Higher-value-denomination notes are driving out the lower-denomination ones from the market, according to bankers and economists, for carrying and payment conveniences.

The bigger notes have been dominating the country's banking channel, the main pipeline of distributing the currency to people. Bigger notes --- Tk 1000 and Tk 500 --- are the common picture of the cash transactions in the banks.

People feel convenient carrying or handling such bigger notes, as spending is also getting bigger for inflation push. They can store it easily in their wallets or vaults.

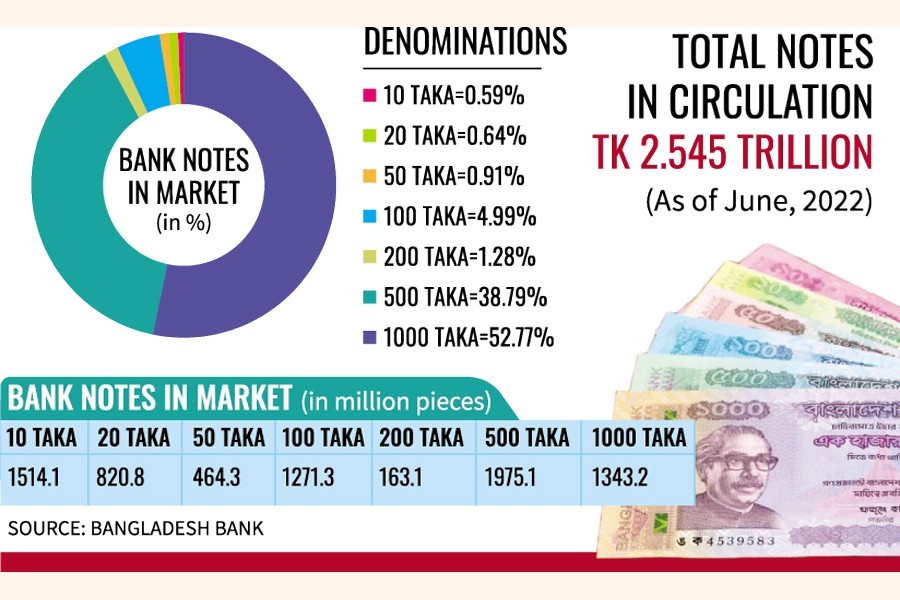

The Tk 1000 and Tk 500 notes occupy nearly 92 per cent of the total currency in circulation, as of June 2022. Bangladesh has a total circulation of money worth Tk 2.54 trillion.

A calculation prepared by the Financial Express based on the Bangladesh Bank-shared data shows that the Tk1000 notes in circulation are 1343.2 million pieces (134.32 crore pieces) and its value, when multiplied by 1000, stands at Tk1343.2 billion or nearly 53 per cent.

And Tk500 notes have 1975.1 million (197.51 crore pieces) in use and its value, when multiplied by 500, is Tk 987.55 billion or nearly 39 per cent, as of June last. And the five other banknotes --- Tk 100 to Tk 10 --- have a market share of around 8.0 per cent of total circulation.

Commemorative banknotes are issued to mark some particular events or occasions. The notes can be used as medium of exchange or legal tender as well as it be used as commemorative money for showcasing or gifting someone.

Economists and mint experts view that there is an impact of adequate higher-valued notes on the economy as the country's economy needs lower- denomination ones also for cash transactions.

Dr M Masrur Reaz, chairman at the Policy Exchange of Bangladesh, told the FE: "This [92 per cent] is worrying for the economy."

He says such biggest share of higher- denomination notes has few implications on the economy. It creates acute shortage of lower denominations. "It may push up inflation and people forced to believe that lower denominations have no value."

Bangladesh Bank argues that they issued the Tk1000 notes as the economy is expanding fast and due to economies of scale.

Dr Atiur Rahman, former governor of the Bangladesh Bank who introduced the Tk1000 notes, told the FE that the main argument for introducing such bigger notes is the economy is expanding fast. He said many South Asian economies also issued such higher notes.

Julhas Uddin, an executive director (Research) at the Bangladesh Bank, told the FE that there is no empirical study as to whether bigger notes drive out the lower denominations. "The economy is becoming bigger and simply for this reason the central bank issued the note in 2011."

From banking perspective, bigger notes are easy to carry and store in their vaults. Besides, such bigger notes are more convenient for the growing ATM and CRM booths in the country.

From central bank's perspective, such bigger notes give it huge financial gains, called 'seignorage' benefits or percentage on minted bullion. This is one of the key earnings of the Bangladesh Bank which shares a significant amount of its profit with the government as non-tax revenue.

Currently, a 1000-taka-note production cost is around Tk 17 but its face value is Tk 1000, so it gains Tk 983 from one note, according to an insider of the Bangladesh Security Printing Corporation, wishing not to be named. This is based on per-plate 28-piece notes.

Contrarily, a Tk 5.0 production cost is around Tk 3.0, although the paper usually remains weaker for small-denomination notes and gets damaged within a year. Here the seignorage benefit is much low. Destroying notes is a long process and involves a number of government agencies.

While visiting a number of branches, this scribe found the lower-denomination notes available only in some branches located in peripheral areas of big bazaars or markets. It's mandatory to keep all types of notes.

