Two leading local business houses are now in a race to acquire the entire foreign stakes in the French drug-maker Sanofi's operations in Bangladesh.

The government of Bangladesh that owns more than 45 per cent shares in the company on Wednesday decided not to compete in the acquisition bid, officials say.

One business house vying for the Sanofi shares owns the country's second largest pharmaceutical company and the other one holds the ownership of a posh hospital and a nursing college in Dhaka. One of the contenders might make its acquisition bid public today (Thursday), sources said.

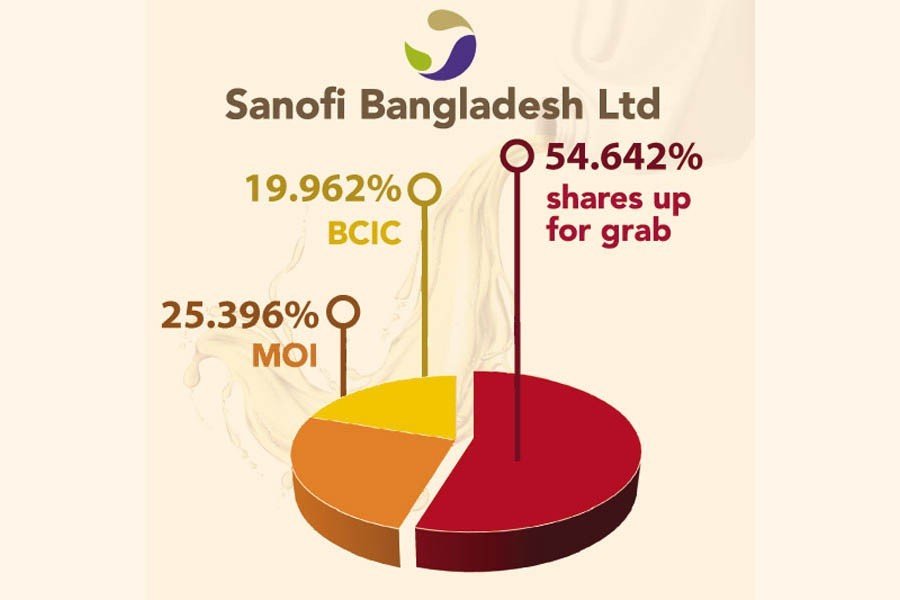

At a board meeting of the Bangladesh Chemical Industries Corporation (BCIC), the state-run corporation that controls around 20 per cent stake in Sanofi Bangladesh, held recently gave its green signal to the multinational pharma company to pick the potential buyers for its 54.68 per cent shares. The remaining 25.32 per cent share of the French drugmaker belongs to the Ministry of Industries. The BCIC earlier had shown interest in buying the foreign stake in the company.

With the clearance, the global drug company, which started manufacturing pharma products during the time of the erstwhile Pakistan in early 60s, went ahead with selling its shares.

When contacted, acting BCIC chairman Md. Amin Ul Ahsan said the corporation had earlier shown its interest to buy Sanofi's stake, but it has abandoned that idea.

Mr Ahsan, who chairs the board meeting as ex-officio, said they have given the clearance to the Sanofi officials in the meeting. "Now Sanofi can choose potential buyers on its own," he said.

The BCIC acting chairman said the government has asked the Sanofi management to protect the interests of employees, other stakeholders and the supply of its existing products in the market before handing over its shares.

He, however, declined to disclose the names of the two interested buyers.

According to officials of the ministry of industries (MoI) that owns 25.32 per cent stake in its business, two local companies are now engaged in the acquisition race with government withdrawing itself.

Seeking anonymity, an official at the ministry said the French drugmaker could choose any of the firms, including a leading pharma company, as a potential buyer of the shares.

Sanofi Bangladesh Limited could not be reached for comments even after repeated efforts.

Less than 15 months after the departure of GlaxoSmithKline from Bangladesh, local chapter of the global drug colossus made its decision public to wind up its Bangladesh operations.

The Sanofi drugs being of high quality are popular in Bangladesh. Its life-saving drugs include taxotere, eloxatine for cancer, and lantus, apidra, insuman for diabetes.

In 1960, Sanofi set up the facility under the name the Pakistan Pharmaceutical Industries (PPI) at Tongi in Gazipur in the then East Pakistan, now Bangladesh.

After the independence, owners of the company left the country and it was then nationalised and renamed Bangladesh Pharmaceutical Industries (BPI) before shifting the responsibility to the BCIC to operate it.

Later, the multinational company on business purposes changed the name on several occasions.

Sanofi-Aventis Bangladesh Limited was formed in 2006 after the merger of three multinational companies-Aventis Limited, Fisons (Bangladesh) Limited and Hoeshst Marion Roussel Limited.

As of December 2017, the paid up capital of the non-listed company was estimated at around Tk 360 million while the total assets of the company have been calculated at nearly Tk 5.15 billion and the external liabilities are valued at Tk 2.65 billion.

In terms of shareholding, the BCIC holds 19.962 per cent, the ministry of industries 25.396 per cent and 54.642 per cent owned by the multinational company.

On the basis of net asset value per share, the BCIC invested Tk 498.64 million, the ministry invested Tk 634.38 million and the multinational firm invested Tk 1.36 billion. Profit per share was estimated Tk 102 in 2017 and the retained earnings were Tk 1.50 billion.

Bangladesh's drug market has been expanding at a double-digit rate, with the turnover reaching at around US$2.0 billion.

Sanofi holds over 2.0 per cent shares in the booming local pharmaceuticals market.