advances made to related parties and cash receipts from related parties arising from sale of goods. As per Companies (Amendment) Act 2013 in India, it is mandatory for companies to disclose related party transactions (RPT) in its financial statements. Besides, SEBI guidelines (LODR), 2015 in India stipulate that all firms require omnibus approval from audit committee to report RPTs in their financial statements. This helps to reduce the accounting scandals that are happening in India. Additionally protection of minority shareholders can be ensured by proper monitoring of transactions by audit committee.

It can be observed in Fig: 2 that while tunnelling activities have reduced after the 2013 regulations, propping has increased to a large extent. Tunnelling type of RPTs have negative impact on firm value and it has decreased since 2013, probably because of mandatory disclosure of RPTs in the financial statements. Moreover, tunnelling activities can be easily detected by close scrutiny of the board.

Propping type of RPTs can have positive impact on firm value. This is why more firms located in countries across the world, including India and Bangladesh, are moving towards propping, probably because cash rich firms are using their funds to provide finance to their affiliates.

Investors planning to invest in group firms should definitely look into the extent and type of RPTs disclosed to determine their likely impact on firm performance. RPTs can be both good and bad for investors depending on the type of transactions. Analysts and investors will need to value firms with RPTs differently from those who do not engage in RPTs.

M Thenmozhi is Director, NISM & Professor at IIT Madras.

Aghila Sasidharan is Research Scholar at IIT Madras. The views expressed are those of the authors and do not reflect the opinion of the organization(s) they represent.