"We usually give Tk 500 and Tk 1000 notes to the customers," said Fatima, a cashier at the NCC bank Motijheel branch, as these notes are easily counted in the machines or by hand. She claimed that customers also prefer such bigger notes.

She said they did not get Tk 50 and smaller-valued notes for long. They get demand sometimes for such notes from the clients.

"We clearly say in the negative when they demand such small denominations".

Some top executives of the banks told the FE that the supply side of small notes is very shallow. They hinted that the central bank does not provide adequate small-denomination notes.

"We don't get small- denomination notes for long," said Syed Mahbubur Rahman, managing director and CEO of the leading private commercial bank Mutual Trust Bank (MTB).

"I, many times, made requisition for Tk 5 notes, especially for giving to the beggars, but I don't get it." said Mr. Rahman, a noted career banker.

Some banks argue that they prefer bigger notes as they have demands.

Besides, the central bank does not take back their torn smaller- denomination notes from banks. If they were replaced, then the market had a good supply side.

Md Shaheen Iqbal, CFA, a deputy managing director at the SME-focused private commercial bank BRAC Bank, told the FE: "Bigger notes have lower expenses to carry and other cash management and that's why we prefer it".

They keep bigger notes, for example, Tk 1000 and Tk 500, for booths as they can load the booth once a week. If they load the smaller denominations, they will require a load every day which will augment their management expenses.

"I believe that bigger notes both in bank counters and ATMs have effect in the market to drive out the small denominations".

Notes tear easily while coins last. From the central bank's point of view, the cost of printing a given note is less than that of minting a given coin although Bangladesh does not mint any coin -- it imports. Nevertheless, overall notes are more expensive to issue than coins since they have to be replaced. In Bangladesh, a note life spans around one year.

A number of experts argue that there should be maintained a ratio against the bigger notes. They mean how many small-denominations notes are required against the bigger notes.

Currently, Bangladesh Bank goes by its own experiences, not any studies or best practices.

The supply side of the government notes and coins remained poor for long, according to people involving with the matter, leading to such shortages of the smaller denomination currencies in the market. The government has last procured such smaller denomination notes and coins at least a decade back in 2013. That time Tk 5.0 coins and Tk 2 coins were procured.

A source at the BSPC said the corporation mainly prints higher notes and lower ones like Tk 20 and Tk 50 and Tk 100. In August the printing was dominated by Tk 100, Tk 500, and Tk 20, according to an insider.

In the meantime, finance division office which takes such moves for such denominations told the FE that they actually are not in a position right this moment to print and procure the coins.

During the Muslim Chowdhury tenure as finance secretary, there was no move made for minting or printing lower-denomination government notes, and during the three years of Mr RoufTaluker, who is now Governor of Bangladesh Bank, also was there no such move, said one additional secretary who is now on retirement, preferring not to be named.

He said the government is also not interested to print such notes as some drug addicts use them for taking drugs.

Sk. Farid, a deputy secretary who once worked at the concerned wing of the finance division, mentioned that during 1975 the ratio of lower- denomination currencies to total currency circulation was 10.7 per cent which now has fallen to less than 1.0 per cent.

"This is because the average price level of goods and services has increased manifold over time. Thus, the demand for small-denomination currencies declined," said Mr. Farid, who now works at the Bangladesh Embassy in Tokyo. He replied to this scribe through mail correspondence in July last.

As long as small-denomination currencies have demand in the market, they should remain there, Mr Farid notes, giving reference of Japan.

Section 5 of Bangladesh Coinage Order says, "The 2-Taka coins, 1-Taka coins, 50-poisha coins, 25-poisha coins, 10-poisha coins, 5-poisha coins, 2-poisha coins and 1-poisha coins issued under the authority of the Government shall be current in Bangladesh until such time as they are called in by the Government by notification in the official Gazette".

The Government shall supply such coins to the Bank on demand, and if it fails to do so at any time, the Bank shall be released during the period of such failure from the obligation to supply them to the public.

It means Bangladesh Bank supplies these coins on behalf of the government in such quantities as may be demanded by the people.

In Japan, the average price level is one of the highest in the world.

The lowest-denomination currency in Japan is 1 yen. All small-denomination currencies in Japan are coins. These are 1-yen, 5-yen, 10-yen, 50-yen, 100-yen, and 500-yen. Banknotes start from 1000-yen to 5000-yen and 10000-yen, Mr. Farid told the FE through email communications.

Ahsan H. Mansur, executive director at the PRI (Policy Research Institute of Bangladesh) feels that maintaining adequate supply of such coins is important in public interest. People prefer notes to coins.

"For the public interest the paper notes and coins should be supplied to the market," he says, adding that banks also be encouraged to receive such coins from the customers.

In many cases the seignorage benefit becomes negative for coins. But coins' lifetime is at least 10 years and they are cheap when the lifespan is considered.

"To my mind, there is negative seignorage benefit of pricing coins. Otherwise the government prints on regular basis," says Dr Ahsan H. Mansur.

The economist, however, suggests that the government should continuously conduct a survey on whether the demand for small- denomination coins and notes is losing out or not.

Humayun Kabir, who worked as general manager and managing director at the BSPC (Bangladesh Security Printing Corporation), told the FE that there is need for regular monitoring of the market to ensure smooth supply.

Mr. Kabir said BPSC just prints, not a policymaker. It carries instructions from the central bank. It does not conduct survey as to which notes necessary, which not.