A tax intelligence team has found that the vast majority of the businesses in Dhaka and Chattogram non-compliant in the matters of VAT (value added tax) payment.

According to a survey conducted by the team, 85.24 per cent of businesses in Dhaka and Chittagong manage to remain out of the VAT net while some 98.71 per cent of them do not submit returns.

The team has found that only 1,995 companies out of 13,508 companies, surveyed by it, have VAT registration, known as Business Identification Number (BIN).

Of the businesses, only 175 have been submitting the VAT returns each month.

According to the law, VAT registration and return submission are mandatory for the businesses having annual sales of over Tk 5.0 million.

It has conducted the survey in eight locations, including Pink City Market, Mouchak Market, Chawkbazar circle, Armanitola circle, Bangshal circle, Sutrapur circle, Tikatuli circle in Dhaka and Mimi super market in Chottogram.

Talking to the FE, director general of the VAT Audit, Intelligence and Inspection Directorate Dr Moinul Khan said they have intensified the drive against tax evaders.

"We detected VAT evasion worth Tk 13.27 billion until November 30 against Tk 3.91 billion in the corresponding period," he said.

The detection of VAT evasion went up by Tk 9.35 billion until November of the current fiscal year, he added.

The wing has investigated 90 companies in the first five months of the current fiscal year, compared with 52 in the corresponding period last year.

According to an analysis of the wing, it unearthed some Tk 1.39 billion VAT evasion until last month.

The wing is also investigating the abuse of the bonded warehouse facility by 13 companies that have gone out of operation by taking delivery of 120 consignments of fabric from the port.

The intelligence team has investigated a number of banks and non-banking financial institutions, including insurance companies since July 1, 2020.

It has found the difference in the payment of VAT by Standard Chartered Bank, Janata Bank, AB Bank, Meghna Bank, Habib Bank, United Commercial Bank Ltd, One bank, Rupali Bank, Dutch-Bangla Bank and Basic Bank.

The insurance companies include Phoenix Insurance, Lankabangla Finance, Alfa Islami Life insurance, Diamond life Insurance co ltd, NRB Global Life Insurance, Trust Islami Life Insurance, South Asia Insurance Co, Chartered Life Insurance, National Life insurance, United Insurance, Homeland Life Insurance and Bangladesh National Insurance.

Former chairman of the Association of Bankers, Bangladesh Syed Mahbubur Rahman said it is not intentional. It remains a matter of interpretation, he added.

Banks maintain transparent accounts and one of the highest-taxpaying sectors, he said.

"We appoint skilled auditors and tax consultants to comply with the law," he said.

He, however, laid emphasis on making the VAT law simple to make it understandable to all.

The wing chief said the main intention of the wing is to ensure compliance under the VAT law.

"This will in a way create a competitive business environment. Evaders always get advantages over those who pay VAT and hence the enforcement is necessary to protect those who are compliant," he said.

Officials said the Covid has taken a toll on the VAT collection since March last.

Until November, the collection of VAT slumped further registering a 5.21 per cent negative growth, said a provisional data of the NBR.

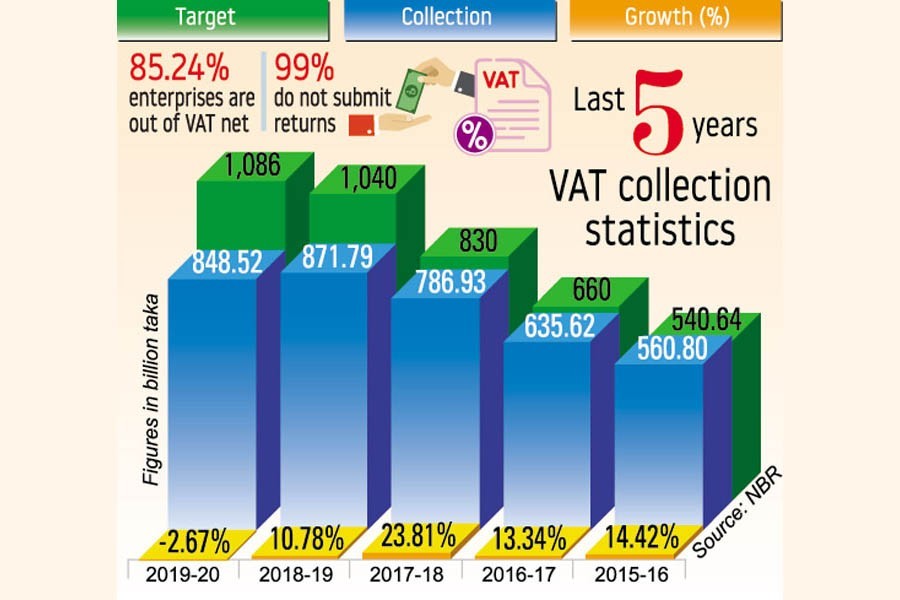

In the FY 2019-20, VAT receipts shrank by 2. 67 per cent for the first time in the last five years.