The National Board of Revenue (NBR) is mulling excluding inactive tax identification numbers from its database.

Both taxpayers and taxmen now feel the necessity of incorporating a provision into the income-tax law or rules to exclude an inactive TIN after a certain period of time.

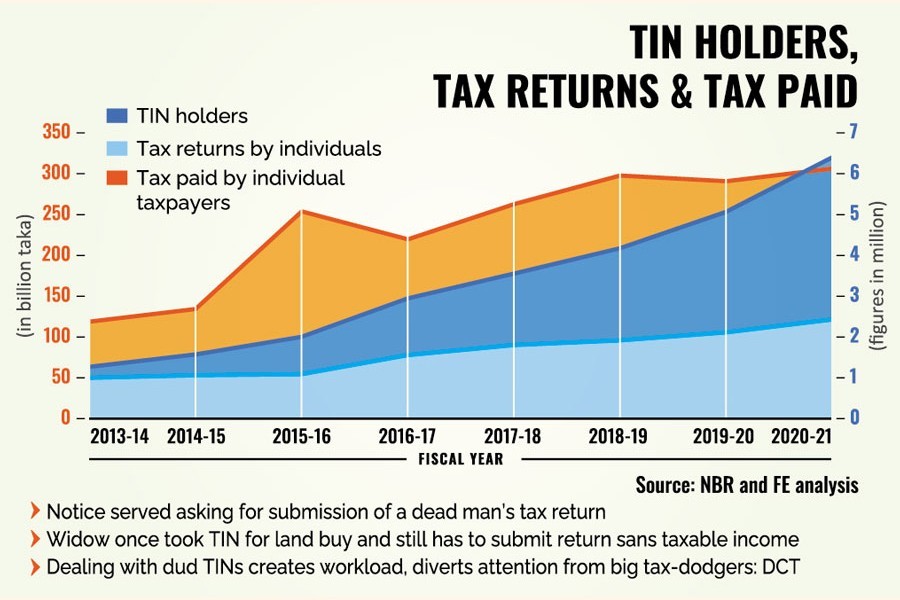

As per data of the National Board of Revenue (NBR), the number of TIN holders stands at 6.3 million while the number of tax returns is less than half at 2.4 million.

The present law doesn't provide for writing off compliance even after a TIN holder's death, sources say.

No matter whether or not one has taxable income, has passed away or left the country permanently, validity of TIN would stay back for unlimited period.

As a number of compliance issues are related with the TIN as per the Income Tax Ordinance 1984, both taxmen and taxpayers have legal obligations to meet the obligations.

A TIN holder has to submit tax returns stating his/her annual income, expenditure and other financial details to the taxmen once a year. Failure in submitting tax returns within the given timeframe is a punishable offence in the income-tax law.

On the other side, taxmen have to enforce the law and follow up the TIN holders to ensure their tax-return submission.

Shaheen Akhter, NBR member of Income Tax Administration, says the wing will work to address the issue as to how it can remove the inactive TINs and clean up the database.

Officials say inactive TINs could be excluded from the database taking undertaking or written applications from the taxpayers.

The widening gap between the number of TIN holders and actual number of taxpayers should be cleaned up to minimize the mismatch as it is giving wrong signal about state of tax compliance in Bangladesh, they observed.

Rehnuma Khanom, a schoolteacher in Dhaka's Mirpur-12 area, got puzzled after getting notice from tax department that her deceased father violated the tax law as he failed to submit tax return in time despite having TIN.

She was unaware that the tax authority must have to be apprised of her father's demise.

Mohammad Ali, who now lives in Loss Angels in California of the United States, left Bangladesh in 2014. He is now a US citizen. But his TIN still hangs on as valid in the tax department in Bangladesh-one among the 6.3 million-as there is no scope to delete it and help him out of the blind alley.

Marina Yasmin, a housewife in city's Moghbazar area, obtained TIN three years ago in order to buy a plot of land. She now goes on submitting tax returns every year with nil income. The widow finds it a hassle and seeks to get rid of "unnecessary trouble".

A deputy commissioner of taxes in a tax circle of the city says he has to handle 12,000 tax returns every year alone, taking huge workload amid acute manpower shortage in the tax-circle office.

"I have found around 30 per cent of the tax returns submitted with nil income that marginal-income group of people submit every year," he told the FE.

Workload of handling those returns drives away attention from large tax-evader groups, he says.

Another DCT, however, expressed different views over TIN closure based on his practical experiences.

"I have found one expatriate who got citizenship in another country but has two apartments in Bangladesh from which he gets monthly rent."

In that case, closure of his TIN would not be possible even though he left the country, he says.

In 2013, the NBR launched electronic TIN that includes the national identity card number, mobile-phone number and e-mail address.

The TIN database, which contains thousands of fake TINs, was cleaned up then.

Following a cleansing drive, the NBR found some 1.7 million TINs active out of 3.2 million.

Former income tax member Aminur Rahman says the TIN was first introduced in 1993 transforming General Index Register (GRN). Some 50 per cent of the TIN holders have no taxable income but can obtain temporary TIN as per law.

"Submission of tax returns for all TIN holders could be reconsidered as it puts pressure on taxpayers and taxmen without brining significant outcome," he adds.