Export income from the readymade garment sector relies largely on a few items, thereby risking its sustainability in the global market, industry insiders and experts have said.

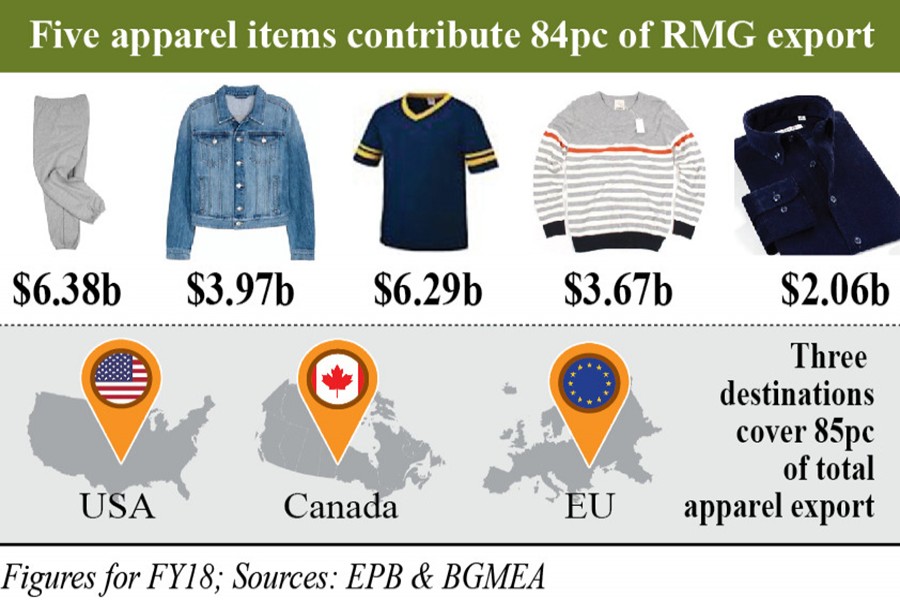

At present, more than 73 per cent of the apparel sector's income comes from the shipment of only five items -- shirt, t-shirt, trouser, jacket and sweater.

Bangladesh exports more than 30 types of garment products.

The country fetched $ 30.61 billion during fiscal year 2017-18 by exporting from knit and woven items.

Out of the earnings, only five items contributed $ 22.39 billion, according to data of the Export Promotion Bureau and the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

Of $ 22.39 billion earnings, $ 6.38 billion came from the exports of trousers, followed by $ 6.29 billion from T-shirts, $ 3.97 billion from jackets, $ 3.67 billion from sweaters and $ 2.06 billion from shirt.

The total export earnings stood at $ 36.66 billion during the last fiscal where apparels accounted for 83.49 per cent of the total, the data showed.

On the other hand, some 84.75 per cent of overseas sales of local garment products is also confined to three major destinations -- the European Union, United States and Canada, they said.

Exporters attributed high global demand for those products, large volume of work orders and cotton-based products to the dependency on such a few items.

They, however, said the diversification of products is happening gradually, especially in denim, dyeing, washing and sweater segments.

Experts and exporters blamed the absence of effective steps for product diversification according to market demands and market exploration, poor infrastructure and entrepreneurs' unwillingness to take risk.

They said such a dependency on a single sector and a few items might put the overall export earnings at risk.

They suggested effective measures and the government's policy support to increase competitiveness of local products, including non-apparels items and explore the untapped markets across the world.

The government's policy support should include the opening of new missions, branding of local products, and cash support for potential sectors to change the export scenario.

"The large dependency on a few items is due to our reliance on cotton-based garment," Faruque Hassan, senior vice-president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), told the FE.

Apparel-makers are gradually switching over to manmade fibre and manufacturing mid-and high-end products from basic items and there are many value-added segments in those five basic products, he added.

For example, sweater makers are now installing jacquard machine for more value addition, he said.

Mahmud Hasan Khan, another vice president of the BGMEA, said more value addition is taking place in trousers segment, especially in denim.

Entrepreneurs have made significant investments in denim making, especially in washing and dyeing pattern, he said.

Earlier only five-pocket denim was produced, but knitted and other value-added denim are being exported in recent years.

Both the leaders, however, said that earnings from shirt -- a basic garment item -- though remained stagnant at $ 2.0 billion for a couple of years -- is not a bad sign.

This means Bangladesh is switching over to value added items, they added.

Export earnings from lingerie -- women's innerwear and nightwear -- stood at $ 1.15 billion, up by 7.84 per cent from the previous fiscal year, Mr Hassan said.

Fazlul Hoque former president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), echoed the BGMEA leaders' views on the value addition.

The growth and increasing export earnings also revealed that though slowly, diversification in garment products is taking place, he said.

Massive change wouldn't be possible at a time and it would take time, he added.

Nazneen Ahmed, senior research fellow of state-run think tank Bangladesh Institute of Development Studies, said earlier discussions were limited to the diversification of non-RMG products, but it is happening in garments as well.

"Diversification is possible in garments," she said.

"After the opening of the Japanese market, diversified and value added items are being manufactured in the country as its buyers are vey quality conscious," she noted.

She, however, stressed the need for diversifying the apparel produces without overlooking the basic items, for which Bangladesh has established its expertise and markets.