The Titas Gas Transmission and Distribution Company Limited (TGTDCL) has sought refund of Tk 15.59 billion source tax -- lying with the tax authority -- to offset acute liquidity crisis that is hampering its regular activities.

The sum of source tax against gas bill has been accumulated since fiscal year (FY) 2014-15.

In a letter, the Energy and Mineral Resources Division (EMRD) under the Ministry of Power, Energy and Mineral Resources (MPEMR) requested the National Board of Revenue (NBR) to refund the deducted source tax.

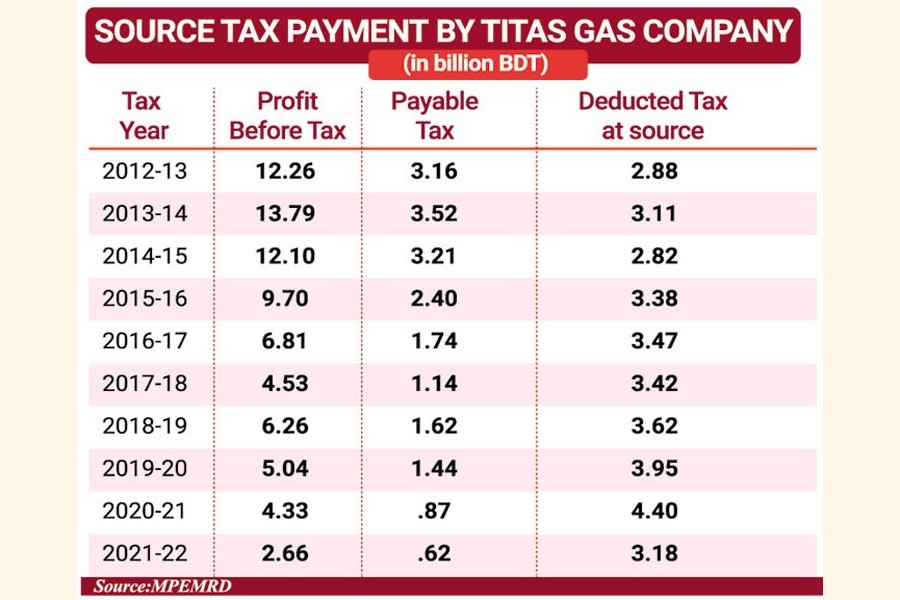

According to official data, source tax payment of the Titas Gas jumped by nearly 10 times than that of its actual payable tax.

Its payable source tax was Tk 287.5 million in FY 2013 that surged to Tk 2.55 billion in FY 2022, as per the MPEMR data.

Currently, the margin between per cubic feet gas sale and distribution is 0.13 per cent.

The TGTDCL needs to pay the difference of the amounts between gas sale and distribution as per an order of the Bangladesh Energy Regulatory Commission (BERC).

As per the Income Tax Ordinance 1984, the company has to pay source tax at a rate of 3.0 per cent on gas sale prices to the consumers and deposit the amount to the public exchequer.

TGTDL Director (Finance) Aporna Islam said the tax rate should be 0.12 per cent instead of 3.0 per cent.

She said the company is gradually becoming a loss-incurring entity due to higher deduction of tax at source.

"We are supposed to pay Tk 870 million tax annually as per the Finance Act, while the NBR is deducting tax worth Tk 4.87 billion," she added.

Due to the deduction of tax at source on sales value, the amount of tax remains higher on its distribution margin income, which is the company's only income.

"The company is not being able to adjust the tax at source with the actual payable tax," the letter said.

Among consumers' stage prices, distribution margin is the only source of income of the TGTDCL. The company is carrying out its operational expenditure with the fund.

The government increased prices of natural gas at consumer level by nearly 23 per cent on June 1 following an increase in liquefied natural gas (LNG) import cost.

However, rate of distribution margin remained unchanged.

Volume of source tax deduction is increasing every year, as source tax is being deducted on total gas bill, the energy ministry wrote.

The Titas Gas paid additional Tk 15.59 billion source tax than that of its tax liability from FY 2014-15 to FY 2021-22, which the company did not get refund - although it is refundable as per the rules, the letter added.

On August 17, both the NBR and the MPEMR held a meeting, where the NBR representatives agreed to refund the amount.

However, talking to the FE, a senior tax official said there is low possibility to refund the amount, as the Titas Gas has legal dispute pending in the High Court.

TGTDL Managing Director Harunor Rashid Mollah said the NBR should refund the additional source tax, as it is an excess paid tax beyond the company's tax liability.

The government is still providing subsidy on gas prices, he noted.